Australia: ATO issues local and master file guidance for 2024

The Australian Taxation Office (ATO) issued guidance for the local and master file requirements for 2024 on 15 July, 2024. This guidance applies to reporting periods commencing from 1 January 2023. This guidance includes the Local file

See MoreAustria approves public CbC reporting

Austria's Federal Council approved the CBCR Publication Act (CBCR-VG) on 11 July 2024, following earlier approval by the National Council. This new law aligns with EU Directive 2021/2101, requiring public disclosure of Country-by-Country (CbC)

See MoreBahamas issues MAP guidance with Japan

The Bahamas Ministry of Finance has released guidance on Mutual Agreement Procedures (MAP) with Japan as per the tax information exchange agreement between the two nations. The guidance details the scope of MAP, eligibility for requesting MAP,

See MorePortugal extends deadline for transfer pricing filing

The Portuguese Secretary of State for Tax Affairs has extended the deadline for filing the transfer pricing documentation from 15 July 2024 to 31 July 2024. The extension was granted by Order 43/2024-XXIV, issued on 27 June 2024. Transfer

See MoreCyprus releases 2023-2024 reference rates for Montenegro and Cameroon notional interest deduction

The Cyprus Tax Department has published the 10-year government bond yield rate of Montenegro (in Euro) and Cameroon (in Euro) as of 31 December 2022 and 31 December 2023. These rates, when increased by 5%, are utilised as reference rates for

See MoreAustralia: ATO to collect data from online marketplaces

The Australian Taxation Office (ATO) registered a gazette notice stating that it will be acquiring sales data from online selling platforms operating in Australia from 2023–24 through to 2025–26. The announcement was made on Monday, 8 July

See MoreFrance publishes interest rate caps on shareholder loan deductions for FY ending June-September 2024

France, on 29 June 2024, has published in its Official Journal the second quarter 2024 interest rates for companies whose fiscal year (FY) ends between 30 June and 29 September, 2024. The interest rates are used to calculate the deductibility of

See MoreUkraine extends tax statute limitations for non-residents

The State Tax Service of Ukraine released a notice announcing the extension of the statute of limitations for documents and information necessary for tax control to 2,555 days (seven years), according to Articles 39 and 39, Paragraph 141.4 –

See MoreCanada enacts 3% digital service tax

Canada’s federal government, in a notice on 28 June 2024, announced it authorised the implementation of a digital services tax (DST),which received royal assent on 20 June, 2024. The government states that the implementation of the Digital

See MoreLithuania: Parliament adopts state defence fund, increases corporate income tax and excise duties

Lithuania's parliament has approved a resolution to establish the State Defense Fund, but to achieve this goal, the parliament has raised the corporate tax rate and excise duties on alcohol, cigarettes and fuel, and enacted the Defence Fund

See MoreAustralia: ATO finalises hybrid mismatch taxation rules

The Australian Taxation Office (ATO) released Taxation Determination (TD) 2024/4 - Income tax: hybrid mismatch rules - application of certain aspects of the 'liable entity' and 'hybrid payer' definitions on 3 July, 2024. TD 2024/4 is applicable

See MoreIreland updates guidelines on payment and receipt of interest, royalties without income tax deduction

Irish Revenue has released eBrief, updating Tax and Duty Manual 08-03-06 regarding the payment and receipt of interest and royalties without income tax deduction. The update clarifies the application of reduced withholding tax under double taxation

See MoreCosta Rica extends beneficial ownership filing deadline

Costa Rica’s Tax Administration announced an extension for the filing deadline of the informative return on beneficial ownership for companies, partnerships, and trusts. However, the announcement is yet to be published in the Official

See MoreUS: Treasury, IRS issue final regulations on tax reporting for digital asset transactions

The US Department of the Treasury and the Internal Revenue Service (IRS) issued final regulations requiring custodial brokers to report sales and exchanges of digital assets, including cryptocurrency, on 28 July, 2024. These reporting

See MoreAngola extends transfer pricing submission deadline

The Angolan General Tax Administration, on 27 June 2024, announced that it is extending the deadline for the submission of the transfer pricing information. The deadline has been extended from 30 June, 2024, to 31 July, 2024. The announcement

See MoreUS, India agree to extend equalisation levy agreement

The US Department of the Treasury announced the extension of its agreement with India on 28 June, 2024, regarding the transition from the existing equalisation levy to a new multilateral solution agreed by the OECD-G20 Inclusive Framework. The

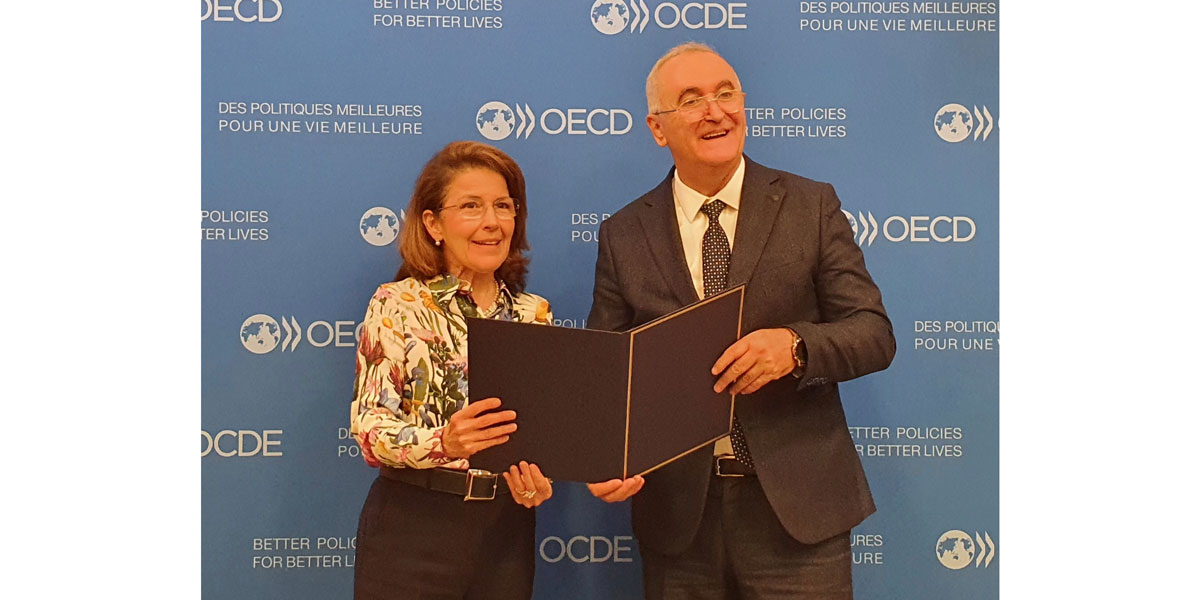

See MoreAlgeria joins BEPS MLI

The OECD, in an announcement, confirmed that Algeria signed the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (BEPS Convention) on 27 June, 2024. Algeria has become the 103rd

See MoreAzerbaijan publishes law ratifying BEPS MLI

The Republic of Azerbaijan published a law ratifying the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent BEPS (MLI) on Monday, 24 June 2024. The Milli Majlis of Azerbaijan made this decision based on Clause 4 of Part I

See More