Portugal announces 2026 Budget, proposes lower corporate tax rates

Portugal’s 2026 draft budget proposes tax cuts for companies, including a corporate tax rate reduction to 19% (and 15% for SMEs), as part of the plan to lower the rate to 17% by 2028. Portugal’s government has presented the draft State

See MoreMalaysia presents 2026 Budget, extends R&D incentives

The 2026 income tax measures introduce new taxes, extended exemptions, and expanded incentives across sectors covering LLP profit distributions, foreign-sourced income, MSME listings, social enterprises, sustainable finance, carbon emissions,

See MoreGreece unveils 2026 budget with targeted tax cuts to ensure fiscal stability

The 2026 budget introduces tax relief measures, including reduced real estate and VAT rates, and additional initiatives such as a Pharmaceutical Innovation Fund and the elimination of the TV subscription fee. Greece’s Ministry of Finance

See MoreLatvia: Finance minister outlines key priorities in 2026 draft budget, initiates discussions with social partners

The 2026 budget proposes diversifying revenue sources through higher gambling and excise taxes, while supporting investment and easing living costs with tax law amendments and a temporary VAT cut on basic foods starting July 2026. Latvia's

See MoreLuxembourg: MoF presents 2026 state budget to Chamber of Deputies, proposes fiscal measures to bolster innovation-driven investments

The 2026 budget focuses on strengthening its financial centre through tax reforms and tech investments, while expanding incentives and support measures for SMEs and start-ups to boost innovation and entrepreneurship. Luxembourg's Minister of

See MoreIreland presents 2026 Budget, proposes increased R&D tax credits

Minister for Finance Paschal Donohoe said the Budget aims to boost productivity, protect jobs, and strengthen Ireland’s economic foundations. Ireland's Department of Finance has released the Budget 2026, which was presented on 7 October 2025,

See MoreZambia: Government presents 2026 budget, proposes VAT refund incentives for energy sector

The national budget for 2026 proposes amendments to key tax laws to enhance revenue, provide targeted relief, promote equity, support economic formalisation, and align with international standards. Zambia’s Minister of Finance and National

See MoreUkraine: Government presents 2026 budget to parliament, proposes increased minimum wage

Draft Law No. 14000 proposes raising the minimum statutory monthly salary from UAH 8,000 to UAH 8,647 and the minimum subsistence level for employed individuals from UAH 3,028 to UAH 3,328. Ukraine’s government has presented Draft Law No.

See MorePoland: Council of Ministers adopt 2026 draft budget act

The 2026 draft includes various fiscal changes, such as an increase in the corporate tax rate for the banking sector, a rise in the VAT exemption threshold, and an increase in excise rates on alcoholic beverages. Poland’s Council of Ministers

See MoreDominican Republic: Council of Ministers approve 2026 draft budget

Minister of the Presidency, José Ignacio Paliza reported that the 2026 Budget amounts to DOP 1.74 trillion, equivalent to 20.1% of GDP. One of the central pillars of the proposal is the promotion of public investment, which will reach 2.5% of

See MoreRussia: MoF presents various tax reforms, includes VAT increases as part of 2026 budget package

The budget proposals include a standard VAT rate hike from 20% to 22%, and the simplified VAT threshold will drop from RUB 60 million to RUB 10 million, amongst others. Russia’s Ministry of Finance has submitted a series of draft laws to the

See MoreSweden: Government proposes simplified business and capital taxation in 2026 budget

The proposed tax measures include business tax credits and simplified forestry and shipping rules, temporary VAT cuts and fraud controls, changes to excise taxes on alcohol and tobacco, permanent tax-free EV workplace charging, and reduced energy

See MoreFinland: Government presents 2026 budget to parliament, proposes reduced corporate taxes

The 2026 budget proposal lowers corporate and CO2 fuel taxes while tightening crypto reporting, adjusting VAT, and raising taxes on vehicles, tobacco, alcohol, and soft drinks. Finland’s government has presented the 2026 budget proposal (HE

