Ireland: Revenue issues guidance on new E-liquid products tax

Revenue published guidance to help suppliers comply with the new E-liquid products tax starting 1 November 2025. Ireland Revenue published detailed guidance on 30 September 2025 to assist suppliers in understanding their obligations under the new

See MoreChina lowers consumption tax threshold on ultra-luxury vehicles

China will lower the consumption tax threshold for super luxury cars from CNY 1.3 million to CNY 900,000. China’s Ministry of Finance and State Taxation Administration will lower the consumption tax threshold for super luxury cars from CNY

See MoreEU Council streamlines carbon border adjustment mechanism, exempts small importers

The regulation aims to simplify the CBAM and lower compliance costs, particularly easing the regulatory burden for EU companies and SMEs. The Council of the European Union, in an announcement on 29 September 2025, stated that it has formally

See MoreTaiwan: Taxation Administration announces statutory payment period for commercial vehicle license tax for second half of 2025

The Taxation Administration stated that the tax payment notice will be sent to taxpayers by mail by the tax collection authorities under their local governments. Taiwan’s Taxation Administration has announced that the statutory payment period

See MoreUK: HMRC publishes 2025 corporate tax statistics

This annual report details corporate tax receipts and liabilities, categorised by company count, income, deductions, industry sector, size, and financial year. The UK tax authority, HM Revenue & Customs (HMRC), published its annual

See MorePoland: Council of Ministers adopt 2026 draft budget act

The 2026 draft includes various fiscal changes, such as an increase in the corporate tax rate for the banking sector, a rise in the VAT exemption threshold, and an increase in excise rates on alcoholic beverages. Poland’s Council of Ministers

See MoreRussia: MoF presents various tax reforms, includes VAT increases as part of 2026 budget package

The budget proposals include a standard VAT rate hike from 20% to 22%, and the simplified VAT threshold will drop from RUB 60 million to RUB 10 million, amongst others. Russia’s Ministry of Finance has submitted a series of draft laws to the

See MoreMalawi: Government amends customs and excise rules to streamline procedures, enhance compliance

The regulation amends and streamlines procedures, enhances compliance, and enforces penalties related to foreign exchange and export transactions. Malawi’s government has introduced new regulations to update its customs and excise laws on 1

See MoreCosta Rica: DGT updates withholding rules for real estate capital gains, transfer taxes

The Resolution will enter into force on 6 October 2025. Costa Rica’s tax administration (DGT) has published Resolution No. MH-DGT-RES-0039-2025 in the Official Gazette on 17 September 2025, updating the withholding rules for real estate

See MoreSweden: Government proposes simplified business and capital taxation in 2026 budget

The proposed tax measures include business tax credits and simplified forestry and shipping rules, temporary VAT cuts and fraud controls, changes to excise taxes on alcohol and tobacco, permanent tax-free EV workplace charging, and reduced energy

See MoreFinland: Government presents 2026 budget to parliament, proposes reduced corporate taxes

The 2026 budget proposal lowers corporate and CO2 fuel taxes while tightening crypto reporting, adjusting VAT, and raising taxes on vehicles, tobacco, alcohol, and soft drinks. Finland’s government has presented the 2026 budget proposal (HE

See MoreCanada announces GST/HST filing deadlines for distributed investment plans

These rules also impose responsibilities on both investors and securities dealers. Canada’s government announced that distributed investment plans, such as mutual fund trusts and investment limited partnerships are required to reach out to

See MoreUK: HMRC issues guidance on PAYE addressing non-compliance in the umbrella company market

These rules are based on draft legislation and the government’s approach to tackling non-compliance in the umbrella company market. HMRC issued guidance on 17 September 2025 outlining new rules that place responsibility on recruitment agencies

See MoreHong Kong: Chief Executive delivers 2025 policy address, includes tax incentives for strategic industries, and digital investments

The Hong Kong government plans to introduce legislative changes in early 2026 to enhance preferential tax regimes and attract more funds, family offices, and carried interest, reinforcing its role as a global financial hub. Hong Kong’s Chief

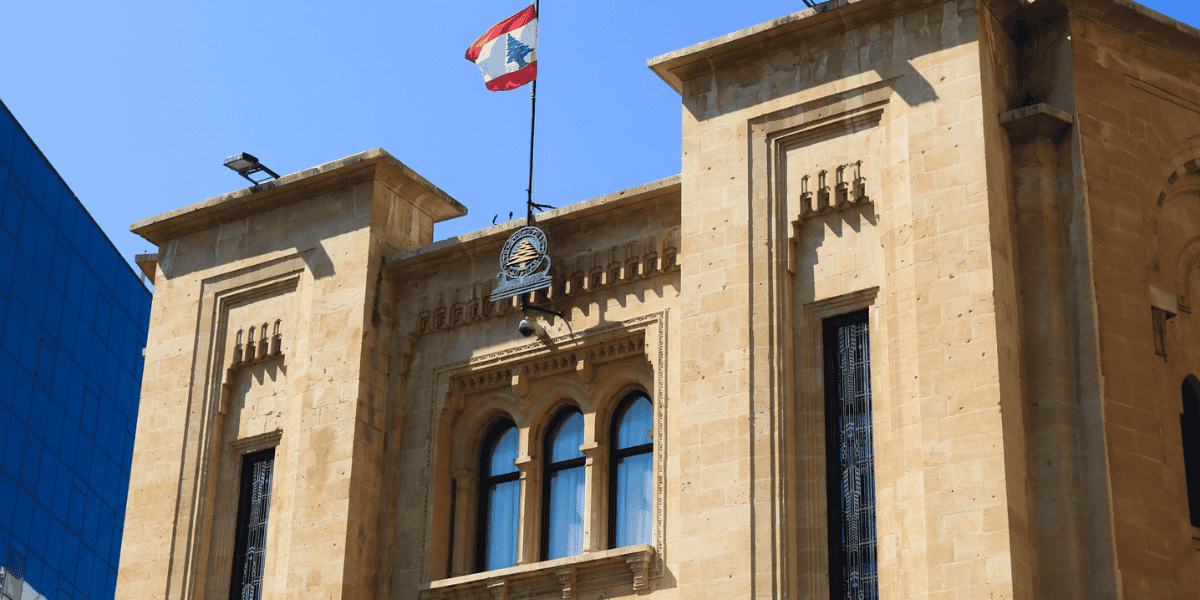

See MoreLebanon: Government tables 2026 budget law draft, introduces amendments to corporate income tax

Lebanon submitted its 2026 Draft Budget Law to the Council of Ministers, proposing wide-ranging reforms across corporate tax, VAT, customs, excise duties, digitalisation, and tax incentives, including stricter deduction rules, and targeted

See MoreHong Kong: Government introduces regulatory framework for basketball betting

The new basketball betting legislation is based on the existing system for football betting and takes effect upon publication in the official gazette. The Hong Kong SAR (HKSAR) government enacted the Betting Duty (Amendment) Bill 2025 on 11

See MoreUS: Treasury, IRS adds 39 substances to superfund list subject to excise tax

These additions will generally take effect for tax purposes starting 1 January 2026, while the specific effective dates for refund claims under section 4662(e) are detailed individually for each substance. The US Treasury Department and Internal

See MoreIreland: Revenue launches payroll tax adjustment period for 2024–2025

Revenue acknowledges that employers may have struggled to adjust payroll systems and is now allowing them to correct any genuine payroll tax classification errors for 2024 and 2025. Ireland Revenue published eBrief No. 172/25, a new Tax and Duty

See More