Cameroon releases 2026 Finance Law, includes new rules for digital giants, green levies

Cameroon’s Ministry of Finance issued a circular on the execution of the 2026 Finance Law, providing guidance on its implementation and outlining the key tax measures introduced for the year. The circular outlines the mandatory instructions for

See MoreLebanon: Government tables 2026 budget law draft, introduces amendments to corporate income tax

Lebanon submitted its 2026 Draft Budget Law to the Council of Ministers, proposing wide-ranging reforms across corporate tax, VAT, customs, excise duties, digitalisation, and tax incentives, including stricter deduction rules, and targeted

See MoreIndonesia: Chief Economic Minister says 19% US tariff may take effect before 1 August

Trump imposed a 19% tariff on Indonesian goods as part of a new trade agreement, effective 1 August Indonesia's Chief Economic Minister, Airlangga Hartarto, announced on 21 July 2025 that the 19% tariff on Indonesian goods entering the US could

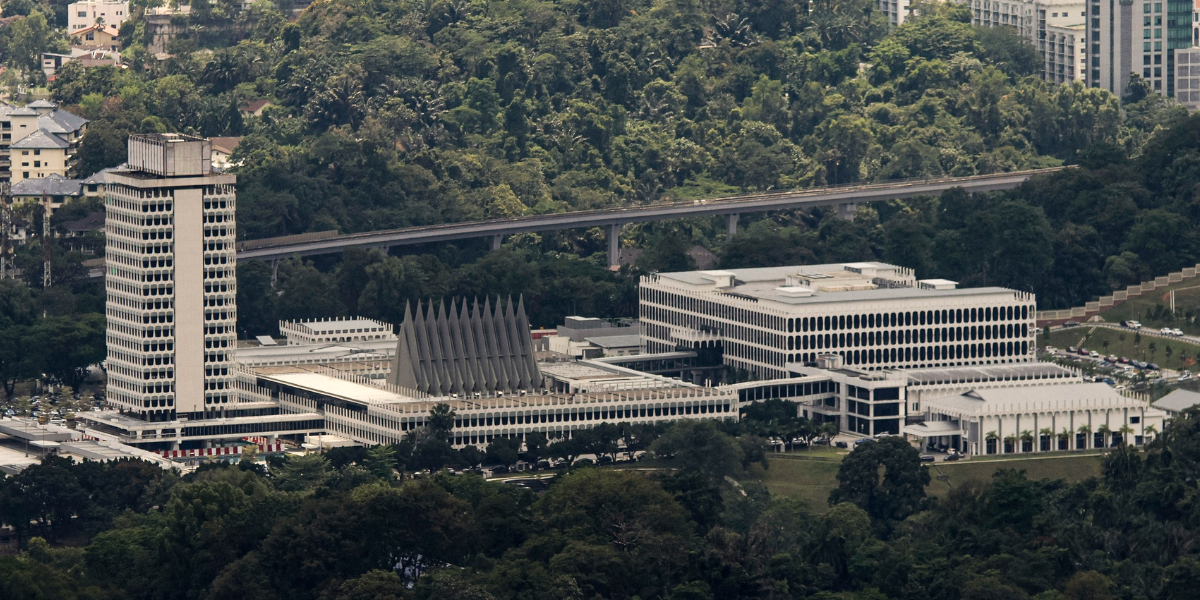

See MoreMalaysia imposes anti-dumping duties on iron and steel from China, South Korea, and Vietnam

Import duties ranging from 3.86% to 57.90% are imposed on galvanized iron and steel coils or sheets from these countries. Malaysia’s Ministry of Trade and Industry has announced provisional anti-dumping duties on certain iron and steel imports

See MoreTaiwan imposes temporary anti-dumping duties on Chinese beer and steel

Taiwan will impose four-month anti-dumping duties on Chinese beer and hot-rolled steel to protect its domestic industry. Taiwan’s Ministry of Finance will impose anti-dumping duties on Chinese-origin beer and hot-rolled steel for four months

