Italy extends deadline for comprehensive overhaul of tax system

The reform reduces tax burdens, improves legal certainty, implements OECD BEPS Pillar Two and seeks to attract foreign investment. Italy has published Law No. 120 of 8 August 2025 in the Official Gazette No. 184 of 9 August 2025, announcing the

See MoreEcuador updates tax haven list, removes Panama

Ecuador’s SRI updates tax haven list, removing Panama effective 18 August 2025. The Ecuadorian Internal Revenue Service (SRI) has issued Resolution No.NAC-DGECCGC25-00000021, which updates the country’s list of tax havens and preferential tax

See MoreOECD releases guidance on ring-fencing mining income

The practice note explains the concept of ring-fencing in mining, its benefits, design options, and implementation challenges, drawing on international experiences to guide effective tax policy and administration. The OECD has released a new

See MoreAustralia: Treasurer outlines tax reforms centred on equity, growth, and sustainability

The tax reforms prioritised ensuring fairness and intergenerational equity for workers, incentivising business investment to address economic productivity challenges, and simplifying the system to fund essential services amid societal shifts like

See MoreOECD expands qualified status central record with 16 new jurisdictions for global minimum tax compliance

The new 16 jurisdictions are Brazil, Gibraltar, Indonesia, Isle of Man, Japan, Jersey, Malaysia, New Zealand, North Macedonia, Poland, Portugal, Singapore, South Africa, Switzerland, Thailand, and the UAE. The OECD/G20 Inclusive Framework on

See MoreAustralia: ATO notifies large corporate taxpayers to review tax transparency data before October 2025 report

This month, companies will receive a notification with the tax information proposed for publication. The communication will also outline steps for correcting any errors prior to publication, including the deadline for responses. The Australian

See MoreSingapore: IRAS revises GST filing guidance on error corrections and extension requests

IRAS updates GST filing guidance, outlining error corrections, refund claims, and deadlines for extensions. Singapore’s tax authority (IRAS) released revised instructions regarding the correction of errors in Goods and Services Tax (GST)

See MoreUS: IRS, Treasury release FAQs for the accelerated termination of select OBBBA energy provisions

These FAQs provide guidance on several energy credits and deductions that are expiring under OBBBA and their termination dates. The US Internal Revenue Service (IRS) has released a fact sheet with FAQs (FS-2025-05) on 21 August 2025 to clarify

See MoreSweden: Central Bank holds policy rate at 2.00%

Riksbank holds rate at 2% amid inflation pressures, signals possible cuts later in 2025 Sweden’s central bank, the Riksbank, held its policy rate at 2% on 21 August 2025, citing higher-than-expected inflation and weak economic growth. The

See MoreTaiwan: MoF clarifies how to handle remaining labour retirement fund balances

The Ministry of Finance says leftover Labour Retirement Reserve funds must be reported as income when settled. Taiwan’s Ministry of Finance (MoF) has stated on 18 August 2025 that when a company is dissolved or has no employees eligible for

See MoreNew Zealand: RBNZ cuts official cash rate to lowest level in three years

The Reserve Bank of New Zealand trimmed its official cash rate by 25 bps on 20 August 2025, signalling possible further cuts as economic growth stalls. The Reserve Bank of New Zealand (RBNZ) cut its official cash rate (OCR) by 25 basis points to

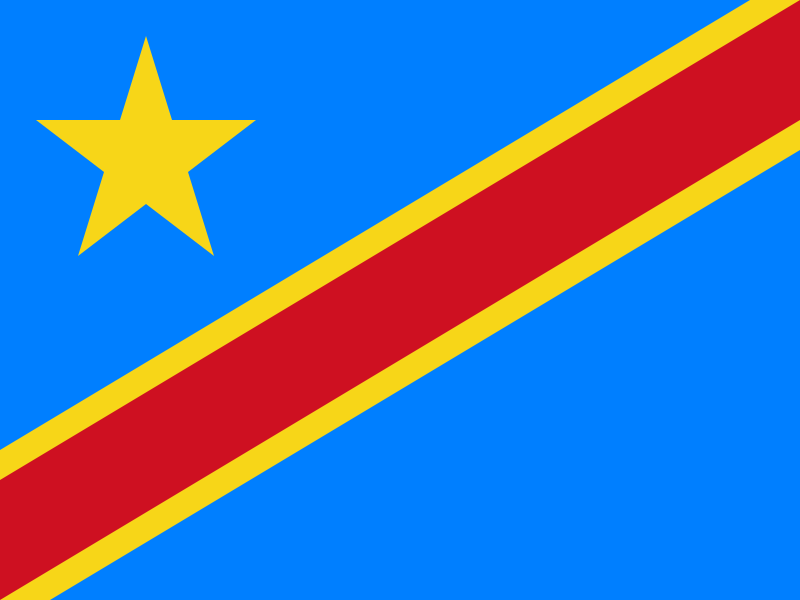

See MoreCongo (DRC) introduces import tax to fund universal healthcare

Congo, DRC introduces import and payroll taxes to secure long-term funding for its universal healthcare program. The Democratic Republic of the Congo has introduced a 2% import tax on goods brought into the country. However, food and

See MoreUS: Treasury, IRS propose new reporting rules for partnership interest sales

Public comments are open until 18 September 2025. The US Department of the Treasury and the Internal Revenue Service (IRS) have proposed regulations modifying information reporting obligations with respect to sales or exchanges of certain

See MoreOECD updates rules on QIIR and QDMTT safe harbours

The OECD updated its central record of legislation, incorporating transitional qualified status, qualified income inclusion rules, qualified domestic minimum top-up tax rules, and QDMTT safe harbours. The OECD has updated its Central Record of

See MoreUS: IRS revises payment loss rules (DLP), extends transition relief for dual consolidated loss and GloBE model rules

Notice 2025-44 proposes the withdrawal of the disregarded payment loss (DPL) rules finalised in January 2025 and extending the transition relief for the interaction of dual consolidated loss (DCL) rules with the OECD/G20 BEPS GloBE model

See MoreIndonesia: Central Bank cuts interest rate to 5.00%

This marks the fifth rate cut since September 2022, bringing rates down by a total of 125 basis points to their lowest level since late 2022. Indonesia’s central bank, Bank Indonesia (BI), announced it has cut its benchmark interest rate by 25

See MoreBrazil: Chamber of Deputies considers introduction of digital social contribution

The CSD would apply to digital advertising services using user data and the sale or transfer of data generated by Brazilian users or collected in Brazil. The aim is to tax revenue derived from the use of Brazilian users’ data. Brazil’s

See MoreSouth Africa: SARS consults 2025 Draft Taxation Laws Amendment Bill, Draft Tax Administration Laws Amendment Bill

The Treasury and SARS have released the 2025 draft tax bills and regulations for public consultation, which ends on 12 September 2025. The National Treasury and South African Revenue Service (SARS) has initiated a public consultation on the

See More