EU: Council adopts DAC9 to support Pillar Two filings

The Council of the EU announced on 14 April 2025 the formal adoption of changes to the Directive on administrative cooperation in taxation (Directive 2011/16/EU) to simplify filing obligations under the Pillar 2 Directive (DAC9). The directive

See MoreTaiwan extends deadline for tax treaty benefit applications

Taiwan’s Ministry of Finance has announced an extension to the application deadline for claiming tax treaty (agreement) benefits on 10 April 2025. The Ministry of Finance promulgated the amendments to Article 34 of the "Regulations Governing

See MoreSingapore: IRAS issues updated guidance on globe rules and domestic top-up tax

The Inland Revenue Authority of Singapore (IRAS) has published new presentations offering guidance on the Global Anti-Base Erosion (GloBE) Rules and the Domestic Top-up Tax (DTT) on 8 April 2025. The first module focuses on the scope and charging

See MoreAustralia: ATO updates guidance on 2024–25 monthly foreign exchange rates

The Australian Taxation Office (ATO) has updated its guidance on Monthly exchange rates for 1 July 2024 to 30 June 2025, including rates for January, February, and March 2025 on 2 April 2025. According to the guidance of the main foreign exchange

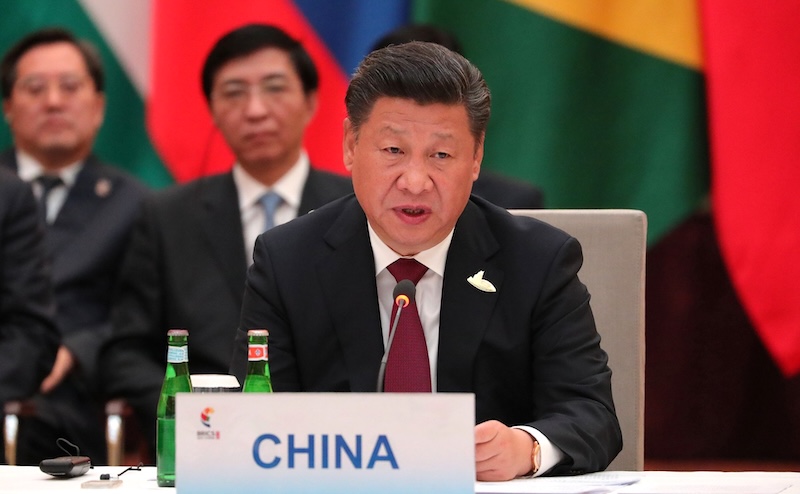

See MoreTrade war escalades: China imposes 125% tariffs on US imports

Beijing announced it has increased its tariffs on US imports to 125% earlier today, 11 April 2025. "The US side's imposition of excessively high tariffs on China seriously violates international economic and trade rules, runs counter to basic

See MoreGermany: Coalition government to lower corporate tax rate amongst other policy changes

Germany’s new coalition government, formed by the conservative alliance led by Friedrich Merz and the centre-left Social Democrats (SPD), announced a set of tax measures on 9 April 2025 as part of their policy agreement. The measures include a

See MoreMexico announces tax incentive guidelines under ‘Mexico Plan’ decree with new evaluation committee

Mexico published a resolution detailing the guidelines for tax incentives under the “Mexico Plan” decree on 21 March 2025, effective from 24 March 2025. The resolution establishes the role of a new Evaluation Committee, composed of members

See MoreNew Zealand opens consultation on GST reform for joint ventures

The Government has launched public consultation on proposals to reform the GST rules for joint ventures on 7 April 2025. The proposals in the discussion document are largely aimed at ensuring the GST rules are fit for purpose for joint venture

See MoreSingapore: IRAS revises e-tax guide on record-keeping for GST and non-GST registered businesses

The Inland Revenue Authority of Singapore (IRAS) has updated two e-Tax Guides on record-keeping requirements for businesses on 31 March 2025. The Record Keeping Guide for GST-Registered Businesses (Eleventh Edition) outlines the necessary

See MoreEU Commission unveils 2024 state aid scoreboard

The European Commission has published the 2024 State aid Scoreboard on 8 April 2025 providing a comprehensive overview of State aid expenditure in the EU in 2023. Notably, tax-related State aid emerged as the second most utilized instrument,

See MoreSaudi Arabia: ZATCA urges taxpayers to benefit from fines cancellation initiative until June 2025

The Saudi Zakat, Tax and Customs Authority (ZATCA) has urged all taxpayers to leverage from the “Cancellation of Fines and Exemption of Penalties Initiative" which ends on 30 June 2025. This announcement was made by ZATCA on 6 April

See MoreEcuador extends 0% remittance tax on essential imports amid energy crisis

The Ecuadorian government issued Executive Decree No. 589 on 29 March 2025 to extend the 0% tax rate on foreign currency outflows (ISD) for essential imports. The measure continues the temporary relief first introduced for January to March 2025

See MoreTaiwan: Ministry of Finance outlines criteria for commission expense deductions

Taiwan's Ministry of Finance issued a notice stating that businesses must provide proof of agency services rendered in order to deduct commission expenses on 31 March 2025. National Taxation Bureau of the Central Area, Ministry of Finance

See MoreUS: IRS updates guidance on branch-level interest tax

The US Internal Revenue Service (IRS) has released an updated practice unit on Branch-Level Interest Tax Concepts. Below is a general overview of the key points covered in this publication: Note: This Practice Unit was updated to remove

See MoreGreece keeps tax debt instalment interest rates fixed until March 2026

The Ministry of National Economy and Finance has announced that interest rates for repaying state debts under the standard arrangement will remain unchanged until March 2026. This move supports taxpayers facing financial difficulties by allowing

See MoreIreland launches consultation on R&D tax credit review

Ireland's Department of Finance has launched a public consultation to review the research and development (R&D) tax credit, seeking feedback on its effectiveness and impact on innovation and business growth on 2 April 2025. The consultation

See MoreGreece proposes tax, crypto and debt settlement reforms in new draft law

Greece's Ministry of Finance submitted a draft law to Parliament on 31 March 2025, proposing several tax and financial reforms. The bill includes provisions allowing carried-forward losses from corporate mergers, including credit institutions,

See MoreAustralia: ATO announces amendments to its top 500 program

The Australian Taxation Office (ATO) has announced updates to its Top 500 Private Groups Tax Performance Program, effective 1 April 2025. About the Top 500 private groups tax performance program The Top 500 private groups tax performance

See More