Belgium: Parliament passes tax bill on withholding refunds, bank taxes

Belgium’s parliament passed legislation on 18 December 2025, proposed by multiple Members of Parliament, to introduce changes to the refund of withholding tax and to raise the tax on credit institutions. The legislation aims to update the 1992

See MoreBrazil: Chamber of Deputies rejects higher taxes on equity interest, financial entities

Proposed tax changes under PM No. 1.303 will not take effect after failing to secure the required approval by the deadline. Brazil's Chamber of Deputies did not approve Provisional Measure (PM) No. 1.303 issued on 11 June 2025, which proposes

See MoreUK: HMRC publishes 2025 corporate tax statistics

This annual report details corporate tax receipts and liabilities, categorised by company count, income, deductions, industry sector, size, and financial year. The UK tax authority, HM Revenue & Customs (HMRC), published its annual

See MoreColombia: MoF proposes major tax reforms for 2026 budget

The proposed 2026 budget legislation introduces significant reforms to corporate surtax, VAT, personal income tax, net wealth tax, and capital gains tax, with new tax rules for crypto-asset transactions. Colombia’s Ministry of Finance submitted

See MoreRomania announces 2025–28 tax reforms, raises dividend tax

The proposed tax reforms target increased taxes on dividends, reduced incentives, stricter expense deductions, and simplified VAT rates. Romania published its decision approving the 2025-2028 Government Programme in the Official Gazette on 23

See MoreUK: BoE likely to hold interest rates amid rising oil prices and inflation risks

The Bank of England is likely to keep interest rates at 4.25%, weighing lower domestic inflation against rising oil prices and global uncertainty. The Bank of England (BoE) is expected to keep its Bank Rate steady at 4.25% in its policy

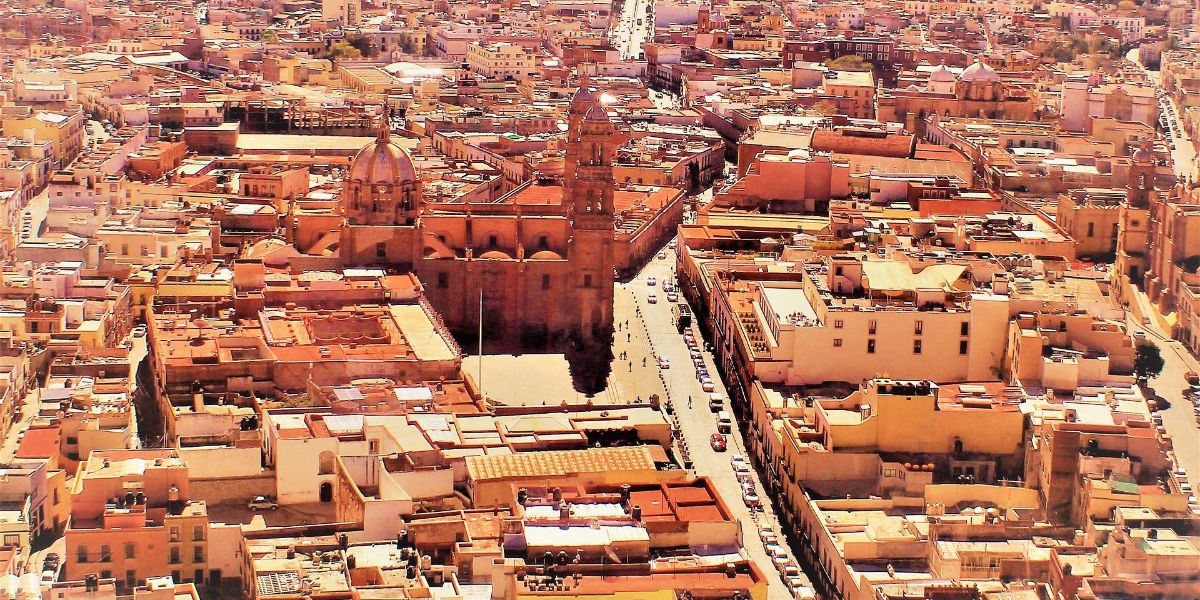

See MoreMexico objects US tax on cross-border remittances

The One, Big, Beautiful Bill (Act), which is now under Senate review, proposes a 3.5% tax on all remittances sent by non-US citizens to foreign countries, regardless of the transfer amount. The US House of Representatives passed the One,

See MoreUkraine raises tax on banks, financial institutions

Ukraine has signed Law 4015-IX (The Law on Amendments to the Tax Code of Ukraine and Other Laws of Ukraine to Ensure the Balance of Budget Revenues during Martial Law) into law on 28 November 2024. One key provision of this new law is the increased

See MoreBangladesh: Central Bank cuts fees for online income tax payments

Bangladesh’s central bank, Bangladesh Bank, has announced in Circular No.9 dated 13 November 2024, that it has reduced the fees associated with income tax payments made via internet banking, debits or credit cards, and mobile financial services

See MoreIreland: Lower House of Parliament passes Finance Bill 2024

The Irish lower house of parliament approved the Finance Bill 2024, which outlines major tax measures from Budget 2025 on Wednesday, 5 November 2024. Finance Bill 2024, which runs to 118 sections and over 200 pages, implements the taxation as

See MoreNigeria reinstates cybersecurity levy with reduced rate

Nigeria’s Central Bank (CBN) announced that it is reintroducing a 0.005% levy on all electronic transactions conducted by banks and financial institutions under the “Cybercrime (Prohibition, Prevention, etc.) Act, 2015” on 17 September

See MoreBrazil considering tax hike without legislative approval

Brazil's government is considering tax increases that can be enacted without congressional approval to address this year's budget deficit, according to two reports from the finance ministry received on 6 September 2024. Officials have indicated

See MoreBrazil to increase income tax on banks

Brazil's government introduced a bill to Congress to raise revenue through increased income taxes, mainly targeting banks with a significant tax rate hike, on Friday, 30 August 2024. The proposed legislation seeks to adjust the social

See MoreItaly dismisses speculations of imposing new taxes on bank profits

Giancarlo Giorgetti, Economy Minister, Italy, said that the government has no plans to introduce new additional taxes on profits on banks and other companies on Wednesday, 7 August, 2024. In August 2023, there was an unprecedented disposal of

See MoreNetherlands reconsidering 2024 tax plan amendments including stock buyback and bank tax changes

On 5 April 2024, the Dutch Ministry of Finance released a letter to the Senate outlining the decision to retract specific policies previously approved under the 2024 Tax Plan. The measures include: From 1 January 2024, the 30% ruling regime

See MoreIsrael: Finance committee approves additional tax on financial institutions

On 4 March 2024, the Finance Committee of Israel’s parliament (Knesset) passed a measure to impose a 6% tax on financial institutions holding assets equivalent to at least 5% of the total assets held by Israeli banks. This additional tax will be

See MoreIreland releases feedback of public consultation on bank levy

On 15 February 2024, Ireland's Department of Finance released the responses to its public consultation on the future of the bank levy. The "Further levy on certain financial institutions," more commonly known as the "Bank Levy" (the Levy), was

See MoreIsrael to raise bank taxes to 26% in 2024 and 2025

On 15 January 2024, Israel's Ministry of Finance proposed to increase the tax rate on bank profits from 17% to 26% in both 2024 and 2025. At present, banks and other financial institutions pay a 17% VAT-equivalent tax on their total payroll and

See More