China releases 16th annual APA report (2024), highlighting strong growth, efficiency

China’s State Taxation Administration (STA) published its 16th Annual Advance Pricing Agreement (APA) Report on 25 November 2025, providing a comprehensive overview of the country’s APA programme and its development between 2005 and 2024. The

See MoreSingapore: IRAS updates transfer pricing guidance, raises indicative margin for related party loans

The Inland Revenue Authority of Singapore (IRAS) has updated its Transfer Pricing guidance for 2026 on 2 January 2026, including the indicative margin for related party loans. For the year 2026, the indicative margin applicable to Risk-Free Rates

See MoreUAE: FTA updates corporate advance pricing agreements guidance

The UAE Federal Tax Authority (FTA) has released a new Corporate Tax Guide on Advance Pricing Agreements (CTGAPA1) in December 2025. The guide outlines the procedural framework for APAs and covers an overview of the APA programme, applicable

See MoreKenya: KRA consults on draft income tax regulations for advance pricing agreement, minimum top-up tax for 2025

The Kenya Revenue Authority (KRA) released two draft regulations for public consultation, covering its global minimum tax regime and advance pricing agreement procedures for 2025, on 3 November 2025. In compliance with the Statutory Instruments

See MoreOECD reports increase in MAP and APA caseloads in 2024 data published on Tax Certainty Day 2025

The OECD has released new tax dispute statistics, highlighting generally positive results despite ongoing challenges on 31 October 2025. Tax certainty: OECD releases new statistics on tax disputes, showing positive outcomes but with challenges

See MoreAustralia: ATO updates APA guidance

The Australian Taxation Office (ATO) updated Law Administration Practice Statement PS LA 2015/4 to reflect enhancements to its advance pricing arrangement (APA) programme. The changes incorporate recommendations from the ATO’s 2023 APA Programme

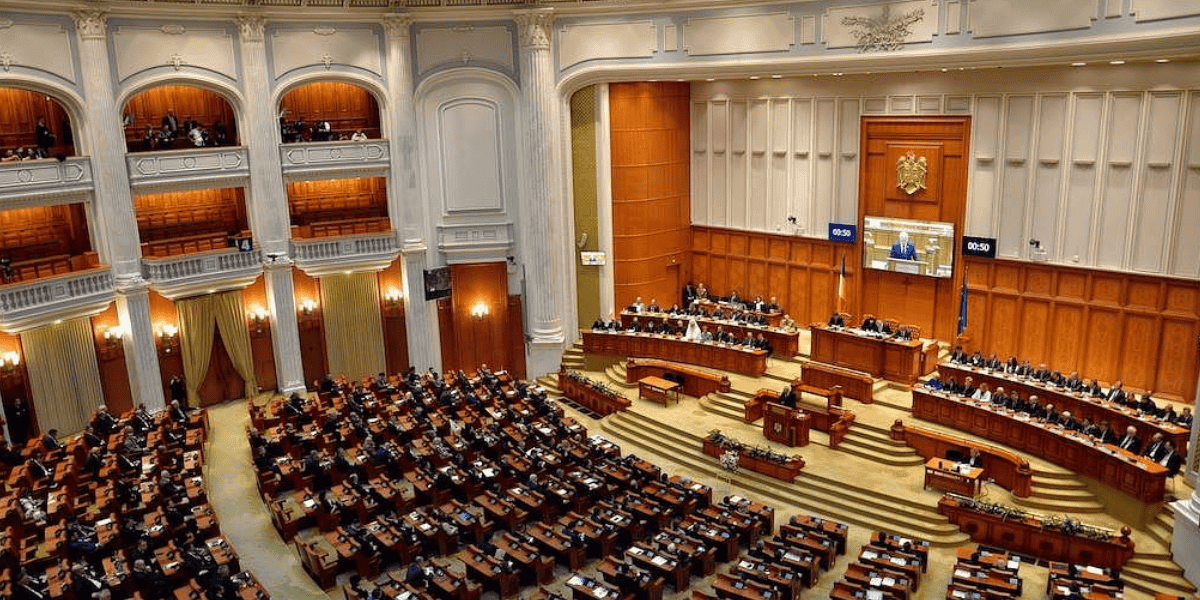

See MoreRomania gazettes legislation to amend APA, MAP

The legislation updates rules for Advance Pricing Agreements (APAs) and Mutual Agreement Procedures (MAPs) Romania’s government published Emergency Ordinance 11/2025 (GEO 11/2025) in the Official Gazette No. 695 on 24 July 2025, to amend the

