Bangladesh: NBR extends 2025-26 PIT income tax return deadline

Bangladesh’s National Board of Revenue (NBR) has announced a one-month extension for filing income tax returns for the 2025-26 tax year. Under a special order issued on 19 November 2025, individual taxpayers now have until 31 December 2025 to

See MoreBangladesh: NBR reminds taxpayers of PIT e-return deadlines

Bangladesh’s National Board of Revenue (NBR) has reminded taxpayers to submit their income tax returns through the electronic filing system by 30 November 2025. The authority urged individuals to file early to avoid last-minute congestion on the

See MoreUS: IRS extends tax relief for Missouri taxpayers impacted by storms, floods

The US Internal Revenue Service (IRS), in a release (MO-2025-03) on 17 November 2025, announced tax relief for individuals and businesses in parts of Missouri affected by severe storms, straight-line winds, tornadoes, and flooding that began on 30

See MoreAlgeria: MoF announces extended deadlines for global income tax, wealth tax filing declarations

Algeria’s Directorate General of Taxes under the Ministry of Finance has issued Circular No. 69/MF/DGI/LF.2025 on 10 November 2025, notifying taxpayers and tax offices of updated filing deadlines introduced by the Finance Law for 2025 for filing

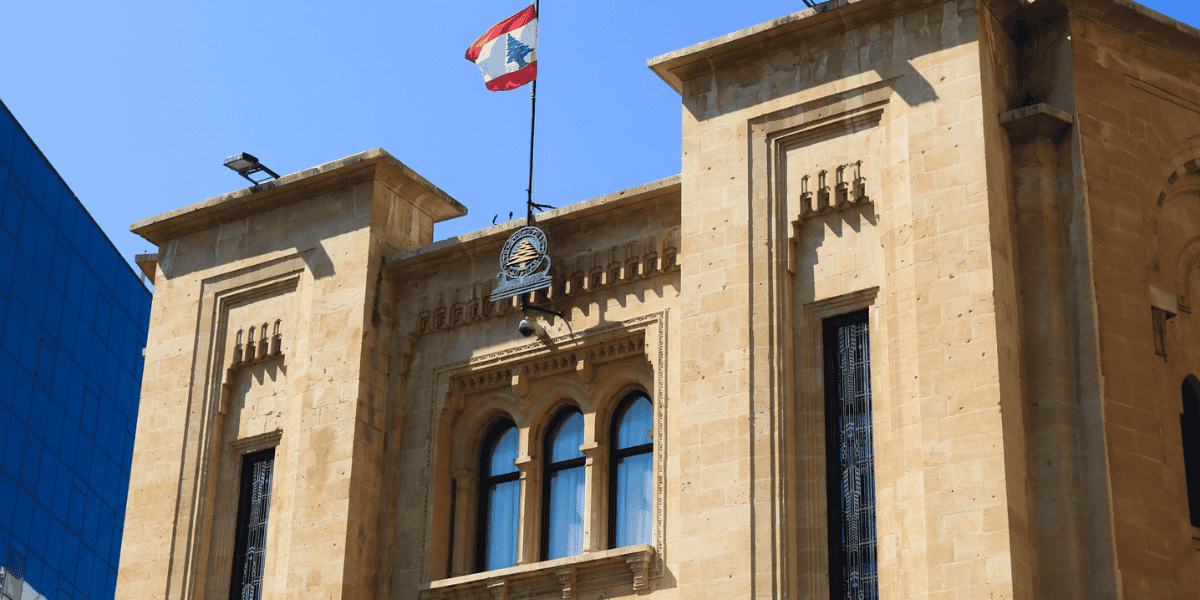

See MoreLebanon: MoF extends CIT, income tax deadlines for 2023–24

Lebanon’s Ministry of Finance (MoF) issued Decision No. 899/1 and related measures on 29 October 2025, extending key filing and payment deadlines for corporate income tax (CIT) and income tax obligations for fiscal years 2023 and 2024. The