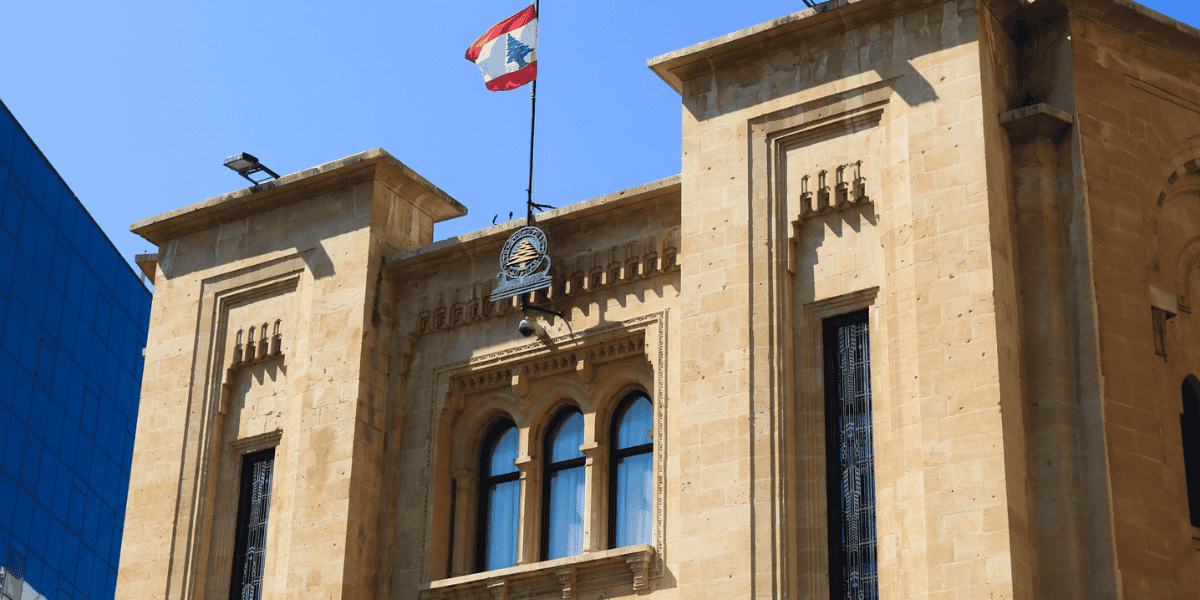

See MoreLebanon: Government tables 2026 budget law draft, introduces amendments to corporate income tax

Lebanon submitted its 2026 Draft Budget Law to the Council of Ministers, proposing wide-ranging reforms across corporate tax, VAT, customs, excise duties, digitalisation, and tax incentives, including stricter deduction rules, and targeted

See MoreNetherlands: Government presents 2026 budget, outlines main tax measures

The plan introduces technical updates and minor adjustments to income tax, wage tax, corporate tax, motor vehicle tax, heavy vehicle tax, and environmental taxes. The Dutch government unveiled the 2026 Budget along with the Tax Plan on 16

See MoreIceland presents 2026 Budget, proposes implementation of Pillar 2 global minimum tax

Iceland’s 2026 Budget introduces the Pillar 2 global minimum tax (IIR and QDMTT), a kilometre-based vehicle tax, and a phased removal of fuel excise duties with higher carbon taxes. Iceland's Finance Minister, Daði Már Kristófersson,

See MoreUK: Budget scheduled for 26 November 2025

UK’s Chancellor sets Budget for 26 November, highlighting key economic and social measures. Today, Wednesday 3 September, UK Chancellor Rachel Reeves confirmed that the Budget will be presented on Wednesday, 26 November. In a video message,

See MoreFinland: Government announces 2026 budget measures

The 2026 budget proposal includes reduced corporate tax rates, tightened crypto reporting requirements, adjusted VAT rates, and cuts to CO2 fuel taxes, as well as increased taxes on vehicles, tobacco, alcohol, and soft drinks. Finland’s

See More