UAE signs multilateral agreement on crypto asset tax reporting

The UAE has signed the OECD’s Multilateral Competent Authority Agreement under the Crypto-Asset Reporting Framework, joining 51 countries in standardising automatic tax information exchange for crypto transactions. The UAE signed the

See MoreNetherlands joins GIR MCAA

As of the OECD update of 26 August 2025, the GIR MCAA has been signed by 15 jurisdictions. The Netherlands has signed the Multilateral Competent Authority Agreement on the Exchange of GloBE Information (GIR MCAA), under Pillar Two of the OECD/G20

See MoreDenmark: Transfer Pricing documentation submission deadline set for FY 2025

Danish companies must submit comprehensive transfer pricing documentation, including master and local files and intercompany agreements, within 60 days of their corporate tax return to comply with section 39 of the Danish Tax Control

See MorePoland: MoF announces measures to combat aggressive transfer pricing strategies

The new measures assist the National Tax Administration in detecting and countering large corporations that evade or underreport their income tax. Poland’s Ministry of Finance has announced two new measures on 19 August 2025, to tackle

See MoreSouth Africa: Treasury proposes strengthening anti-avoidance rules for hybrid equity instruments

South Africa proposes more rigid tax rules on hybrid equity instruments, expanding the scope and taxing dividends as income from 1 January 2026. The South African National Treasury has proposed changes to section 8E of the Income Tax Act to

See MoreChile: SII updates rules for digital platforms to confirm users’ tax registration

The new rules mandates digital payment and intermediation platforms to verify users' compliance with business activity obligations through the SII platform’s “situación tributaria” option, API tax ID queries, or other SII-provided digital

See MoreIndia: Lower house approves higher standard deductions, pension exemptions, incentives for Saudi investment funds

Lok Sabha approves Taxation Laws (Amendment) Bill 2025, proposing higher standard deductions, pension exemptions, and incentives for Saudi investment funds. The Lok Sabha, India’s Lower House of Parliament approved the Taxation Laws (Amendment)

See MoreMalaysia updates transfer pricing audit framework for 2025

IRBM revises penalty and surcharge rules in the updated guidelines. The Inland Revenue Board of Malaysia (IRBM) has issued the Malaysia Transfer Pricing Tax Audit Framework 2025 on 31 July 2025, replacing the previous Transfer Pricing Tax Audit

See MorePoland: MoF consults on draft DAC8, DAC9 implementation bill

The deadline for submitting comments is 18 August 2025. Poland’s Ministry of Finance initiated a consultation regarding Draft Bill No. UC110 on 25 July 2025. The bill focuses on implementing mandatory automatic exchange of information (AEOI)

See MoreBolivia: National Tax Service extends corporate tax filing deadlines for FY March 2025

The extension was issued in Resolution No. 102500000034 on 4 August 2025. Bolivia's National Tax Service (SIN) extended the corporate tax return and payment deadline for the fiscal year ending on 31 March 2025 to 18 August 2025. The extension

See MoreSwitzerland adds Tunisia to CbC report exchange list

Switzerland updates the CbC report list, including Tunisia as reciprocal from January 2024. Switzerland has updated its list of jurisdictions for the exchange of Country-by-Country (CbC) reports under the Multilateral Competent Authority

See MoreItaly implements emergency tax revisions on CFC, hybrid mismatch penalty rules

Urgent tax measures include revising the domestic CFC rules, tax loss carry-forward provisions, and the penalty protection regime for hybrid mismatch assessments. Italy’s parliament converted Law Decree No. 84 of 17 June 2025 into law with

See MoreOECD releases updated reporting formats for global minimum tax, CARF, issues new FAQs on CARF, CRS

The OECD has released XML Schemas and User Guides to facilitate reporting and information exchange under the Global Minimum Tax and CARF. As part of ongoing efforts to enhance tax transparency and improve international tax compliance, the OECD

