Latvia adopts legislation to enforce DAC8

Latvia published the Law on Amendments to the Law on Taxes and Duties in the Official Gazette on 21 November 2025, introducing measures to implement Council Directive (EU) 2023/2226 of 17 October 2023 (DAC8), including new reporting and due

See MoreHong Kong: IRD extends 2024/25 tax return filing deadline for year-ends January–March 2025

To assist businesses and practitioners with recent operational demands, through Circular Letter to Tax Representatives on the Block Extension Scheme for Lodgement of 2024/25 Tax Returns on 21 November 2025, the Inland Revenue Department (IRD)

See MoreAustralia: ATO mandates super funds, collective investment vehicles for RTP schedule filing from 2026

The Australian Taxation Office (ATO) announced, on 18 November 2025, that large superannuation funds and collective investment vehicles (CIVs) will be required to file the reportable tax position (RTP) schedule, starting 1 January 2026. The ATO

See MoreAngola: National Assembly approves 2026 budget, proposes several tax law modifications

Angola’s parliament has approved the General State Budget for 2026 on 19 November 2025, introducing amendments to several tax laws. The key amendments are: Corporate Tax Reforms Electronic filing mandate: General and simplified regime

See MoreSlovak Republic: MoF issues updated model tax return for Pillar 2 supplementary domestic top-up tax

The Slovak Republic’s Ministry of Finance has issued Notification No. MF/15676/2025-724, introducing a model tax return form for the additional (supplementary) domestic top-up tax, in accordance with the Pillar 2 QDMTT framework. The new

See MoreEU Commission consults e-invoicing regulations in public procurement

The EU Commission has launched a consultation on 19 November 2025 on its plans to revise EU rules on electronic invoicing in public procurement to address shortcomings in the current framework, promote harmonised e-invoicing across the EU, and

See MoreMalta: MTCA publishes second edition of AEOI newsletter

Malta’s Tax and Customs Administration (MTCA) has published issue 2 of its AEOI Newsletter. The second issue highlights that MTCA has launched a redesigned website, which centralises information on international tax cooperation. The site now

See MoreEuropean Commission publishes follow-up assessment of direction on administrative cooperation (DAC)

The European Commission has launched its second evaluation of Council Directive 2011/16/EU on administrative cooperation in taxation (the Directive on Administrative Cooperation, or DAC) on 19 November 2025. The DAC is a key legislative

See MoreUS: IRS extends tax relief for Missouri taxpayers impacted by storms, floods

The US Internal Revenue Service (IRS), in a release (MO-2025-03) on 17 November 2025, announced tax relief for individuals and businesses in parts of Missouri affected by severe storms, straight-line winds, tornadoes, and flooding that began on 30

See MoreAlgeria: MoF announces extended deadlines for global income tax, wealth tax filing declarations

Algeria’s Directorate General of Taxes under the Ministry of Finance has issued Circular No. 69/MF/DGI/LF.2025 on 10 November 2025, notifying taxpayers and tax offices of updated filing deadlines introduced by the Finance Law for 2025 for filing

See MoreLebanon: MoF extends CIT, income tax deadlines for 2023–24

Lebanon’s Ministry of Finance (MoF) issued Decision No. 899/1 and related measures on 29 October 2025, extending key filing and payment deadlines for corporate income tax (CIT) and income tax obligations for fiscal years 2023 and 2024. The

See MoreBrazil extends tax payment deadlines for Rio Bonito do Iguacu, Parana

Brazil’s Federal Revenue Service (RFB) has issued an Ordinance on 13 November 2025, extending the deadlines for the payment of federal taxes, including instalment payments, and fulfilling ancillary obligations. The measure also suspends

