Australia: ATO releases updated excise tax guidelines for tobacco sector

The revised guidelines align with recent legislative reforms introduced to simplify and modernise the overall excise administration process. The Australian Taxation Office (ATO) has updated its excise tax guidelines for the tobacco industry.

See MoreLatvia: Finance minister outlines key priorities in 2026 draft budget, initiates discussions with social partners

The 2026 budget proposes diversifying revenue sources through higher gambling and excise taxes, while supporting investment and easing living costs with tax law amendments and a temporary VAT cut on basic foods starting July 2026. Latvia's

See MoreSlovak Republic: Parliament approves third consolidation package of tax reforms, includes higher corporate taxes

Key tax changes include higher corporate and investment taxes, along with increased consumption taxes, including higher VAT on specific food products, and increased tax on online gaming. The Slovak Republic’s National Council gave its approval

See MoreIreland: Revenue issues guidance on new E-liquid products tax

Revenue published guidance to help suppliers comply with the new E-liquid products tax starting 1 November 2025. Ireland Revenue published detailed guidance on 30 September 2025 to assist suppliers in understanding their obligations under the new

See MorePoland: Council of Ministers adopt 2026 draft budget act

The 2026 draft includes various fiscal changes, such as an increase in the corporate tax rate for the banking sector, a rise in the VAT exemption threshold, and an increase in excise rates on alcoholic beverages. Poland’s Council of Ministers

See MoreMalawi: Government amends customs and excise rules to streamline procedures, enhance compliance

The regulation amends and streamlines procedures, enhances compliance, and enforces penalties related to foreign exchange and export transactions. Malawi’s government has introduced new regulations to update its customs and excise laws on 1

See MoreSweden: Government proposes simplified business and capital taxation in 2026 budget

The proposed tax measures include business tax credits and simplified forestry and shipping rules, temporary VAT cuts and fraud controls, changes to excise taxes on alcohol and tobacco, permanent tax-free EV workplace charging, and reduced energy

See MoreFinland: Government presents 2026 budget to parliament, proposes reduced corporate taxes

The 2026 budget proposal lowers corporate and CO2 fuel taxes while tightening crypto reporting, adjusting VAT, and raising taxes on vehicles, tobacco, alcohol, and soft drinks. Finland’s government has presented the 2026 budget proposal (HE

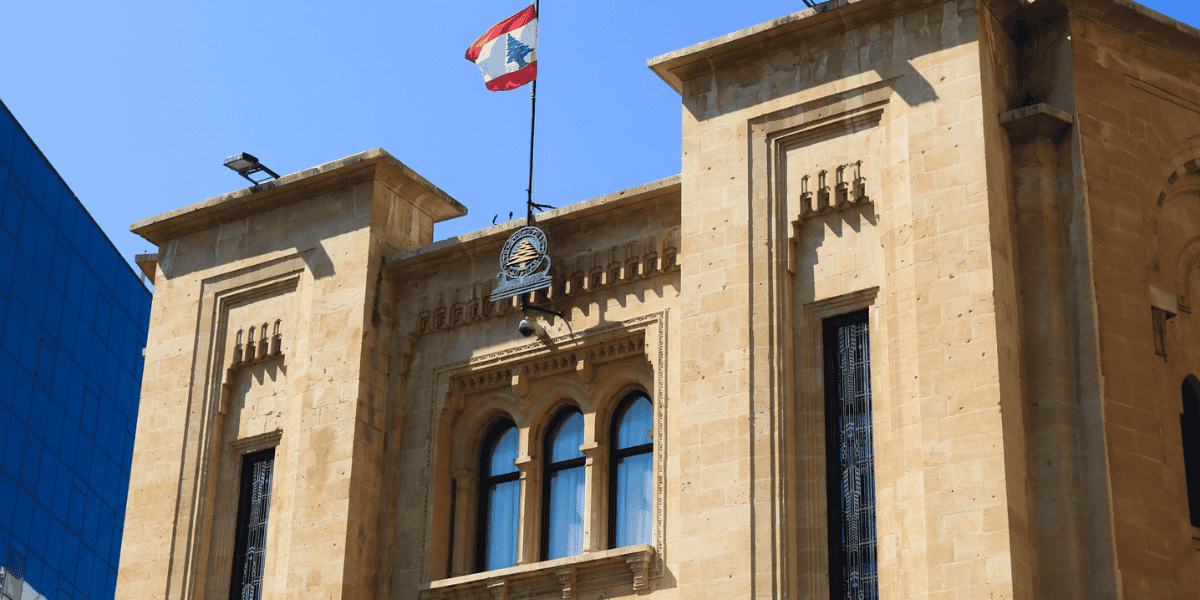

See MoreLebanon: Government tables 2026 budget law draft, introduces amendments to corporate income tax

Lebanon submitted its 2026 Draft Budget Law to the Council of Ministers, proposing wide-ranging reforms across corporate tax, VAT, customs, excise duties, digitalisation, and tax incentives, including stricter deduction rules, and targeted

See MoreUS: Treasury, IRS adds 39 substances to superfund list subject to excise tax

These additions will generally take effect for tax purposes starting 1 January 2026, while the specific effective dates for refund claims under section 4662(e) are detailed individually for each substance. The US Treasury Department and Internal

See MoreMexico: Federal Executive Branch presents 2026 Economic Package to Congress, includes indirect tax reforms

Mexico’s Federal Executive Branch submitted the 2026 Economic Package to Congress, proposing major changes to VAT, excise, and income taxes, as well as the federal tax code, which are under review until 31 October 2025. Mexico’s Federal

See MoreSlovak Republic: MoF unveils 2026 public finance, tax reform measures

The key tax changes are in the corporate and investment sectors, which face higher taxes: the top corporate license fee rises to EUR 11,520, and the special levy jumps to 15%. Consumption taxes increase, with VAT on sugary/salty foods at 23% and

See MoreFinland: Government announces 2026 budget measures

The 2026 budget proposal includes reduced corporate tax rates, tightened crypto reporting requirements, adjusted VAT rates, and cuts to CO2 fuel taxes, as well as increased taxes on vehicles, tobacco, alcohol, and soft drinks. Finland’s

See MoreDenmark announces 2026 Finance Bill, proposes reduced electricity and excise tax reliefs

The 2026 Finance Bill includes an electricity tax cut, excise duty removal on food products, VAT abolition on books, and tax adjustments for rural properties. Denmark’s government presented the 2026 Finance Bill on 29 August 2025, proposing tax

See MorePoland: Government adopts 2026 budget law, increases corporate tax for banks

The draft 2026 budget law increases the corporate tax rate for the banking sector, a rise in the VAT exemption threshold from PLN 200,000 to PLN 240,000, and a 15% hike in excise rates on alcoholic beverages. Poland's government has adopted the

See MoreNigeria: President abolishes 5% excise duty on telecom services

The abolition of the 5% excise tax on telecommunication services is aimed at improving affordability and service standards in the telecom sector. Nigeria’s President Bola Tinubu has officially abolished the 5% excise tax on telecommunication

See MoreFinland consults on proposed tax hike for soft drinks and selected beverages

The deadline for submitting comments is 6 August 2025. Finland’s Ministry of Finance launched a public consultation on 2 June 2025, proposing a EUR 0.15 per litre sugar-based tax on soft drinks and an increased excise duty on fermented

See MoreZambia advances 2025 tax reform, proposes 1% minimum alternative tax for businesses

Key proposals include a 1% MAT on turnover, 15% to 20% withholding tax on government securities, and excise duty hikes on cigarettes, alcohol, sugary drinks, and betting services. Zambia's National Assembly has advanced the Income Tax

See More