OECD: Report to the July Meeting of G20 Finance Ministers

On 25 July 2024 the OECD published the report prepared for the meeting of G20 Finance Ministers and Central Bank Governors held in Brazil from 25 to 26 July 2024. The report notes some recent developments in important areas of international tax

See MoreKuwait publishes decree on tax information exchange

The Kuwaiti government implemented Decree-Law No. 6 of 2024 to enhance tax transparency and compliance with international tax agreements on 14 July, 2024. This legislation introduces measures to ensure rigorous information exchange and adherence to

See MoreBulgaria approves CbC exchange agreement with US

Bulgaria’s Council of Ministers approved the Bulgaria – United States Agreement on the Automatic Exchange of Country-By-Country (CbC) Reports on 17 July, 2024. This automatic exchange of CbC reports will enhance international tax transparency

See MoreArgentina removes five countries from non-cooperative jurisdictions list

Argentina has issued Decree 603/2024 of 10 July 2024, updating the list of non-cooperative jurisdictions for tax purposes as defined under Decree 862/2019. In this revised non-cooperative jurisdictions list, it removed Burkina Faso, Benin, Papua New

See MoreCzech Republic updates jurisdictions list for automatic exchange of financial account information

The Czech Republic issued Financial Bulletin No. 5/2024 on 18 June, 2024, which features an updated roster of contracting states and jurisdictions for the automatic exchange of information on financial accounts under the OECD Common Reporting

See MoreGreece updates list of jurisdictions under AEOI-CRS

The Greek Public Revenue Authority (AADE) has announced an update with the publication of Circular A.1089, issued on 3 June 2024. This circular revises the lists of reportable and participating jurisdictions for the Automatic Exchange of Financial

See MoreMalta implements public CbC reporting directive

Malta has implemented public Country by Country Reporting (CbCR) into domestic legislation (Act XVIII of 2024) on 17 May 2024. Multinational enterprises (MNEs) located in the EU and those outside the EU operating within the EU via a branch or

See MoreAustria: Parliament considers bill to amend tax laws

On 12 June 2024, Austria’s lower house of parliament approved Bill No. 2610 dB for consideration. This bill proposes key amendments to the Tax Amendment Act 2024. The bill focuses on three main measures: Deduction of grants for

See MoreAustria updates list of jurisdictions under AEOI-CRS

Austria published a revised list of jurisdictions involved in, and subject to, the automatic exchange of financial account information under the Common Reporting Standard (CRS). The updated list replaces the one published in June, 2023, and comes

See MoreOman Tax Authority extends CRS report deadline

The Oman Tax Authority has declared that the deadline for submitting reports under the Common Reporting Standard (CRS) for the fiscal year 2023 has been extended to 30 June, 2024. Earlier, the Tax Authority Chairman's Decision No. 78/2020,

See MoreColombia issues resolution on international tax information exchange

Colombia's tax authority (DIAN) has released Resolution No. 000096 on 31 May, 2024, providing an update on the exchange of tax information with international jurisdictions. This resolution is key in assessing the cooperation of various nations in

See MoreGreece announces 2024 CbC report exchange partners

On 30 May 2024, the Greek Public Revenue Authority (AADE) has released Circular A.1083, dated 21 May 2024, outlining the jurisdictions that will exchange Country-by-Country (CbC) reports with Greece in 2024 for the 2022 fiscal year under the

See MoreDominican Republic extends CbC reporting deadline to 30 August 2024

The Dominican Republic's General Directorate of Internal Revenue (DGII) issued Notice No. 10-24, on 31 May, 2024, extending the deadline for Country-by-Country (CbC) reporting for multinational enterprises (MNEs) as part of Action 13 of the Base

See MoreEU issues notices to member states for non-compliance with DAC7

The European Commission (EC) has decided to open an infringement procedure by sending a letter of formal notice to Germany , Hungary , Poland , and Romania for failing to exchange information on income generated by companies and individuals through

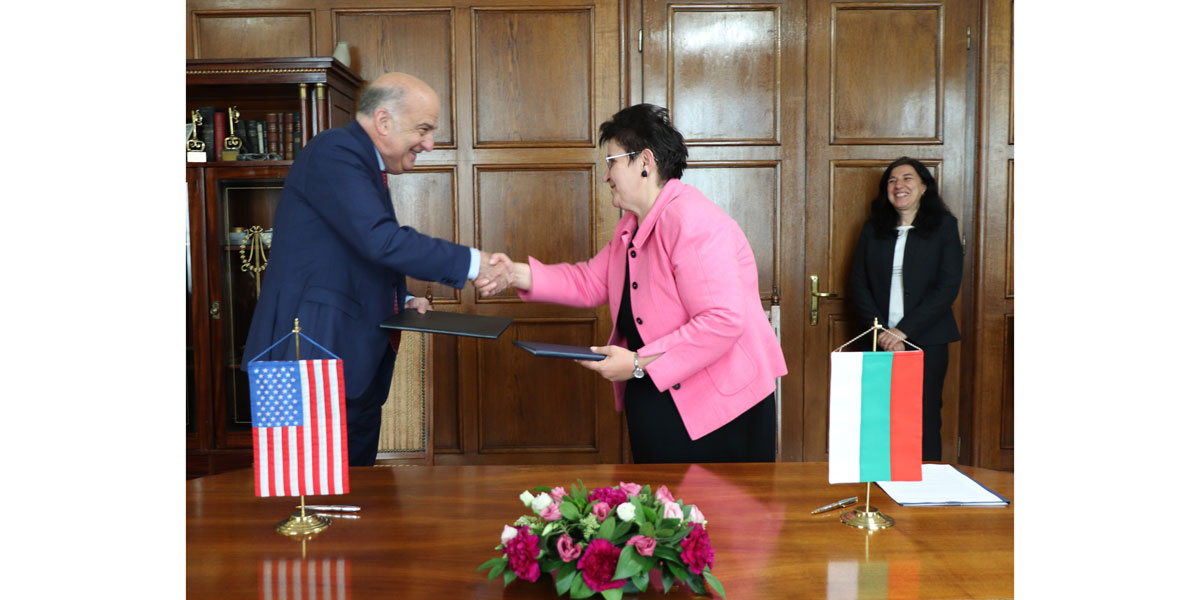

See MoreUS, Bulgaria sign CbC exchange agreement

Bulgaria's Ministry of Finance signed a country-by-country (CbC) exchange agreement with the US on 30 May, 2024. The automatic exchange of CbC reports will enhance international tax transparency and aid tax administrations in targeting resources

See MoreTaiwan calls for improved compliance with CRS standard

The Ministry of Finance has issued a critical directive to all Financial Institutions (FIs), emphasising the need for strict adherence to the "Measures for Financial Institutions to Implement Joint Reporting and Due Diligence Operations" on 24 May,

See MoreBulgaria signs AEOI agreement with USA

The Bulgarian Ministry of Finance announced, on 30 May 2024, the signing of an agreement with the United States for the automatic exchange of information (AEOI). Lyudmila Petkova, Deputy Prime Minister and Minister of Finance, Bulgaria, alongside

See MoreJapan updates CRS FAQs

Japan's National Tax Agency updated its FAQs on the common reporting standard (CRS) for automatic exchange of financial account information concerning non-residents on 9 April 2024. The revised FAQ includes new guidance on reporting requirements

See More