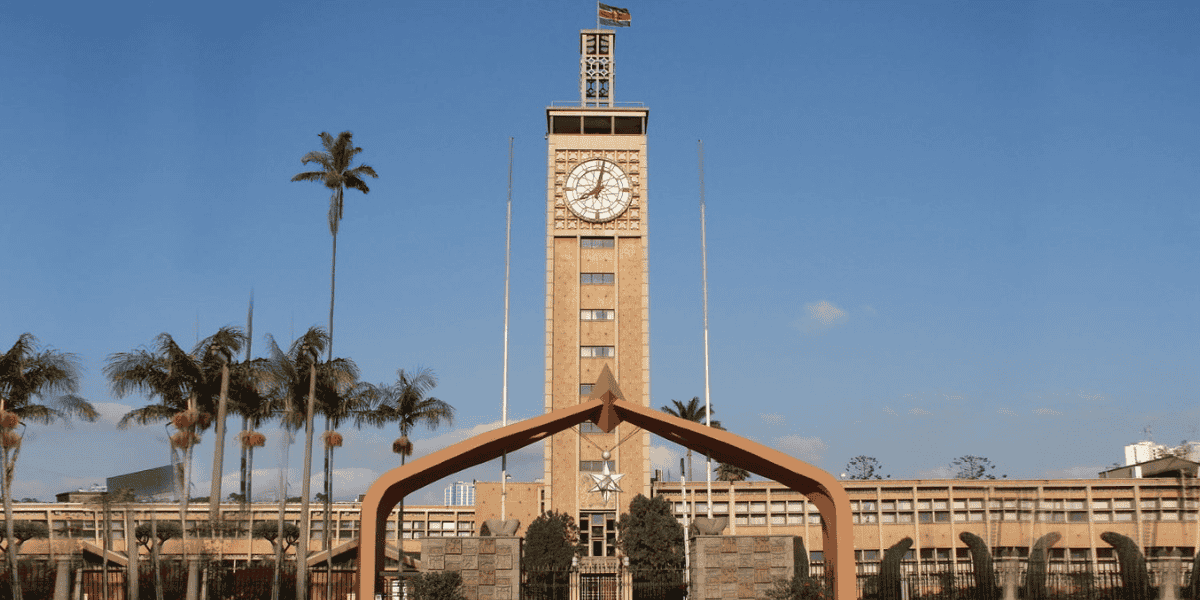

See MoreKenya: KRA to cross-check tax returns against official data sources

The Kenya Revenue Authority announced on 11 November 2025 that, beginning 1 January 2026, it will start cross-checking income and expenses reported in both individual and non-individual tax returns against specific data sources. Validation of

See MoreNetherlands: Government proposes aligned DAC9, DAC8 implementation date

The Netherlands government has submitted an amendment aligning the effective date of the DAC9 implementation bill (Directive 2025/872) with the bill introducing DAC8 (Directive 2023/2226). The updated amendment was released on the Ministry of

See MoreKenya: KRA launches automated payment plan for tax liabilities

The Kenya Revenue Authority has released a public notice announcing the rollout of automated payment plans for outstanding tax liabilities on 10 November 2025. Roll-out of Automated Payment Plan for Tax Liabilities The Kenya Revenue Authority

See MoreGermany: Bundestag approves draft law to implement DAC8 crypto reporting rules

Germany’s lower house of parliament (Bundestag) approved the draft law (KStTG) on 5 November 2025, aimed at implementing the EU’s DAC8 directive on the taxation of digital financial products, including crypto assets. Under the draft law,

See MoreNigeria: FIRS calls on major taxpayers to adopt e-invoicing, electronic fiscal systems

Nigeria's Federal Inland Revenue Service (FIRS) issued a follow-up public notice on 6 November 2025, noting the steady progress recorded since the commencement of the National e-Invoicing and Electronic Fiscal System (EFS) on 1 August 2025. A

See MoreMalawi: MRA extends transition period for electronic invoicing system

The Malawi Revenue Authority (MRA) announced on 4 November 2025 an extension of the transitional period for implementing the Electronic Invoicing System (EIS) from 1 November 2025 to 1 February 2026. This decision follows feedback from taxpayers

See More