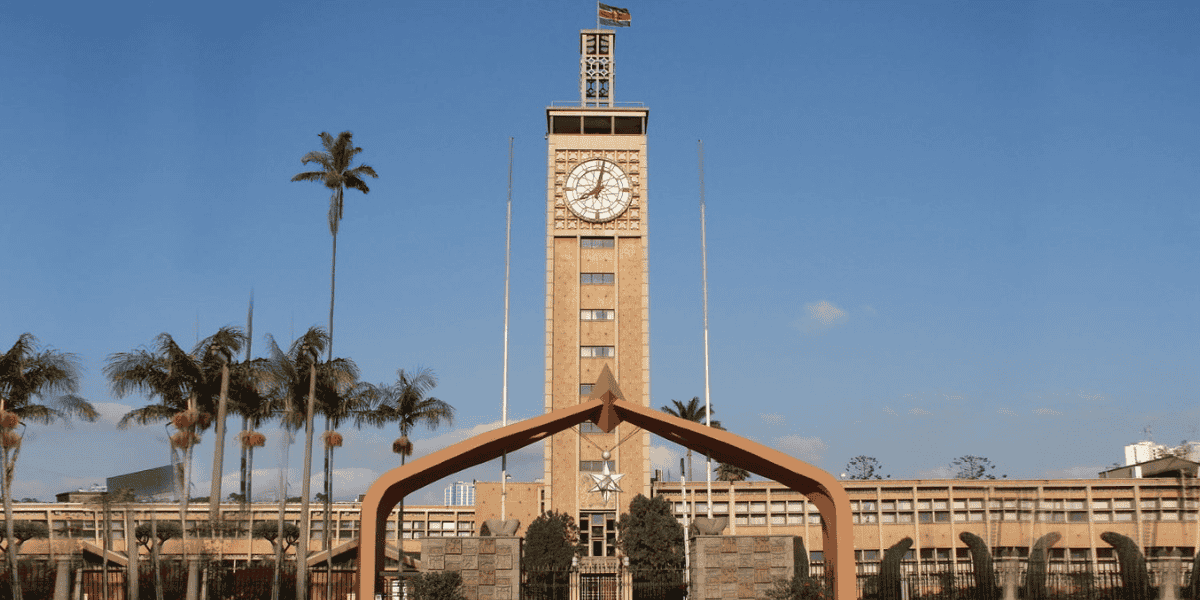

See MoreKenya: KRA to cross-check tax returns against official data sources

The Kenya Revenue Authority announced on 11 November 2025 that, beginning 1 January 2026, it will start cross-checking income and expenses reported in both individual and non-individual tax returns against specific data sources. Validation of

See MoreUS: Treasury Department discontinues direct file option for individual tax returns

The US Department of the Treasury issued a report to Congress in October 2025 regarding the replacement of the Direct File program for individual income tax returns. Initially launched during the 2024 tax filing season in 12 states, the program

See MoreUS: Minnesota revises tax forms due to One Big Beautiful Bill Act (OBBBA) nonconformity

The US State of Minnesota has updated its draft tax forms and instructions for 2024 and 2025 to reflect federal tax changes from the One Big Beautiful Bill Act (OBBBA) passed in July 2025. However, as of 1 May 2023, Minnesota's tax code conforms

See MoreBangladesh: NBR extends deadline for taxpayers facing online filing issues

The Bangladesh National Board of Revenue (NBR) has extended the deadline for taxpayers unable to file their income tax returns online due to technical or registration issues. In a special order issued on 30 October 2025, NBR Chairman Md. Abdur

See MoreUS: IRS announces tax relief for North Dakota and South Dakota storm, flood victims

The US Internal Revenue Service (IRS) released ND-2025-01 and SD-2025-01 on 29 October 2025, announcing tax relief for individuals and businesses in parts of North Dakota and South Dakota affected by severe storms and flooding that began on 12 June

See MoreUS: IRS announces tax relief to Alaska storm and flood victims

The US Internal Revenue Service (IRS) in a notice (AK-2025-0) on 30 October 2025 announced tax relief for individuals and businesses in the Lower Kuskokwim Regional Educational Attendance Area, Lower Yukon Regional Educational Attendance Area, and

See MoreBelgium extends personal income tax filing deadline

Belgium's Federal Public Service (SPF) Finance announced on 29 October 2025, the postponement of the deadline for filing online tax returns for individuals with specific income via MyMinfin to 7 November 2025. The deadline was 31 October

See MoreUS: IRS announces reduced services amid federal shutdown

RF Report The US Internal Revenue Service (IRS) announced on 21 October 2025 that, despite its limited operations during the ongoing US government shutdown, taxpayers are still required to meet all regular tax obligations. Tax refunds will

See MoreUS: IRS urges tax professionals to renew PTINs ahead of 2026 filing season

All paid tax return preparers and enrolled agents must renew their PTINs annually, as 2025 PTINs will expire on 31 December 2025. Regfollower Desk The US Internal Revenue Service (IRS) issued a notice on 27 October 2025, reminding more than

See MoreCyprus: Tax authorities mandate non-resident filing of tax withholding, GHS contributions via TFA system

The Department of Taxation announced that non-residents must submit the Deducted at Source (DAS) Declaration and make related payments exclusively through the TFA system. The Cyprus Tax Department announced, on 6 October 2025, detailing updated

See MoreUS: IRS reminds taxpayers who filed for extensions for 15 October 2025 tax return deadline

The IRS reminded taxpayers that 15 October 2025 is the deadline to file 2024 tax returns for those who obtained an extension. The US Internal Revenue Service (IRS) issued a notice on 14 October 2025, in which it reminded individuals who filed

See MoreIreland: Revenue updates 2024 income tax return guidance

Revenue issues eBrief with updates on non-resident landlords, PRSA contributions, and PRSI exemptions. The Irish Revenue published Revenue eBrief No. 181/25 on 6 October 2025 with amendments to the Tax and Duty Manual Part 38-01-04I related to

See MoreTaiwan reminds foreigner taxpayers to file property returns within 30 days

The Ministry of Finance reminded foreign nationals to file property tax returns within 30 days of transfer completion. The National Taxation Bureau of Taipei, Ministry of Finance states that any individual, whether a Taiwanese or foreign

See More