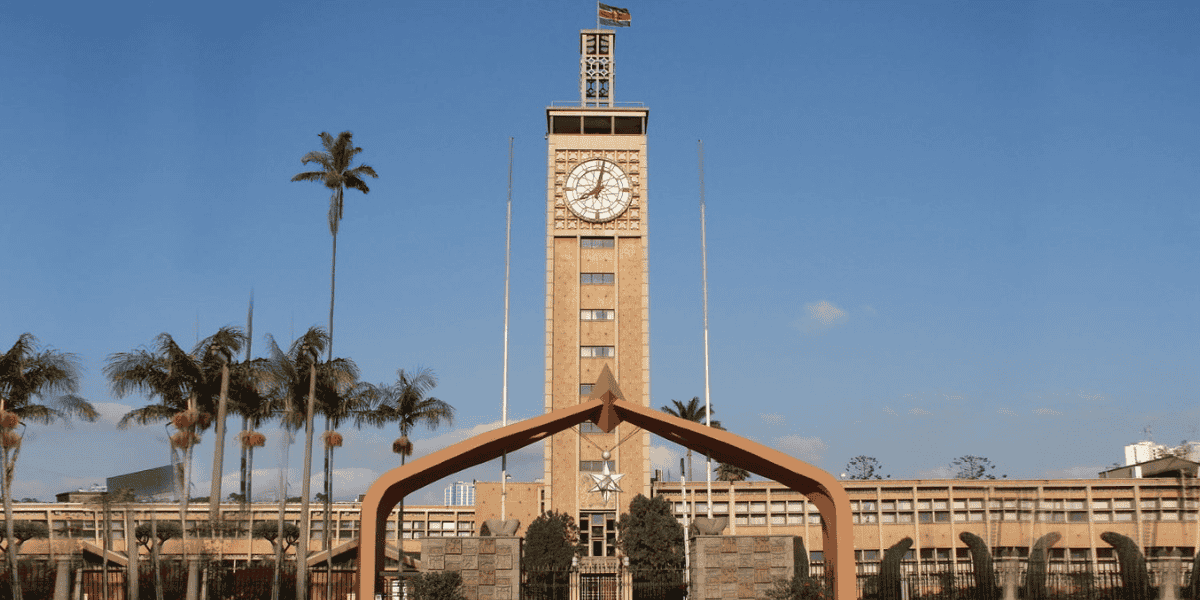

Kenya reduces market rates for fringe benefit tax, non-resident loans

For July to December 2025, the rate has been reduced to 8% (from 9%), and the low-interest loan benefit rate has dropped to 9% (from 14%). The Kenya Revenue Authority (KRA) released a public notice on 10 July 2025 regarding updates to the market

See MoreUK: HMRC launches compliance campaign on directors’ loans

HMRC is contacting directors over potentially undeclared released loans, with possible implications for both personal and company tax compliance. The UK’s HMRC is contacting company directors who had loans released or written off between April

See MoreOECD highlights progress and burden reduction on BEPS standards

The OECD/G20 Inclusive Framework report endorsed practical adjustments to ease the BEPS minimum standards' administrative burdens. RegFollower Desk The OECD reported on 4 July 2025 that the members of the OECD/G20 Inclusive Framework has

See MoreOECD reports growing tax support needs in developing nations

The report highlighted that developing countries are prioritising domestic revenue generation, driving higher demand for tax support and expanded OECD activities. The OECD has published the "Tax Co-operation for Development: Progress Report on

See MoreOECD: VAT receipts boost tax revenue in Asia-Pacific

The report states that tax revenues in the Asia-Pacific rose for a third straight year in 2023 due to higher VAT receipts. The OECD has released the Revenue Statistics in Asia and the Pacific 2025 report on 8 July 2025, which reveals that tax

See MoreOECD consults on copper transfer pricing framework

Comments are due by 5 September 2025. The OECD has initiated a public consultation on a transfer pricing framework for copper on 10 July 2025. The comment submission deadline is set for 5 September 2025. Determining the Price of Minerals: A

See MoreTanzania enacts 2025-26 budget measures, includes new transfer pricing penalty

The measures will apply from 1 July 2025, unless otherwise specified. Tanzania's Finance Act 2025 was enacted on 30 June 2025, implementing tax measures from the 2025-26 Budget Speech with some adjustments to the initially announced

See MoreEcuador clarifies tax exemption rules for share transfers

The Circular clarified income tax rules and filing obligations for share transfers and corporate restructurings. Ecuador’s Internal Revenue Service (SRI) issued Circular No. NAC-DGECCGC25-00000005 on 30 June 2025, clarifying income tax rules

See MoreSingapore: IRAS releases 8th edition guide on additional conveyance duties

This guide outlines the Additional Conveyance Duties (ACD) introduced on 11 March 2017, covering their treatment and calculation for acquiring or disposing of equity interests in property-holding entities (PHEs) primarily owning Singapore

See MoreBulgaria to adopt the euro from 2026

Bulgaria will adopt the euro starting 1 January 2026, replacing the lev at a fixed rate after meeting EU criteria. Bulgaria will officially adopt the euro as its currency on 1 January 2026, becoming the 21st member of the eurozone. The decision

See MoreJapan, Iran Customs Mutual Assistance Agreement enters into force

Japan and Iran’s Customs Mutual Assistance Agreement entered into force on 18 June 2025, following its signing on 22 August 2021. The Customs Mutual Assistance Agreement (CMAA) between Japan and Iran entered into force on 18 June 2025. This

See MoreUK: HMRC introduces strict crypto reporting rules starting 2026

UK crypto traders will face penalties if they fail to provide personal information under HMRC’s updated reporting requirements. The UK's HM Revenue & Customs (HMRC) has published updated guidelines introducing new reporting obligations for

See MoreBangladesh begins second-round of negotiations with US to avert 35% tariff on exports

The second-round talks are being held at Washington from 9–11 July 2025. Bangladesh has started the second round of negotiations with the US in Washington, DC, from 9 to 11 July 2025, in an effort to stop the implementation of a proposed 35%

See MoreBRICS leaders endorse UN framework for international tax cooperation

The BRICS leaders' declaration from the 17th BRICS Summit in July 2025 highlights their support for the UN Framework Convention on International Tax Cooperation, as endorsed by BRICS Finance Ministers and Central Bank Governors. The BRICS leaders

See MoreUS: IRS repeals 83 outdated tax regulations

The tax regulations are deemed outdated due to repealed statutes, expired emergency provisions, or matters now resolved by new legislation. The US Internal Revenue Service (IRS), under President Donald Trump's Executive Order 14219 (19 February

See MoreUS to impose 35% tariff on Bangladeshi exports from August

US to apply 35% tariff on Bangladeshi exports from 1 August, raising concerns for the country’s key garment sector. The US will impose a 35% tariff on imports from Bangladesh starting 1 August 2025, following an announcement by President Donald

See MoreUS to impose 25% tariffs on Japan, Korea (Rep.) from August 2025

Trump announced new tariffs on Japan and Korea (Rep.), urging trade negotiations before 1 August. US President Donald Trump announced a 25% tariff on all imports from Japan and Korea (Rep.) on 8 July 2025, due to take effect on 1 August. The

See MoreOECD urges Iceland to reform its fiscal framework

The OECD report recommends that Iceland reform its fiscal framework to enhance sustainability and reduce economic volatility. The Organisation for Economic Co-operation and Development (OECD) has published a report on 26 June 2025, advising

See More