Cameroon releases 2026 Finance Law, includes new rules for digital giants, green levies

Cameroon’s Ministry of Finance issued a circular on the execution of the 2026 Finance Law, providing guidance on its implementation and outlining the key tax measures introduced for the year. The circular outlines the mandatory instructions for

See MoreAngola gazettes amendments to tax laws proposed in 2026 budget

Angola’s National Assembly approved amendments to various tax laws through the General State Budget 2026 on 15 December 2025 after receiving final approval the same day. The measures were formally promulgated by the President and published in the

See MoreZimbabwe: President assents 2026 national budget, maintains gold royalty rate

Zimbabwe’s President has formally approved both the Finance Act and the Appropriation Act, giving legal effect to the measures outlined in the 2026 National Budget. Together, these laws implement the government’s fiscal and tax policy agenda for

See MoreZimbabwe: Government announces 2026 budget, proposes digital services withholding tax

Zimbabwe’s Ministry of Finance, Economic Development, and Investment Promotion (MoFEDIP) has presented the 2026 national budget to the Parliament on 27 November 2025, proposing higher VAT rates and digital service withholding taxes. The

See MoreZambia: MoF presents 2026 budget, promotes corporate investments in key sectors

Zambia’s Ministry of Finance and National Planning delivered the 2026 Budget Speech to the National Assembly on 26 September 2025, announcing a series of revenue measures aimed at strengthening domestic resource mobilisation, supporting small

See MoreEU: Council to reduce or eliminate customs duties for several agri-food products for Ukraine

The Council approved the EU’s position in the EU-Ukraine Association Committee to reduce or remove customs duties on various agri-food products, including dairy, meat, and produce destined for Ukraine. The EU Council has adopted a decision on

See MoreSlovak Republic: Parliament approves third consolidation package of tax reforms, includes higher corporate taxes

Key tax changes include higher corporate and investment taxes, along with increased consumption taxes, including higher VAT on specific food products, and increased tax on online gaming. The Slovak Republic’s National Council gave its approval

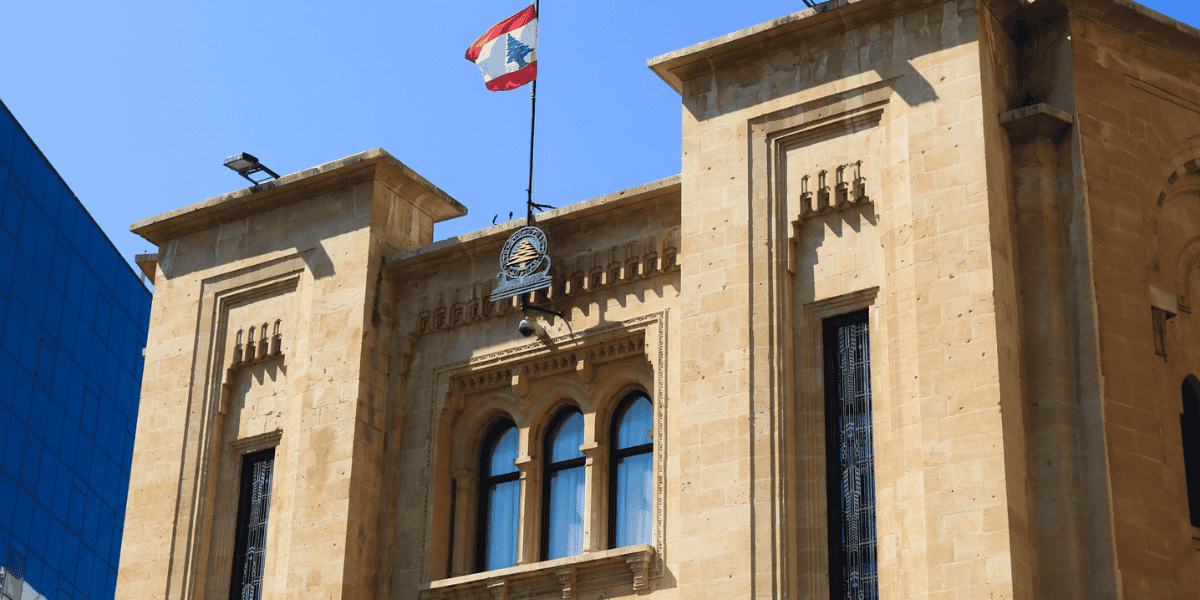

See MoreLebanon: Government tables 2026 budget law draft, introduces amendments to corporate income tax

