Colombia proposes comprehensive tax reforms to stimulate economy

The draft bill offers VAT exemptions for hotels and renewable energy, vehicle tax penalty discounts, debt relief for low-income electricity users, and a traffic fine amnesty through 2024. Colombia has published Bill No. 507 of 2025 in the

See MoreAzerbaijan: Central Bank lowers key interest rate

The rate has been lowered from 7.25% to 7%, effective 24 July 2025. The Central Bank of Azerbaijan has lowered its key refinancing rate from 7.25% to 7.0%, effective 24 July 2025. The decision was based on actual inflation aligning with

See MoreSri Lanka releases consolidated Inland Revenue Act 2025

The consolidated version of the Inland Revenue Act reflects the recent legal amendments. The Sri Lankan Inland Revenue Department released the consolidated version of the Inland Revenue Act No. 24 of 2017 on 24 July 2025. The updated text

See MoreIreland: Revenue updates guidance on outbound payment defensive measures

Irish Revenue has updated its guidance on outbound payment defensive measures to reflect the 2025 legislative changes to Section 817U of the TCA, effective from 1 January 2026. Irish Revenue has published eBrief No. 139/25 announcing updates to

See MoreUS: IRS clarifies BEAT exception rules; states services cost method not mandatory, documentation essential

The IRS clarified that under BEAT rules, taxpayers may exclude the cost portion of service payments to foreign related parties using the Section 59A(d)(5) exception, even without applying the specific transfer pricing method. The US Internal

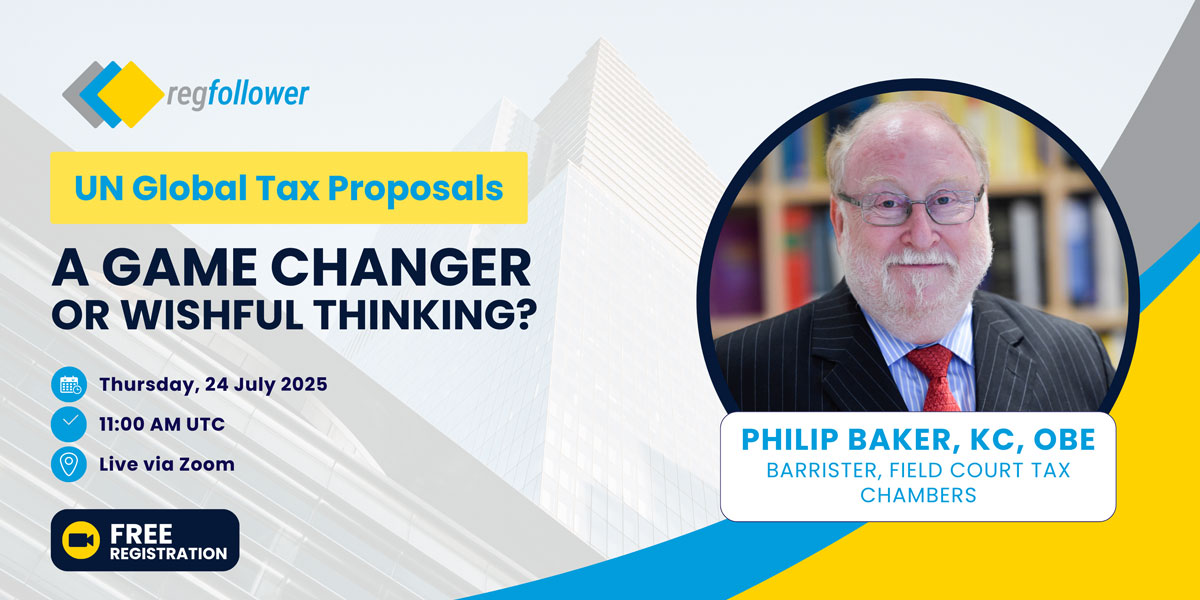

See MoreUN Tax Proposals: A game changer or wishful thinking?

Regfollower debuted its official podcast, Regtalks, live on 24 July 2025, with a compelling discussion with Philip Baker OBE KC, one of the world’s leading experts in international tax law. He unpacked two UN initiatives: the Framework

See MoreIreland: Revenue issues guidance on taxation of income from social media and promotional activities

Irish Revenue has issued guidance on the tax treatment and compliance obligations for income earned from social media and promotional activities under Income Tax and Corporation Tax rules. Irish Revenue released eBrief No. 138/25 on 21 July 2025

See MoreZambia advances 2025 tax reform, proposes 1% minimum alternative tax for businesses

Key proposals include a 1% MAT on turnover, 15% to 20% withholding tax on government securities, and excise duty hikes on cigarettes, alcohol, sugary drinks, and betting services. Zambia's National Assembly has advanced the Income Tax

See MoreIreland to increase infrastructure spending by 30%

The updated National Development Plan outlines a wide-ranging strategy for infrastructure development from 2026 to 2030, focusing on housing, energy, water, and transport. Ireland’s government has announced a major boost to infrastructure

See MoreBelgium: Chamber of Deputies approve participation exemption changes, exit tax rules, other tax reforms

From 2026, Belgium's tax changes include stricter participation exemption rules, exit tax on cross-border reorganisations, a permanent 6% VAT for residential demolition/reconstruction, and higher VAT on coal and fossil fuel boilers. The Belgian

See MoreEU urges Netherlands to align investment fund tax rules with EU law

The European Commission issued a reasoned opinion to the Netherlands for not aligning its tax levy reduction scheme with the free movement of capital under EU and EEA agreements. The European Commission issued a reasoned opinion to the

See MoreEU to shift VAT liability on imported distance sales to non-EU sellers, platforms

The change aims to promote the use of the VAT Import One-Stop-Shop (IOSS), enabling VAT registration in a single EU state for sales across the EU. The EU General Affairs Council adopted amendments to the VAT directive during a meeting on 18

See MoreG20 finance ministers, central bank governors commit to ongoing discussions on Pillar Two global minimum tax concerns

They expressed their commitment to continuing constructive engagement to address concerns surrounding the Pillar Two global minimum taxes. The G20 Finance Ministers and Central Bank Governors issued a Communique following their meeting held on

See MoreEU unveils 2028–2034 budget proposal, includes CORE corporate contribution

The framework provides Europe with a long-term investment budget to support its ambitions for independence, prosperity, security, and economic growth over the next decade. The European Commission presented its 2028-2034 budget proposal for an

See MoreColombia clarifies tax on indirect transfers of free trade zone branches

The Ruling clarifies tax rules for indirect transfers of Free Trade Zone branches, excluding preferential rates. The Colombian tax authority (DIAN) issued Ruling 7858 int 924 on 18 June 2025, clarifying the taxation of indirect transfers

See MoreZambia announces broad tax reforms in 2025 budget

Zambia’s 2025 Budget introduces wide-ranging tax reforms across income, turnover, VAT, property transfer, and excise duties to boost revenue and compliance. Zambia has introduced a range of tax changes in its 2025 Budget, affecting income tax,

See MoreItaly: Council of Ministers approves additional supplementary and corrective amendments to tax reform

The bill simplifies regulations, enhances transparency and fairness, revises the Taxpayer's Bill of Rights, and clarifies the self-assessment process with added sanctions. Italy’s Council of Ministers has preliminarily approved a Legislative

See MoreEU revises list of high-risk third countries for money laundering and terrorist financing

The regulation goes into effect on 5 August 2025. The EU published the Commission Delegated Regulation (EU) 2025/1184 on 16 July 2025, updating Regulation 2016/1675 by revising the list of high-risk third countries with anti-money laundering

See More