Sweden proposes property tax increase on wind turbines from 2026

The Swedish Government has announced a proposal to raise the property tax on wind turbines. This announcement was made by the Swedish Government on 2 January 2025. The legislative amendment is proposed to take effect on 1 January

See MoreTurkey releases guide on mandatory transaction documentation

Turkey has released a new guide outlining the requirement for taxpayers and non-taxpayers, including end consumers, to document collections and payments exceeding 30,000 TL. These transactions must be recorded through documents issued by banks,

See MoreIreland: Revenue updates guidance on digital games tax

Irish Revenue has released eBrief No. 015/25 on 21 January 2025, providing updated guidance on the Section 481A Digital Games Corporation Tax Credit. Tax and Duty Manual Part 15-02-07 - Section 481A Digital Games Corporation Tax Credit - has been

See MoreDominican Republic launches public forum on beef cattle tax regulation

The Dominican Republic Directorate General of Internal Taxes informs taxpayers and the public that a public forum has been opened for the discussion of the draft "General Standard Regulating the Tax Treatment Applicable to the Beef Cattle Farming

See MoreRussia clarifies tax implications of dividends paid in property

Russia's Ministry of Finance has issued guidance Letter No. 03-07-11/121626 on the corporate income tax and VAT implications of dividends distributed in the form of property. The letter confirms that transferring ownership of assets to

See MoreEgypt: House of Representatives approves amendments to unified tax procedures law

The Egyptian House of Representatives approved a draft law to amend provisions of the Unified Tax Procedures Law (Law No. 206 of 2020) On 26 January 2024,. The amendments allow the Minister of Finance or their representative to negotiate

See MoreEgypt launches tax reform to simplify compliance and support business growth

Egypt’s Ministry of Finance launched a tax reform initiative aimed at simplifying administrative procedures, expanding the taxpayer base, and creating a more supportive environment for businesses. The reforms were developed in collaboration with

See MoreSweden plans reforms to R&D and expert tax incentives

Sweden is set to revise its research and development (R&D) tax incentives and expert tax relief rules to simplify administration and expand access. A government report has proposed key changes, expected to take effect on 1 January 2026. For

See MoreGermany updates tax haven defense ordinance, removes five jurisdictions

Germany published the Third Ordinance amending the Tax Haven Defense Ordinance in the Official Gazette on 30 December 2024. The amendments reflect the EU Economic and Financial Affairs Council's 2024 decisions to remove Antigua and Barbuda, the

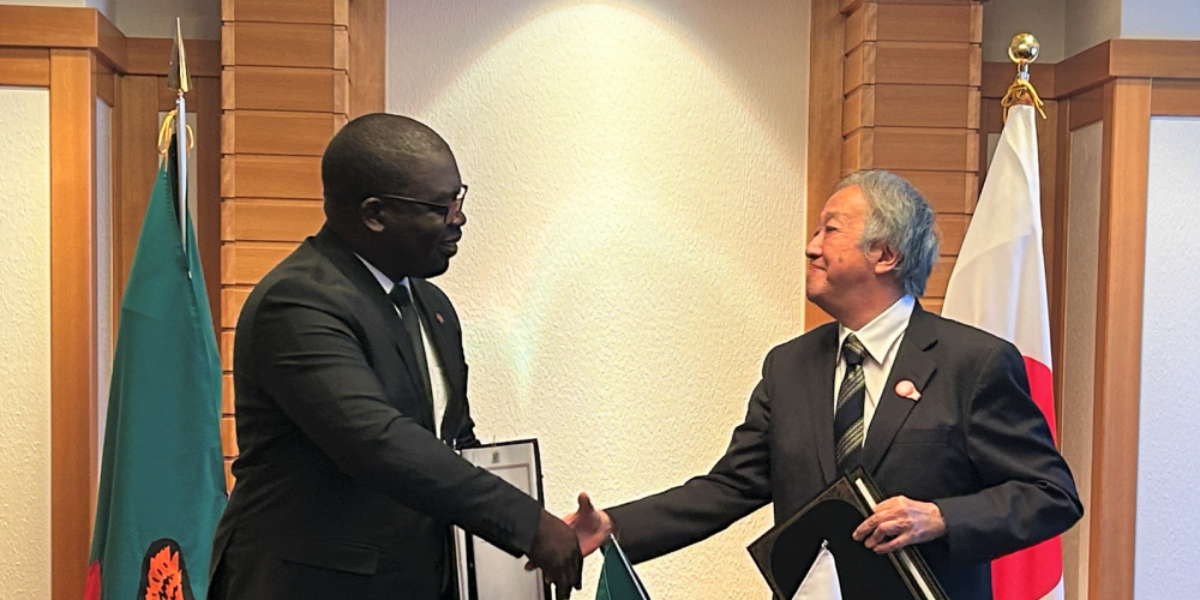

See MoreJapan, Zambia sign investment agreement

The “Agreement between Japan and the Republic of Zambia for the Promotion and Protection of Investment” (Japan-Zambia Investment Agreement) was signed in Tokyo by H.E. Mr. TAKEUCHI Kazuyuki, Ambassador Extraordinary and Plenipotentiary of Japan

See MoreIreland: Revenue updates guidance on Residential Zoned Land Tax

Irish Revenue has released eBrief No. 031/25 on 4 February 2025, providing updated guidance on the Residential Zoned Land Tax (RZLT). The Residential Zoned Land Tax (“RZLT”) was introduced by section 80 of the Finance Act 2021 and is

See MoreUK: HMRC late payment interest rates to be revised after Bank of England lowers base rate

The UK tax authority, His Majesty’s Revenue and Customs (HMRC) has announced a reduction in interest rates for late payments and repayments following the Bank of England's base rate cut on 6 February 2025. The base rate was lowered from 4.75%

See MoreUAE: MoF launches public consultation on e-Invoicing data dictionary

The UAE Ministry of Finance (MoF) has launched a public consultation on the data dictionary for electronic invoicing (e-invoicing). The consultation period will remain open until 27 February 2025. It is a structured form of invoice data that

See MoreFrance approves 2025 Finance Law with new tax measures

The French Senate approved the Finance Law for 2025 on 6 February 2025, following approval by the National Assembly on 5 February. With both chambers' approval, the law is adopted, pending constitutional review. The law includes the indexation of

See MoreOECD consults Tax Incentives Principles

The Platform for Collaboration on Tax (PCT), under the Organisation for Economic Co-operation and Development (OECD), has initiated a public consultation draft titled “Tax Incentives Principles” on 10 December 2024. The consultation draft seeks

See MoreSaudi Arabia: ZATCA issues guidance on real estate transaction tax for BOOT contracts

The Saudi Arabian Zakat, Tax, and Customs Authority (ZATCA) provided new guidance regarding Real Estate Transaction Tax (RETT) for Build-Own-Operate-Transfer (BOOT) contracts on 25 January 2025. The rules specify that immovable assets such as

See MoreSri Lanka, UAE finalise investment protection agreement

Sri Lanka and UAE have finalised an agreement on reciprocal promotion and protection of investments between the two countries. This announcement was made by the Ministry of Foreign Affairs, Foreign Employment and Tourism on 3 February 2024. The

See MoreUkraine revises tax haven list in Resolution

The Ukrainian Ministry of Finance issued Resolution No. 1505 on 4 February 2025 , revising the list of tax havens for transfer pricing purposes. List of states (territories) that meet the criteria established by subparagraph 39.2.1.2 of

See More