See MoreUzbekistan reduces customs-duty-free import thresholds for selected goods

The Ministry of Economy and Finance has reduced customs duty exemption thresholds for personal imports to USD 1,000 by air and USD 500 by rail or river, while allowing up to 65 grams of jewellery worth up to USD 2,000 to be imported without

See MoreUganda presents 2025–26 budget, proposes income tax exemption for start-ups

Uganda's Ministry of Finance unveiled a UGX 72.136 trillion national budget for 2025-26. Uganda’s Ministry of Finance Planning and Economic Development has unveiled a UGX 72.136 trillion national budget for the 2025-26 financial year on 12

See MoreTanzania presents 2025-26 budget, introduces withholding tax and higher AMT

The budget speech highlighted key fiscal changes, which included a new withholding tax, higher alternative minimum tax, and VAT adjustments. Tanzania's Minister of Finance, Mwigulu Nchemba, has presented the 2025-26 Budget Speech to parliament on

See MoreUS extends Section 301 tariff exemptions on Chinese imports through August 2025

The USTR has extended certain product exclusions from Section 301 tariffs on Chinese imports until 31 August 2025. The Office of the US Trade Representative (USTR) has announced an extension of specific product exclusions from Section 301 tariffs

See MoreArgentina to scrap mobile phone import tariffs, reduce excise duties on electronics

Argentina will scrap import tariffs on mobile phones and reduce excise duties on other electronic products. Presidential Spokesperson Manuel Adorni says that this initiative will reduce crime, smuggling and lower prices for consumers. The 16%

See MoreJamaica: Cabinet approves 20% expanded duty concession for agricultural vehicles

Jamaica’s Cabinet has approved the expansion of the 20% duty concession for agricultural vehicles on 9 April 2025. Minister of Agriculture, Fisheries and Mining, Floyd Green, announced this during the post-cabinet press briefing at Jamaica

See MoreChina exempts tariffs on US ethane imports

China has exempted the 125% tariff on US ethane imports imposed earlier this month, alleviating pressure on Chinese companies that rely on ethane imported from the US for petrochemical production, reports Reuters . China has increased tariffs on

See MoreMalawi: Parliament passes 2025-26 budget with corporate tax cut for permanent establishments

Malawi's Parliament approved the 2025-26 Budget on 26 March 2025, with several tax measures. The 2025-26 budget is estimated at MWK 8.08 trillion. The initial estimated MWK 8.5 trillion budget was adjusted before final approval. The main tax

See MoreNigeria lifts import duty, VAT on pharma raw materials

The Nigeria Customs Service in a press release on X on 26 March 2025 announced that a two-year exemption from import duty and VAT will apply to raw materials used in pharmaceutical production. This benefit is limited to pharmaceutical manufacturers

See MoreGhana: Parliament passes 2025 budget measures

Ghana's Ministry of Finance announced that the Parliament approved several 2025 Budget measures on 26 March 2025. The passage of these bills marks a major leap for economic reform and a significant step in fulfilling the government’s commitment

See MoreUN Tax Committee: Guidance on Indirect Taxes

At the meeting of the UN Tax Committee on 27 March 2025 the subcommittee dealing with indirect taxation matters put forward some potential issues that the next membership of the Tax Committee may wish to consider at future sessions. The

See MoreUN Tax Committee: Extractive Industries Taxation

On 25 March 2025 the Subcommittee on the Extractive Industries taxation presented to the UN Tax Committee a draft supplement to Chapter 5 (tax incentives) of the UN Handbook on Selected Issues for Taxation of the Extractive Industries; draft

See MoreUN Tax Committee: Transfer Pricing Subcommittee Discusses Future Guidance

On 26 March 2025 the UN Tax Committee discussed their transfer pricing work. Since the previous session of the Committee, the Subcommittee on Transfer Pricing has gathered feedback from members on possible future workstreams that could be pursued by

See More