See MoreFrance: DGFIP publishes Charter governing APAs to modernise and strengthen framework

Optional in 2025, the charter strengthens mutual commitments to optimise the APA process. The French tax authorities (DGFIP) published a new Charter governing advance pricing agreements (APAs) to modernise and strengthen the APA framework on 16

See MoreGermany suspends new advance pricing agreements with China

Until further notice, the BZSt, as the competent authority for APAs, will not initiate any new procedures aimed at concluding APAs with China. Germany has temporarily suspended the initiation of new advance pricing agreements (APAs) with China,

See MoreKenya repeals digital assets tax, expands economic presence tax under Finance Act 2025

The Finance Act 2025 introduces a 10% excise duty on virtual asset transaction fees, expanded SEP tax, a 5-year loss carry forward limit, AMT, and new APA guidelines. Kenya’s President William Ruto signed the Finance Act 2025 into law on 26

See MoreHungary updates tax rates on retail, financial entities, and insurance sectors

Act LIV of 2025 introduces updated tax rates, increased VAT thresholds, and new regulations across retail, financial, insurance, and energy sectors, along with enhanced R&D deductions. Hungary has published Act LIV of 2025 in the Official

See MoreLithuania implements DAC8 and APA rollback in tax law amendments

Lithuania has amended its tax law to implement DAC8, APA rollback, and update reporting, VAT, GDPR, and penalty rules, which take effect on 1 January 2026. Lithuania adopted amendments to the Law on Tax Administration on 30 June 2025, which

See MoreKenya enacts Finance Act 2025, reduces corporate tax rates

The Finance Act 2025 allows NIFCA-certified companies to benefit from reduced corporate tax rates, tax exemptions on dividends with reinvestment conditions. Kenya’s President William Ruto signed the Finance Act 2025 into law on 26 June

See MoreUK: HMRC updates guidance on unilateral APA programme for development CCAs

HMRC has updated its international manual with new guidance and a sample agreement for a unilateral APA programme covering UK entities’ participation in development cost contribution arrangements. The UK HM Revenue & Customs (HMRC) has

See MoreKenya: National Treasury publishes budget statement 2025-26, reduces corporate and digital tax rates

Kenya's National Treasury has released the 2025-26 Budget Statement on 12 June 2025. Kenya's National Treasury published the 2025-26 Budget Statement on 12 June 2025, outlining key tax measures aligning with proposals highlighted in the 2025

See MoreUS: IRS issues guidance on APA submission review

The US Internal Revenue Service (IRS) Large Business and International (LB&I) division released memorandum LB&I-04-0425-0005 on 22 April 2025, which reissues interim guidance LB&I-04-0423-0006 on 25 April 2023. This

See MoreIndia: CBDT signs record number of advance pricing agreements in FY 2024-25

The Indian Central Board of Direct Taxes (CBDT) announced that India has entered into a record 174 Advance Pricing Agreements (APAs) with Indian taxpayers in FY 2024-25. These include Unilateral APAs (UAPAs), Bilateral APAs (BAPAs) and Multilateral

See MoreUkraine: State Tax Service highlights possibility of concluding АРА agreement

Ukraine’s State Tax Service, in a release, highlighted the possibility of concluding Advance Pricing Arrangement (АРА) on 28 March 2025. Transfer pricing rules in Ukraine, introduced since 2013, are a tool to combat tax evasion and ensure

See More