Finland: Parliament adopts budget for 2026

Finland’s parliament concluded its deliberations and voting on the 2026 Budget on 19 December 2025. The key tax measures, including the reduced corporate tax rates and the 2026 income tax schedule, have been adopted. The single reading of the

See MoreNetherlands: Senate approves 2026 Tax Plan package

The Netherlands Senate approved the legislative proposals contained in the 2026 Tax Plan package on 16 December 2025. The measures will enter into force once they receive royal assent and are published in the Official Gazette. The Ministry of

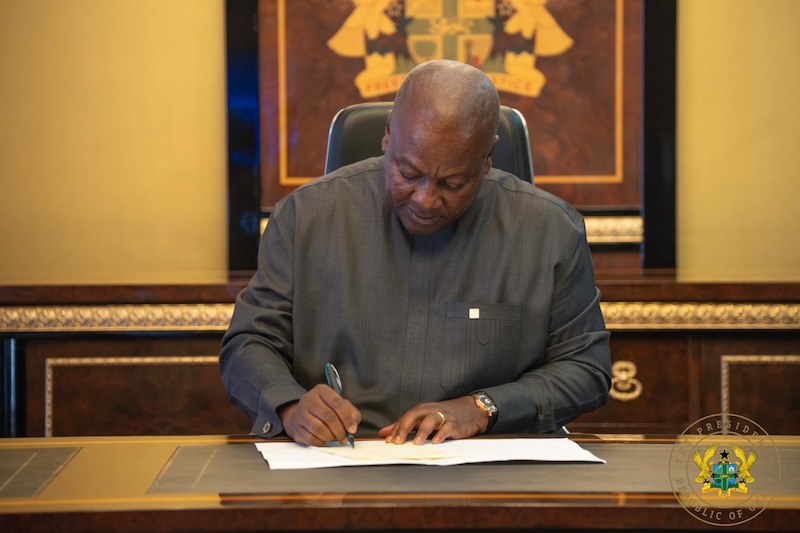

See MoreGhana abolishes COVID-19 health recovery levy

Ghana’s President John Dramani Mahama signed the COVID-19 Health Recovery Levy Repeal Act 2025 into law on 10 December 2025, ending the 1% levy on goods, services, and imports from January 2026. The repeal fulfills a key campaign promise, as

See MoreHungary enacts 2026 autumn tax reforms, additional measures

Hungary has enacted several significant tax measures through legislative acts to reduce administrative burdens, promote business investment, and align domestic rules with EU directives. The measures are scheduled to take effect in 2026 unless

See MoreItaly to impose duties on non-EU parcels, increase financial transaction taxes

Italy is preparing several new tax measures to boost revenue and protect local industries. A EUR 2 levy on small non-EU parcels, aimed at platforms like Shein and Temu, will apply to packages worth up to EUR 150 and is expected to raise over EUR

See MoreNorway: Parliament approves 2026 budget bill, corporate tax rate unchanged

Norway’s parliament passed the proposed 2026 Budget bill on 5 December 2025. This follows Norway’s government's presentation of its 2026 state and national budget proposals on 15 October 2025. The bill boosts welfare, defence, and climate

See MoreAlgeria revises stamp duties, vehicle taxes effective from January 2025

Algeria’s Ministry of Finance has issued Circular No. 73/LF25 on 23 November 2025, detailing revisions to various stamp duties and taxes as part of the 2025 Finance Law. The circular addresses the increase in the minimum perception of stamp

See MoreBelgium: SPF Finances announces importation of goods subject to CBAM from January 2026

Belgium’s tax authority (SPF Finances) announced, on 8 December 2025, that only importers holding a “carbon border adjustment mechanism (CBAM) declarant” authorisation will be permitted to import goods covered by the CBAM regulations. This

See MoreIsrael: Cabinet approves 2026 state budget amid controversy

The Israeli cabinet approved the 2026 state budget on 5 December 2025 after prolonged negotiations and internal disputes over allocations. The key tax measures and policy changes are as follows: Corporate and Banking Taxes New measures

See MorePoland: Parliament adopts 2026 Budget Act, increases bank tax rates

Poland’s Ministry of Finance announced, on 5 December 2025, that the lower chamber of parliament (Sejm) had adopted the Budget Act for 2026, introducing wide-ranging tax changes set to reshape the country’s fiscal landscape next year. The

See MoreCameroon: Parliament adopts Finance Act for 2026, introduces significant economic presence (SEP) standard

Cameroon’s Parliament has adopted the 2026 Finance Act on 26 November 2025, introducing tax measures from the 2026 Budget designed to expand the country’s fiscal base and strengthen revenue mobilisation. The legislation establishes a new

See MoreSouth Africa: SARS to enhance transfer duty declaration process to improve compliance

The South African Revenue Service (SARS) announced on 8 December 2025 a series of enhancements to the Transfer Duty Declaration (TDC01) on eFiling, aimed at simplifying compliance, reducing inaccurate declarations, and strengthening the collection

See MoreSlovak Republic revises financial transaction tax law, exempts self-employed individuals

The National Council of the Slovak Republic has passed an amendment to Act No. 279/2024 Coll. on the Financial Transaction Tax (FTT), bringing several significant changes into effect on 1 January 2026. Sole traders or self-employed individuals

See MoreUzbekistan outlines 2026–28 budget and fiscal plan, proposes higher corporate income tax

Uzbekistan's Ministry of Economy and Finance has announced the Budget and Tax Policy for 2026 to 2028 on 26 November 2025. A cornerstone of the forthcoming tax strategy is the consistency of the primary ad valorem tax rates, providing

See MoreBrazil: RFB, GST committee issue guidelines for CBS and IBS implementation starting January 2026

Brazil’s tax authority, the Federal Revenue Service (RFB) and the Goods and Services Tax Management Committee (CGIBS) have released guidance on the upcoming Contribution on Goods and Services (CBS) and Goods and Services Tax (IBS) on 2 December

See MoreMalawi: MoF presents 2025-26 mid-year budget review, to introduce Minimum Alternate Tax

Malawi’s Ministry of Finance, Economic Planning, and Decentralisation (MoFEPD) presented the 2025-26 Mid-Year Budget Review Statement to the National Assembly on 21 November 2025. The 2025-26 Mid-Year Budget Review Statement proposes various

See MorePoland gazettes law raising corporate income tax rate for banks

Poland has published the “Act of 6 November 2025 amending the Corporate Income Tax Act and the Act on the Tax on Certain Financial Institutions”, in the Official Gazette on 28 November 2025, raising the corporate income tax rate for

See MoreZimbabwe: Government announces 2026 budget, proposes digital services withholding tax

Zimbabwe’s Ministry of Finance, Economic Development, and Investment Promotion (MoFEDIP) has presented the 2026 national budget to the Parliament on 27 November 2025, proposing higher VAT rates and digital service withholding taxes. The

See More