EU publishes implementing regulation to facilitate automatic exchange of tax information under DAC9

The EU's implementing regulation under DAC9 aims to enable automatic information exchange between Member States through technical solutions. The European Commission has published the implementing regulation in the Official Journal of the EU

See MoreNigeria enacts law renaming FIRS to National Revenue Service (NRS)

The law aims to enhance tax compliance, increase revenue, and streamline administration to eliminate inefficiencies. Nigeria’s President Bola Tinubu signed the Nigeria Revenue Service (Establishment) Act, 2025 on 17 July 2025, which rebrands

See MoreTaiwan clarifies rules on foreign tax credit eligibility

Unclaimed treaty relief blocks foreign tax credit in Taiwan Taiwan’s Ministry of Finance has clarified that profit-seeking enterprises are not eligible to claim a foreign tax credit for excess taxes paid in treaty jurisdictions if they do not

See MoreColombia: Government considers tax hike to fund 2026 budget

The government is considering tax reform to raise COP 26 trillion for its 2026 budget. Colombia’s government is considering a tax reform proposal aimed at generating COP 26 trillion, primarily through tax increases, to support the 2026

See MoreIreland: Irish Revenue revises schedule of revenue powers

The brief confirms the updates to the Tax and Duty Manual (TDM) as of July 2025. The Irish Revenue has published eBrief No. 135/25 on 15 July 2025 about updates to Tax and Duty Manual (TDM) 38-04-15 Schedule of Powers. Revenue eBrief No.

See MoreMexico updates final lists of taxpayers linked to fake transactions

The updated lists of taxpayers suspected of issuing invalid invoices due to non-existent transactions require affected parties to provide proof or amend tax returns within 30 days. Mexico’s Tax Administration (SAT) has revised the final lists

See MoreTurkey extends tax payment deadlines in earthquake-hit regions

Turkey delays tax debt repayments for earthquake-affected taxpayers until after November 2025. Turkey's Revenue Administration announced the enactment of Presidential Decision No. 10700 on 14 July 2025, extending the payment periods for

See MoreColombia sets shareholder loan rate at 9.25% for 2025

Colombia has lowered the deemed minimum interest rate on shareholder and partner loans to 9.25% for the 2025 tax year, down from 12.69% in 2024. Colombia’s Ministry of Finance has issued Decree No. 0771 on 7 July 2025, establishing a deemed

See MoreBangladesh, US to hold final tariff negotiations before August 25

Bangladesh and the US to hold final tariff negotiations next week to avert 35% export duty. Bangladesh will commence a third and final round of negotiations with the US next week to avert a 35% tariff on its exports, scheduled to take effect on 1

See MoreEU warns of retaliation if US proceed with tariffs from August

Following a meeting in Brussels, EU foreign and trade ministers expressed frustration with Washington’s lack of agreement and signalled readiness to respond if negotiations break down. The European Union (EU) on 14 July 2025 warned that it may

See MoreNetherlands : Senate approves box 3 Rebuttal scheme

The Dutch Senate approved the Box 3 Rebuttal Scheme on 8 July 2025, allowing taxpayers to prove actual returns on savings and investments. The Dutch Senate approved the Box 3 Rebuttal scheme on 8 July 2025, allowing taxpayers to prove the actual

See MoreIreland updates carbon tax and horticultural relief rates from May 2025

The eBrief updates tax guides to reflect revised mineral oil, solid fuel carbon, and natural gas carbon tax rates, including updated relief rates, contact details, and manual titles. The Irish Revenue has published Revenue eBrief No. 132/25,

See MoreUAE: FTA offers penalty waiver for late tax registration

The FTA clarified conditions for waiving or refunding penalties for late corporate tax registration, requiring returns or declarations to be filed within seven months of the first tax period. The UAE Federal Tax Authority (FTA) has released

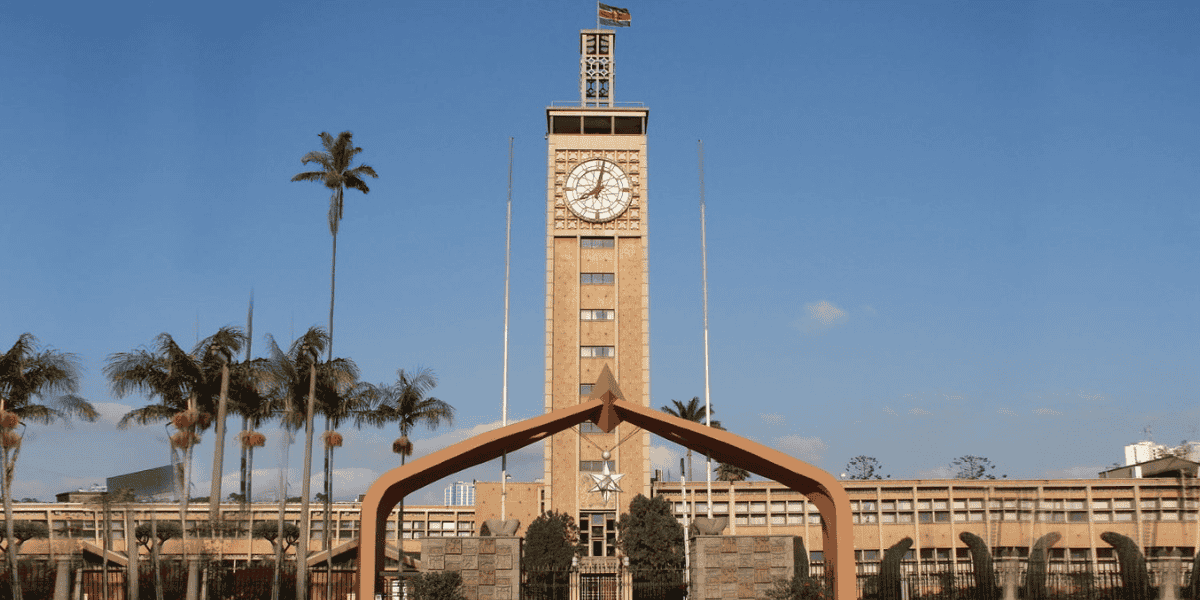

See MoreKenya reduces market rates for fringe benefit tax, non-resident loans

For July to December 2025, the rate has been reduced to 8% (from 9%), and the low-interest loan benefit rate has dropped to 9% (from 14%). The Kenya Revenue Authority (KRA) released a public notice on 10 July 2025 regarding updates to the market

See MoreUK: HMRC launches compliance campaign on directors’ loans

HMRC is contacting directors over potentially undeclared released loans, with possible implications for both personal and company tax compliance. The UK’s HMRC is contacting company directors who had loans released or written off between April

See MoreOECD highlights progress and burden reduction on BEPS standards

The OECD/G20 Inclusive Framework report endorsed practical adjustments to ease the BEPS minimum standards' administrative burdens. RegFollower Desk The OECD reported on 4 July 2025 that the members of the OECD/G20 Inclusive Framework has

See MoreOECD reports growing tax support needs in developing nations

The report highlighted that developing countries are prioritising domestic revenue generation, driving higher demand for tax support and expanded OECD activities. The OECD has published the "Tax Co-operation for Development: Progress Report on

See MoreOECD: VAT receipts boost tax revenue in Asia-Pacific

The report states that tax revenues in the Asia-Pacific rose for a third straight year in 2023 due to higher VAT receipts. The OECD has released the Revenue Statistics in Asia and the Pacific 2025 report on 8 July 2025, which reveals that tax

See More