Romania mandates GloBE information return, notification requirements

Romania published Order No. 218, issued by the National Agency for Fiscal Administration (ANAF) on 16 February 2026, in its Official Gazette on 24 February 2026. The order sets out the official templates and procedural rules for two key forms

See MoreEU Council approves streamlined sustainability reporting, due diligence rules for businesses

With a view to boosting EU competitiveness, the EU Council announced the approval of a simplification of the sustainability reporting and due diligence requirements for companies on 24 February 2026. This legislation simplifies the directives on

See MorePanama: MEF to dissolve thousands of suspended companies starting February 2026

The Ministry of Economy and Finance (MEF) announced on 23 February 2026 that it will launch a major initiative to dissolve suspended legal entities, reinforcing Panama's commitment to legal and financial transparency while meeting international

See MoreBolivia unveils major tax relief programme to ease business burden

The Bolivian government introduced the Transparency and Tax Relief Bill on 19 February 2026, marking a significant overhaul of the country's tax system aimed at helping entrepreneurs and businesses overcome crippling debts and administrative

See MoreBelgium mandates electronic filing for affected intermediary, recognised representative legal entities

Belgium’s tax authority announced, in the Official Gazette no. 2026001356 of 23 February 2026, that Belgian intermediary legal entities and Belgian recognised representative legal entities are required to file annual tax returns on securities

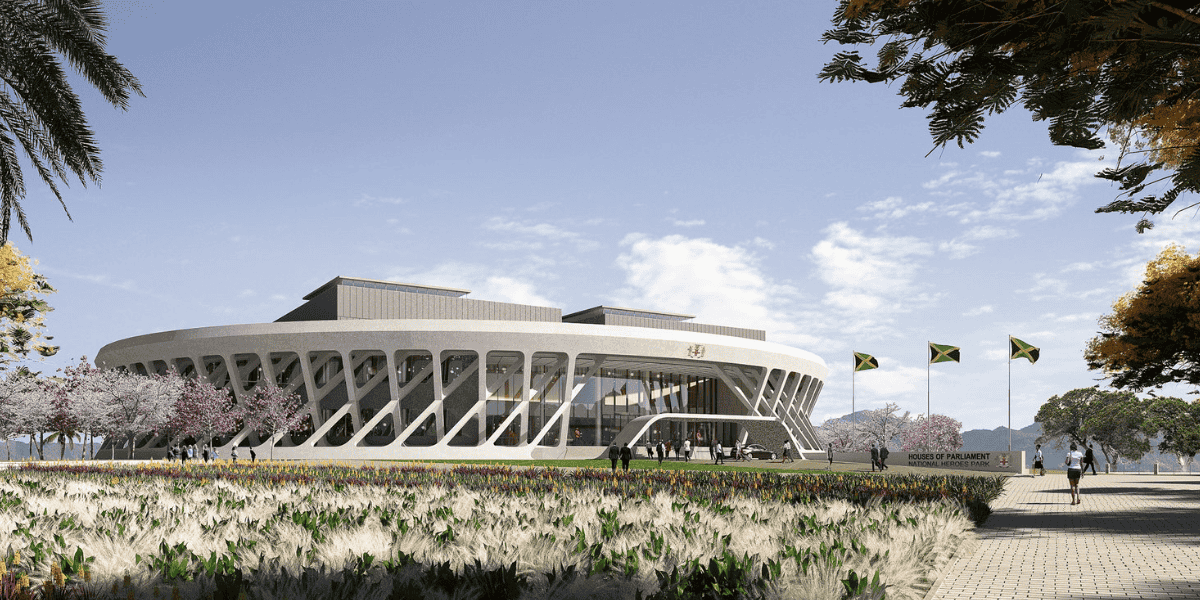

See MoreJamaica: TAJ extends corporate income tax filing deadline

Jamaica’s tax administration (TAJ) announced, on 19 February 2026, that it will introduce separate due dates for the filing of Final Income Tax and Assets Tax Returns, beginning with the Year of Assessment 2025. Under a proposed amendment to

See MoreIMF Working Paper: Benefits of Setting Up a Large Taxpayer Office

On 20 February 2026 an IMF working paper was published with the title Who Pays When Tax Administration Improves? Revenue, Compliance, and Behavioural Responses to Georgia’s Large Taxpayer Office. The authors, J. Atsebi, M. Chikviladze, M. Das, E.

See MoreRomania: ANAF to revise withholding tax reporting requirements

Romania’s tax authority, the National Agency for Fiscal Administration (ANAF), has issued an Order No. 179/2022 on 16 February 2026 to modify the reporting requirements for Form 205, the "Informative Declaration on Withholding Tax and Investment

See MorePoland: Senate considers DAC8 crypto-asset reporting, DAC9 centralised top-up tax filing rules

Poland's Senate is examining draft legislation to implement two EU directives on administrative cooperation in taxation — DAC8 and DAC9 — following its approval by the Committee on Budget and Public Finance on 18 February 2026. Poland, along

See MoreBrazil: RFB extends deadline for cooperative tax compliance programme

Brazil's Federal Revenue Service (RFB) announced yesterday, 19 February 2026, that it has extended the application deadline for the inaugural edition of its Cooperative Fiscal Compliance Programme — known as Confia — to 20 March 2026, following

See MoreArgentina: ARCA introduces monthly electronic settlement to streamline VAT, income tax compliance

Argentina's tax authority (ARCA) introduced new electronic invoicing requirements and a monthly settlement system through General Resolution 5824/26 to simplify tax compliance for businesses and individuals on 13 February 2026. Financial

See MoreBrazil: Tax authority announces deadline for property declaration under lower rates

Brazil's Federal Revenue Service (RFB) issued an alert on 13 February 2026, reminding taxpayers of the approaching deadline to enrol in the Special Regime for Updating and Regularising Assets under the Update modality (Rearp Update). The

See MoreRomania introduces 3% incentive on 2025 direct tax liabilities

Romania’s Ministry of Finance has released draft legislation on 5 February 2026 proposing a 3% tax incentive for 2025, applicable to corporate income tax and microenterprise income taxes, which can also be used to offset other tax

See MoreRomania: MOF proposes deferred tax accounting rules within GloBE framework

Romania's Ministry of Finance has issued a draft order on 9 February 2026 detailing how constituent entities subject to Law 431/2023 should account for deferred tax under the Minimum Taxation Directive (2022/2523). Entities applying Romanian

See MoreArgentina regulates tax innocence regime, exempts interest on dollar deposits from withholding tax

Argentina’s tax authority (ARCA) announced on 9 February 2026 that it implemented its Tax Innocence Regime through Law No. 27799, marking a fundamental shift away from decades of restrictive taxation that forced millions into the informal economy.

See MoreRomania: MoF unveils comprehensive economic recovery plan

Romania's Ministry of Finance has published a comprehensive fiscal and investment package on 9 February 2026, designed to accelerate economic recovery and modernise the country's tax framework. Earlier, the Ministry of Finance published a draft

See MoreChile: SII announces 2026 compliance risk management plan

Chile’s tax authority (SII) has presented its 2026 Tax Compliance Management Plan (PGCT) on 29 January 2026, emphasising taxpayer support, business formalisation, cooperative compliance, and the fight against tax evasion and organised

See MoreItaly finalises global minimum tax declaration form for multinational groups

Italy's Revenue Agency issued a directive on 6 February 2026, approving the annual declaration form for supplementary taxation under the Global Minimum Tax regime established by Legislative Decree no. 209/2023. The provision finalises the

See More