US: NYC Mayor proposes tax increases to address budget deficit

New York City Mayor Zohran Mamdani proposed raising taxes on high earners and corporations on Wednesday, 12 February 2026, during testimony at the State Senate's budget hearing. The Democratic mayor reported that the city has narrowed its budget

See MoreRomania introduces 3% incentive on 2025 direct tax liabilities

Romania’s Ministry of Finance has released draft legislation on 5 February 2026 proposing a 3% tax incentive for 2025, applicable to corporate income tax and microenterprise income taxes, which can also be used to offset other tax

See MoreAustralia: ATO confirms formalisation of GIR MCAA agreement

The Australian Taxation Office has updated its global and domestic minimum tax guidance on 9 February 2026 to reflect Australia's signing of the Multilateral Competent Authority Agreement on the Exchange of GloBE Information Return (GIR MCAA), which

See MoreMalaysia publishes domestic top-up tax guidelines, updates global minimum tax FAQs

Malaysia's Inland Revenue Board has updated its Pillar 2 Global Minimum Tax guidance with new Guidelines on Domestic Top-up Tax implementation in Malaysia and an updated FAQ, both on 3 February 2026. The GMT requirements apply for fiscal years

See MoreQatar: GTA introduces global, domestic minimum tax framework

Qatar’s General Tax Authority (GTA) announced that it has implemented global and domestic minimum tax rules aligned with international standards through Cabinet Resolution No. (2) of 2026, published in the Official Gazette on 12 February

See MoreSingapore: 2026 budget proposes short-term corporate tax relief, longer-term structural reforms

Singapore's Prime Minister and Minister for Finance, Lawrence Wong, has delivered the FY2026 Budget Statement in Parliament on 12 February 2026, setting out a package of measures aimed at supporting businesses amid cost pressures while advancing

See MoreRomania: MOF proposes deferred tax accounting rules within GloBE framework

Romania's Ministry of Finance has issued a draft order on 9 February 2026 detailing how constituent entities subject to Law 431/2023 should account for deferred tax under the Minimum Taxation Directive (2022/2523). Entities applying Romanian

See MoreICC: Economic Impact of UN Model Article 12AA on Cross-Border Services

A report released by the International Chamber of Commerce (ICC) on 3 February 2026 assesses the potential economic impact of the new UN Model Article 12AA on taxation of cross-border services. The new services article was designed to strengthen

See MoreArgentina regulates tax innocence regime, exempts interest on dollar deposits from withholding tax

Argentina’s tax authority (ARCA) announced on 9 February 2026 that it implemented its Tax Innocence Regime through Law No. 27799, marking a fundamental shift away from decades of restrictive taxation that forced millions into the informal economy.

See MoreRomania: MoF unveils comprehensive economic recovery plan

Romania's Ministry of Finance has published a comprehensive fiscal and investment package on 9 February 2026, designed to accelerate economic recovery and modernise the country's tax framework. Earlier, the Ministry of Finance published a draft

See MoreGermany enacts law to strengthen financial sector, promote private investments

Germany published the Act on the promotion of private investment and the financial sector in the Official Gazette (BGBl. I 33/2026) on 9 February 2026 . The Act aims to strengthen Germany’s financial sector and encourage private investment through

See MoreBelgium amends advance RIR supplementary tax payments under Pillar 2 rules

Belgium’s Federal Public Service (SPF) Finance announced on 9 February 2026 that new procedures apply to advance payments of the RIR supplementary tax under the Pillar 2 minimum tax rules for multinational enterprises and large national groups,

See MoreNigeria: NRS scraps road tax credit scheme over verification challenges

The Nigeria Revenue Service (NRS) has ended the road infrastructure tax credit programme on 5 February 2026, citing its inability to verify construction projects completed under the initiative. NRS Chairman Zacch Adedeji announced the decision,

See MoreItaly: Agricultural businesses with cadastral income can access special economic zone tax credit

Italy's Revenue Agency has clarified in Response No. 25 on 9 February 2026 that agricultural businesses that determine income from cadastral (land registry) records can access the tax credit for investments in the Single Special Economic Zone (ZES)

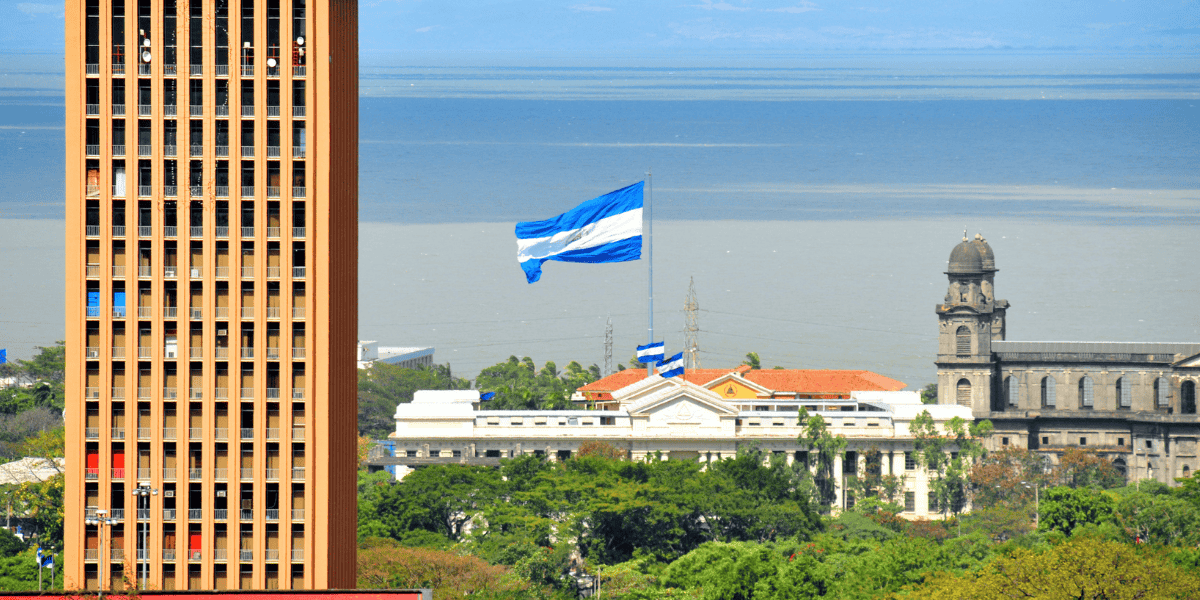

See MoreNicaragua tax authority establishes January 2026 tax filing dates

Nicaragua’s tax authority (DGI) issued Notice No. 019-02-2026 on 2 February 2026, establishing tax compliance deadlines for taxpayers with annual income below NIO 60 million. The notice specified that the filing deadline for January 2026 tax

See MoreChile: SII announces 2026 compliance risk management plan

Chile’s tax authority (SII) has presented its 2026 Tax Compliance Management Plan (PGCT) on 29 January 2026, emphasising taxpayer support, business formalisation, cooperative compliance, and the fight against tax evasion and organised

See MoreItaly finalises global minimum tax declaration form for multinational groups

Italy's Revenue Agency issued a directive on 6 February 2026, approving the annual declaration form for supplementary taxation under the Global Minimum Tax regime established by Legislative Decree no. 209/2023. The provision finalises the

See MoreUruguay: DGI launches website for domestic minimum top-up tax compliance

The Uruguayan tax authority (DGI) has launched a new website to provide guidance for compliance with the Qualified Domestic Minimum Top-Up Tax (QDMTT), known in Spanish as the Impuesto Mínimo Complementario Doméstico (IMCD). This announcement

See More