Austria enacts Tax Amendment Act 2024

Austria has enacted the Tax Amendment Act 2024, the law was published as Law No. 113 in the Austrian Official Gazette on 19 July 2024. The Tax Amendment Act 2024 came into effect on 20 July, 2024. Key highlights Country-by-Country

See MoreAustria approves public CbC reporting

Austria's Federal Council approved the CBCR Publication Act (CBCR-VG) on 11 July 2024, following earlier approval by the National Council. This new law aligns with EU Directive 2021/2101, requiring public disclosure of Country-by-Country (CbC)

See MoreFinland implements public CbC reporting directive

Finland approved legislation for the implementation of the EU Public Country-by-Country (CbC) Reporting Directive on 4 May, 2024. Finland’s version of its public country-by-country reporting largely aligns with the EU Directive. However, it did

See MoreAustralia introduces public country-by-country (CbC) reporting bill

On 5 June 2024, the Australian government presented new legislation in the parliament titled Treasury Laws Amendment (Responsible Buy Now Pay Later and Other Measures) Bill 2024. The bill includes public country-by-country (CbC) reporting, among

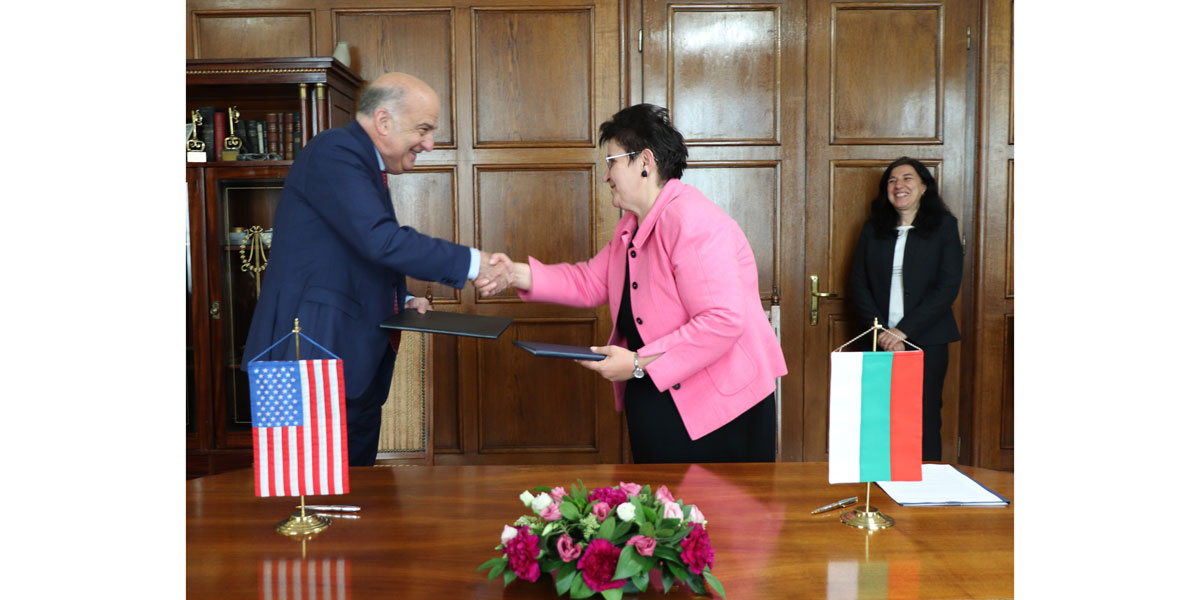

See MoreUS, Bulgaria sign CbC exchange agreement

Bulgaria's Ministry of Finance signed a country-by-country (CbC) exchange agreement with the US on 30 May, 2024. The automatic exchange of CbC reports will enhance international tax transparency and aid tax administrations in targeting resources

See MoreOECD updates guidance on implementation of CbC reporting of dividends

The Organisation for Economic Cooperation and Development (OECD) has released an updated version of its Guidance on the Implementation of Country-by-Country Reporting: BEPS Action 13. It refines the treatment of dividends in accordance with the

See MoreUS negotiates CbC exchange deal with Dominican Republic

As per an update to the IRS Country-by-Country Reporting Jurisdiction Status Table, the US has initiated negotiations with the Dominican Republic for a competent authority arrangement concerning the exchange of Country-by-Country (CbC)

See MoreGhana mandates transfer pricing compliance in CbC reporting

Ghana has made it mandatory for Multinational Enterprises (MNEs) operating in the country, that meet specific revenue thresholds, to provide detailed information on their worldwide operations through Country-by-Country Reporting (CbCR). MNEs are

See MoreAlbania signs multilateral competent authority agreement on exchange of CbC reports

The Organisation for Economic Co-operation and Development (OECD) updated its list of signatories to the Multilateral Competent Authority Agreement (MCAA) on the Exchange of Country-by-Country Reports (CbCR), on 30 April 2024, showing that Albania

See MoreFiling deadline approaches for CbCR in Dominican Republic

The Country-by-Country Report (CbCR) must be filed in the Dominican Republic by 31 May 2024. The General Norm 08-2021 was released by The Dominican Republic's Tax Administration (DGII) on the CbCR in October 2021. The provisions established in

See MoreAustralia ATO introduces change to CbC local file reporting from 2025

The Australian Taxation Office (ATO) released a notice announcing changes to the Country-by-Country (CbC) Local file reporting on Wednesday, 1 May 2024. These changes will take effect starting 1 January 2025. The key points of the notice

See MoreEstonia passes laws for public CbC reporting and partial adoption pillar 2 GloBE rules

On 10 April 2024, Estonia’s parliament passed the Act supplementing the Tax Information Exchange Act, the Taxation Act, and the Income Tax Act (379 SE). This law outlines the requirements for the implementation of public CbC reporting in

See MoreHungary releases 2024 audit plan with targets transfer pricing

Hungary's National Tax and Customs Administration (NAV) has released its audit strategy for the 2024 calendar year, highlighting transfer pricing as its key area of focus among other sectors. The new transfer pricing reporting obligation introduced

See MoreUkraine revises form and procedures for county-by-country (CbC) reports

The State Tax Service of Ukraine released updates to the form and procedures for preparing country-by-country reports. Among the main changes to the procedure for filling out the country-by-country report of the international group of companies

See MorePoland: Parliament passes public CbC reporting legislation

The Polish Parliament has passed a law implementing public Country-by-Country (CbC) reporting in accordance with the requirements of Directive (EU) 2021/2101. This legislation establishes a public reporting threshold for companies with annual

See MoreEstonia: Preliminary bill for public CbC reporting submitted to parliament

On 12 February 2024, a draft bill was introduced to the Estonian Parliament to incorporate the EU Public Country-by-Country (CbC) Reporting Directive into Estonian legislation. The parliament acknowledged there are a limited number of companies that

See MoreNetherlands releases decision on public CbC reporting

On 1 March 2024, the Netherlands released the Decision of February 14, 2024, concerning the enforcement of the Directive (EU) 2021/2101. As previously stated, the Netherlands approved a law for public CbC reporting in December 2023 to partially

See MoreAustralia holding public consultation on updated public CbC reporting legislation

On 12 February 2024, the Australian Treasury announced it is conducting an additional public consultation regarding implementing new requirements for publishing selected tax information on a Country-by-Country (CbC) basis or public CbC reporting.

See More