Bulgaria: National Assembly reviews VAT Act amendments to align with EU small business scheme

Bulgaria's National Assembly is reviewing a draft bill, presented on 2 December 2024, to amend the Value Added Tax (VAT) Act to implement the EU small business scheme for cross-border supplies. The draft bill is under parliamentary review and

See MoreKenya introduces pre-filled VAT returns for November 2024

The Kenya Revenue Authority (KRA) has issued a public notice announcing to all VAT registered taxpayers that the VAT return will be pre-filled with tax information available to KRA starting from the November 2024 tax period. This measure is being

See MoreSaudi Arabia: ZATCA announces 18th wave of e-invoicing integration

The Zakat, Tax and Customs Authority (ZATCA) has revealed the criteria for the 18th group of taxpayers who must comply with the integration phase of the e-invoicing system on 29 November 2024. The 18th wave included all taxpayers whose revenues

See MoreVietnam: National Assembly passes 2024 VAT Law

Vietnam's National Assembly passed the 2024 Law on Value-Added Tax (VAT) on 26 November 2024, which will come into effect on 1 July 2025. This new legislation introduces several amendments. One of the changes is the increase in the tax-exempt

See MoreChile revises VAT registration, payment rules for non-resident service providers

Chile’s tax authority (SII) has recently issued Resolution No. 105 on 30 October 2024 and Resolution No. 107 on 14 November 2024. These resolutions update the previous regulations regarding VAT registration and payment for non-resident

See MoreEuropean Commission launches new VAT portal for small businesses

The Directorate-General for Taxation and Customs Union of the European Commission has unveiled a new web portal about the Special VAT regime for small businesses, which will be implemented on 1 January 2025. The special VAT regime is allowing

See MoreColombia: National Tax Authority updates reporting requirements for 2025

Colombia’s National Tax Authority (DIAN) has updated rules for submitting certain tax information starting with the 2025 tax year. The changes, detailed in Resolution 000188 of 30 October 2024, expand the list of taxpayers required to report

See MoreSaudi Arabia: ZATCA clarifies VAT audit process

Saudi Arabian Zakat, Tax and Customs Authority (ZATCA) has introduced new guidelines to clarify VAT audit procedures and ensure better compliance with tax regulations. The guidelines provide businesses with clear steps for audits, corrections,

See MoreEstonia: Parliament passes VAT Act amendments, introduces EU small business scheme

The Estonian Parliament (Riigikogu) passed Bill No. 462 SE, on 13 November 2024,amending the VAT Act which introduces the legislation to implement the EU small business scheme for cross-border supplies, as outlined in Council Directive (EU) 2020/285

See MoreEU issues new guidance on VAT for small businesses

European Commission, on 11 November 2024, released the Guide to the SME scheme and explanatory notes for the updated Small Enterprise Scheme (SME scheme), which will take effect on 1 January 2025. This guide aims to provide a better understanding

See MoreTurkey updates VAT implementation Communiqué

The Ministry of Treasury and Finance has released Communiqué No. 52 on Value Added Tax (VAT) on Thursday, 31 October 2024, which includes updates to the VAT General Implementation Communiqué. These amendments address multiple facets of VAT

See MoreSaudi Arabia reveals criteria for 17th phase of e-invoicing

The Saudi Zakat, Tax, and Customs Authority (ZATCA) has announced updated compliance criteria for the 17th group of businesses required to join the e-invoicing system as part of their broader effort to digitalise the tax system and increase VAT

See MoreCzech Republic passes bill on VAT scheme for small enterprises

Czech Republic’s lower chamber of parliament has passed the bill amending the VAT Law on 30 October 2024, aiming to incorporate the Amending Directive to the VAT Directive (2020/285) concerning the special scheme for small enterprises, among other

See MoreHungary to mandate e-invoicing for energy sector starting January 2025

Effective 1 January 2025, electronic invoicing (e-invoicing) will be compulsory in Hungary for electricity and natural gas suppliers, including traders, distributors, and transmission system operators supplying electricity and natural gas to

See MoreDominican Republic unveils rules for enforcing mandatory e-invoicing

The Directorate General of Internal Revenue (DGII) of the Dominican Republic has released Notice 20-24 regarding the promulgation of Decree 587-24, which introduces new regulations for implementing Law 32-23, known as the Electronic Invoicing

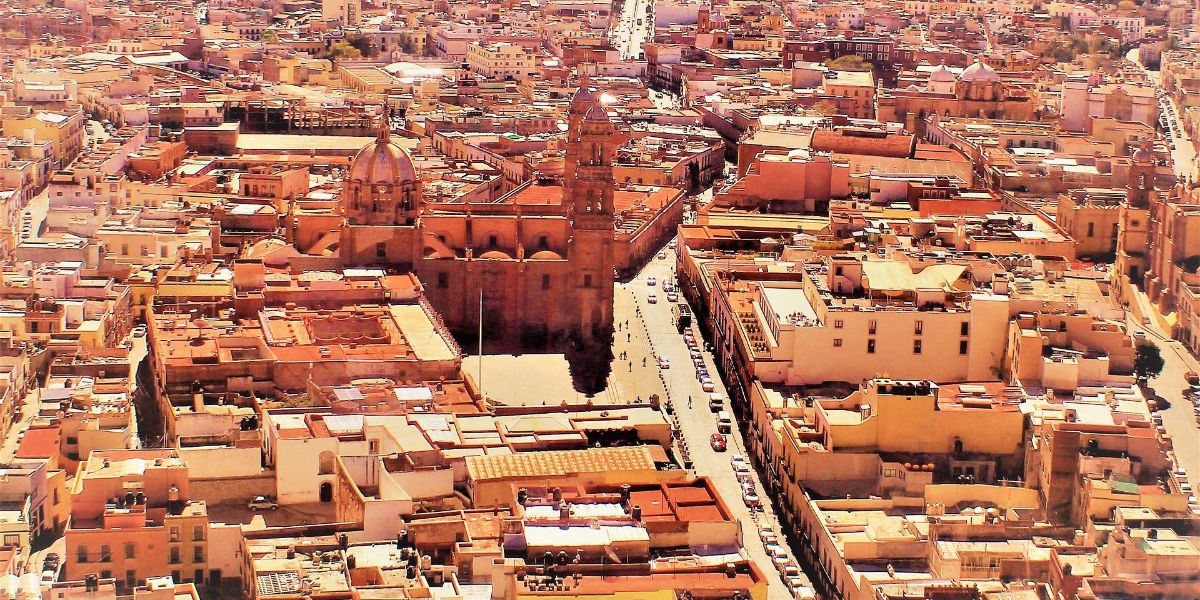

See MoreMexico introduces new withhold income tax, VAT obligations for crowdfunding platforms

The Mexican tax administration (SAT) released the Second Resolution of Modifications to the Miscellaneous Fiscal Resolution for 2024 on 11 October 2024, which mandates that crowdfunding platforms provide specific information to the SAT concerning

See MoreGermany publishes final guidance on mandatory e-invoicing

The German Ministry of Finance has published the final guidance on mandatory e-invoicing on 15 October 2024. The principles of the guidance are to be applied to all sales made after 31 December 2024. As established by the Growth Opportunities

See MoreUN Tax Committee: Indirect Tax Issues

On 18 October 2024 the subcommittee on indirect tax issues presented a series of papers on VAT guidance for developing countries. The papers had been presented to the Tax Committee for comment at the previous session and were now submitted in their

See More