Lebanon submitted its 2026 Draft Budget Law to the Council of Ministers, proposing wide-ranging reforms across corporate tax, VAT, customs, excise duties, digitalisation, and tax incentives, including stricter deduction rules, and targeted

See MoreIndonesia: Chief Economic Minister says 19% US tariff may take effect before 1 August

Trump imposed a 19% tariff on Indonesian goods as part of a new trade agreement, effective 1 August Indonesia's Chief Economic Minister, Airlangga Hartarto, announced on 21 July 2025 that the 19% tariff on Indonesian goods entering the US could

See MoreMalaysia imposes anti-dumping duties on iron and steel from China, South Korea, and Vietnam

Import duties ranging from 3.86% to 57.90% are imposed on galvanized iron and steel coils or sheets from these countries. Malaysia’s Ministry of Trade and Industry has announced provisional anti-dumping duties on certain iron and steel imports

See MoreTaiwan imposes temporary anti-dumping duties on Chinese beer and steel

Taiwan will impose four-month anti-dumping duties on Chinese beer and hot-rolled steel to protect its domestic industry. Taiwan’s Ministry of Finance will impose anti-dumping duties on Chinese-origin beer and hot-rolled steel for four months

See MoreUzbekistan reduces customs-duty-free import thresholds for selected goods

The Ministry of Economy and Finance has reduced customs duty exemption thresholds for personal imports to USD 1,000 by air and USD 500 by rail or river, while allowing up to 65 grams of jewellery worth up to USD 2,000 to be imported without

See MoreUganda presents 2025–26 budget, proposes income tax exemption for start-ups

Uganda's Ministry of Finance unveiled a UGX 72.136 trillion national budget for 2025-26. Uganda’s Ministry of Finance Planning and Economic Development has unveiled a UGX 72.136 trillion national budget for the 2025-26 financial year on 12

See MoreTanzania presents 2025-26 budget, introduces withholding tax and higher AMT

The budget speech highlighted key fiscal changes, which included a new withholding tax, higher alternative minimum tax, and VAT adjustments. Tanzania's Minister of Finance, Mwigulu Nchemba, has presented the 2025-26 Budget Speech to parliament on

See MoreUS extends Section 301 tariff exemptions on Chinese imports through August 2025

The USTR has extended certain product exclusions from Section 301 tariffs on Chinese imports until 31 August 2025. The Office of the US Trade Representative (USTR) has announced an extension of specific product exclusions from Section 301 tariffs

See MoreArgentina to scrap mobile phone import tariffs, reduce excise duties on electronics

Argentina will scrap import tariffs on mobile phones and reduce excise duties on other electronic products. Presidential Spokesperson Manuel Adorni says that this initiative will reduce crime, smuggling and lower prices for consumers. The 16%

See MoreJamaica: Cabinet approves 20% expanded duty concession for agricultural vehicles

Jamaica’s Cabinet has approved the expansion of the 20% duty concession for agricultural vehicles on 9 April 2025. Minister of Agriculture, Fisheries and Mining, Floyd Green, announced this during the post-cabinet press briefing at Jamaica

See MoreChina exempts tariffs on US ethane imports

China has exempted the 125% tariff on US ethane imports imposed earlier this month, alleviating pressure on Chinese companies that rely on ethane imported from the US for petrochemical production, reports Reuters . China has increased tariffs on

See More