See MoreKorea (Rep.): Ministry of Economy and Finance proposes corporate tax hikes, AI investment incentives, QDMTT Pillar Two rules

The proposals will require approval from the National Assembly before they can enter into force. The South Korean Ministry of Economy and Finance released the 2025 tax law amendment proposal, on 31 July 2025, which includes corporate tax hikes,

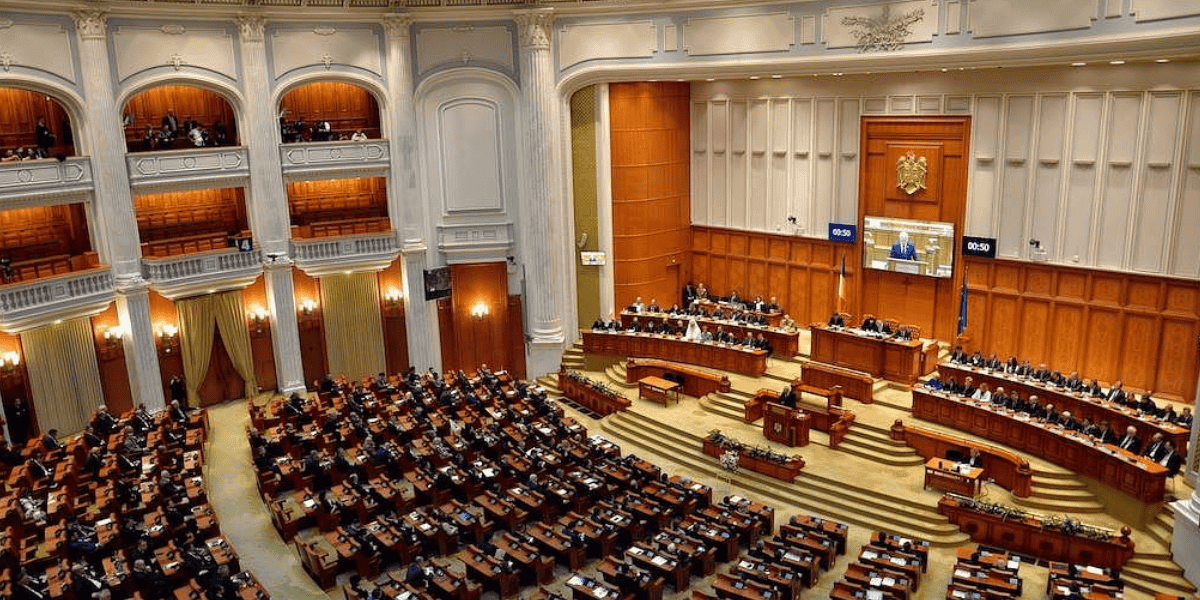

See MoreRomania gazettes legislation to amend APA, MAP

The legislation updates rules for Advance Pricing Agreements (APAs) and Mutual Agreement Procedures (MAPs) Romania’s government published Emergency Ordinance 11/2025 (GEO 11/2025) in the Official Gazette No. 695 on 24 July 2025, to amend the

See MoreKazakhstan adopts transfer pricing law amendments, emphasises ‘substance over form

Kazakhstan’s President signed amendments to transfer pricing regulations on 18 July 2025, introducing new rules effective 1 January 2026 that emphasize substance over form, revise reporting thresholds, define key financial terms, and tighten

See MoreBolivia: National Tax Service extends filing deadlines for corporate tax, transactions declarations

Corporate tax returns for tax years ending 31 March 2025 are now due by 29 August 2025. Bolivia’s National Tax Service (SIN) issued Resolution No. 102500000032 on 28 July 2025, in which it extended filing deadlines for corporate income tax

See MoreNetherlands clarifies application of ATAD interest deduction limitations

The Netherlands has issued a new decree clarifying the application of ATAD interest deduction limitations, effective from 30 July 2025. The Netherlands State Secretary for Finance has published Decree no. 2025-17107 of 16 July 2025, in Official

See More