Philippines enacts Capital Markets Efficiency Promotion Act (CMEPA)

Philippine President Ferdinand R. Marcos, Jr. has signed the Capital Markets Efficiency Promotion Act (CMEPA) into law on 30 May 2025, which goes into force on 1 July 2025. Philippine President Ferdinand R. Marcos, Jr., has signed the Capital

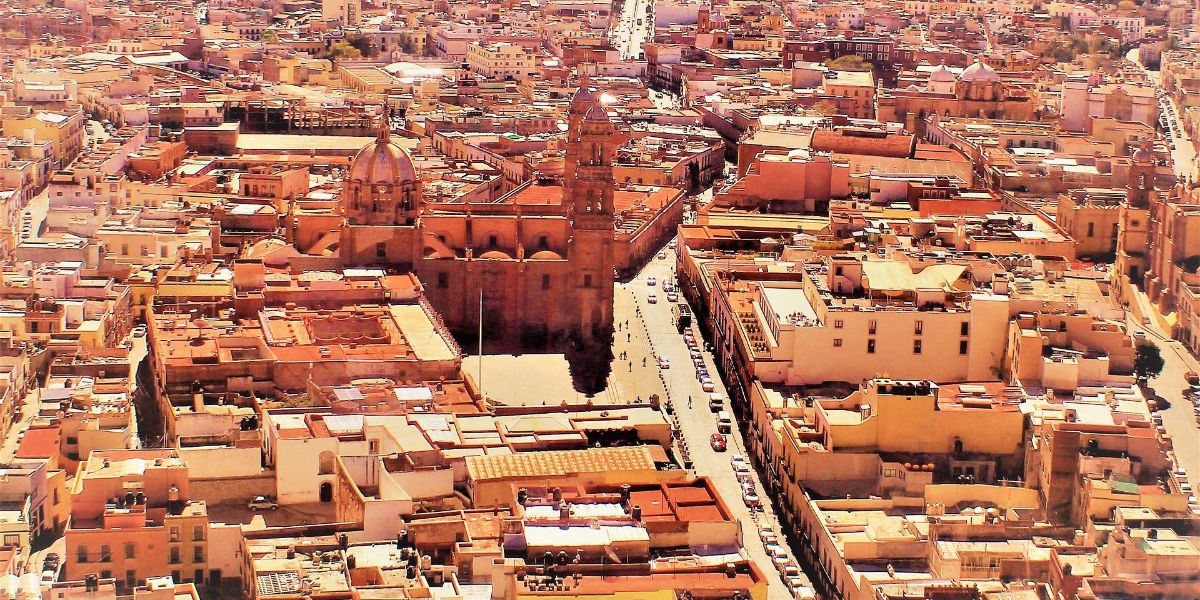

See MoreMexico objects US tax on cross-border remittances

The One, Big, Beautiful Bill (Act), which is now under Senate review, proposes a 3.5% tax on all remittances sent by non-US citizens to foreign countries, regardless of the transfer amount. The US House of Representatives passed the One,

See MoreUS: Hawaii introduces lodging tax for climate-change mitigation

The law adds a 0.75% "Green Fee" to the existing transient-accommodations tax of 10.25% and imposes a levy on cruise-ship passengers docking in the islands. Hawaii Governor Josh Green has signed SB 1396 into law, making Hawaii the first US

See MoreMalta extends property tax incentives until December 2025

The Maltese government has extended property tax exemptions on qualifying transfers until 31 December 2025. The Maltese government has extended property tax incentives through Legal Notice 93 of 2025, published on 27 May 2025. The exemption

See MoreAustralia: Tasmania unveils 2025–26 budget, abolishes stamp duty for first home buyers

The 2025-26 budget introduces no new taxes or changes to existing ones. Its key initiative is removing stamp duty for first home buyers in Tasmania on homes up to AUD 750,000. Guy Barnett, Treasurer and Deputy Premier of Tasmania, presented the

See MoreUK: Scotland extends LBTT group relief provision

The legislation extends LBTT group relief to non-partition demergers and clarifies that the sub-sale relief period begins on the qualifying sub-sale date. Scotland’s government released legislation titled “The Land and Buildings Transaction

See MoreAustralia: ATO consults draft GST instruments

Comments are open until 25 June 2025. The Australian Taxation Office (ATO) has issued two draft legislative instruments, LI 2025/D6 and LI 2025/D7, for public consultation on the goods and services tax (GST) on 28 May 2025. The key measures

See MoreBrazil: Economic Team to propose final alternative plan for IOF tax increases

Brazil’s government will present an alternative plan for the IOF tax increase within 10 days. Brazil’s Congress lower house speaker, Hugo Motta, said in an X post on 29 May 2025, that the government will present an alternative plan for

See MoreCanada: Government proposes GST rebate for first-time home buyers, repeal of consumer carbon price, middle-class tax cuts

Canada’s Finance Minister proposed the measures on 27 May 2025. Canada’s Finance Minister, François-Philippe Champagne, has tabled a notice of Ways and Means Motion in Parliament on 27 May 2025, proposing GST relief for first-time

See MoreSouth Africa: SARS clarifies revised carbon offset rules

The update modifies the eligibility criteria for renewable energy projects under the carbon offset allowance. The South African Revenue Service (SARS) has released an Explanatory Memorandum on 15 March 2025 outlining amendments to the Carbon

See MoreBrazil raises financial transaction tax on select insurance, credit, forex transactions

The Tax on Financial Operations (IOF) is a financial levy applied to individuals and businesses in Brazil, covering a range of financial transactions. Brazil has issued Decree No. 12.466 of 22 May 2025, which increases the financial transactions

See MoreSpain considers legislation to improve access to housing

This legislation urges the government to advance initiatives addressing housing challenges, ensure legal certainty, mobilise vacant homes, make housing more affordable, expand public housing, and increase social and affordable rental

See MoreUAE: MoF temporarily eases listing requirement for REIT exemption

The Decision outlines conditions for certain Real Estate Investment Trusts (REITs) to qualify for corporate tax exemption. The UAE Ministry of Finance has issued Ministerial Decision No. 96 of 2025 on Conditions to Exempt Certain Real Estate

See MoreUS: Washington adopts major business and occupation tax reforms

The law introduces significant changes to the B&O tax and extends the retail sales tax to computer-related services. Washington Governor Bob Ferguson signed two bills, Bill HB 2021 and Bill SB 5814, into law on 20 May 2025, introducing major

See MoreEU: European Parliament endorses revisions to EU carbon border mechanism

The European Parliament has approved changes to the EU's carbon border adjustment mechanism (CBAM), simplifying the rules and exempting 90% of importers. The European Parliament approved changes to the EU's carbon border adjustment mechanism

See MoreBrazil: MoF scraps higher tax on investments made abroad

Finance Ministry dropped plans for a higher tax on overseas investments on Friday, following criticism that it signalled a return to capital controls. Brazil's Finance Ministry dropped a higher transaction tax on overseas investments on Friday,

See MoreOECD: Carbon taxes and emissions trading most effective climate policies

The paper examines carbon mitigation policies, their impact on emissions, and methods to measure carbon intensity across sectors. The Organisation for Economic Co-operation and Development (OECD) released a paper titled “The effects of climate

See MoreUS: Texas introduces new tax incentives for businesses, seeks to ban transactions and occupation taxes

Texas Governor Greg Abbott signed three bills into law on 14 May 2025, introducing tax incentives for businesses and securities market operators. Texas Governor Greg Abbott signed three bills into law on 14 May 2025, offering tax incentives for

See More