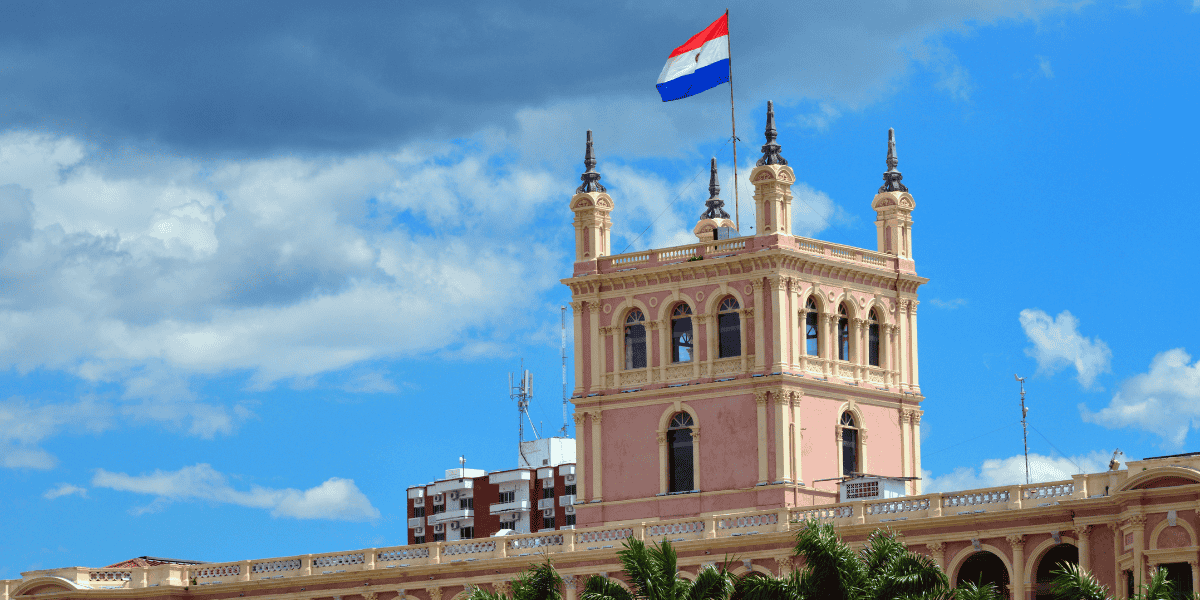

Paraguay unveils new tax incentives for local, foreign investors

Key incentives include exemptions on customs duties, VAT, nonresident income tax, and dividend/profit tax for substantial investments in capital goods, industrial or agricultural production, and large-scale tourism or entertainment projects, subject

See MorePhilippines introduces tax reforms targeting large-scale metallic mining activities

Republic Act No. 12253 takes effect on 20 September 2025, affecting large-scale metallic mining contractors 150 days later, with implementing rules to be issued within 90 days. The Philippines has published Republic Act No. 12253, an Act

See MoreNigeria gazettes tax reform acts, updates corporate and minimum effective tax rates

The Nigeria Tax Act 2025 and the Nigeria Tax Administration Act 2025, which will take effect on 1 January 2026, as well as the Nigeria Revenue Service (Establishment) Act 2025 and the Joint Revenue Board (Establishment) Act, which came into force on

See MorePortugal updates blacklist of favourable tax jurisdictions

Portugal delists Hong Kong, Liechtenstein, and Uruguay from its tax blacklist. Portugal has issued Ordinance No. 292/2025/1 on 5 September 2025, introducing changes to the list of jurisdictions considered to have privileged tax regimes under

See MoreVietnam: Government issues decree on Pillar 2 global minimum tax implementation, includes compliance

The Decree outlines Vietnam’s Pillar 2 global minimum tax rules for MNEs, including IIR and QDMTT, specifying notification, registration, and reporting deadlines. Vietnam’s government announced that it has issued Decree No. 236/2025/ND-CP,

See MoreIceland presents 2026 Budget, proposes implementation of Pillar 2 global minimum tax

Iceland’s 2026 Budget introduces the Pillar 2 global minimum tax (IIR and QDMTT), a kilometre-based vehicle tax, and a phased removal of fuel excise duties with higher carbon taxes. Iceland's Finance Minister, Daði Már Kristófersson,

See MoreTurkey: Government tightens criteria for simplified business taxation

The simple method allows eligible taxpayers to calculate business income by subtracting expenses from revenue without detailed accounting, provided they meet the participation, rental, turnover, and IIT exemption criteria. Turkey’s government

See MoreSouth Africa: SARS consults on draft tax exemption guidance

Comments on the draft Note must be submitted by 10 October 2025. The South African Revenue Service (SARS) has initiated a public consultation on a draft interpretation note on the income tax exemption applicable to bodies corporate, share block

See MoreUAE: MoF issues new rules on qualifying and excluded activities in free zones

UAE issues Ministerial Decision No. 229 of 2025 on Free Zone corporate tax activities, effective from 1 June 2023. The UAE Ministry of Finance ( MOF) issued Ministerial Decision No. 229 of 2025 on 28 August 2025, which repeals Ministerial

See MoreThailand: Cabinet approves bill on Qualified Refundable Tax Credits in Pillar 2 framework

The Bill allows promoted companies to receive cash refunds for unused tax credits, which are treated as income for Pillar 2 purposes, ensuring no adverse effect on the effective tax rate. QRTCs cover investments in R&D, advanced skills,

See MoreUzbekistan: President announces tax incentives for legal firms

From 1 January 2026, legal entities switching from turnover tax to VAT for the first time will receive a 1-year corporate tax exemption, a 1-year waiver of VAT registration penalties, and a six-month deduction on accounting

See MoreChile: SII issues guidance on reduced tax rates and advance payments for SMEs

The reduced income tax rates take effect on 1 January 2025, and the reduced PPM rates apply from August 2025 to December 2027. Chile’s Tax Administration (SII) has published Circular SII No. 53-2025 on its website on 3 September 2025, outlining

See MoreUS: IRS issues USD 162 million in fines for fraudulent tax credit claims promoted on social media

The IRS warns taxpayers about rising social media scams promoting the misuse of tax credits, such as the Fuel Tax Credit and the Sick and Family Leave Credit, which have led many to file invalid returns and face denied refunds and penalties. The

See MoreMalta to introduce 15% minimum tax for MNEs

Malta imposes a 15% final tax on large multinationals under new regulations. Malta’s government has issued Legal Notice 188 of 2025, titled the Final Income Tax Without Imputation Regulations, 2025, under Article 22B of the Income Tax Act on 2

See MoreRomania gazettes ordinance amending global minimum tax rules

The Ordinance updates Law No. 431/2023 to implement the Pillar 2 global minimum tax under EU Directive 2022/2523. Romania has published Ordinance No. 21 of 28 August 2025 in the Official Gazette on 29 August 2025. Government Ordinance No.

See MoreIreland: Irish Revenue releases Pillar 2 Registration guidance

The guidance offers comprehensive instructions on how to register for Pillar 2 taxes. Irish Revenue has released eBrief No. 170/25 on Tax and Duty Manual Part 04A-01-01A on 5 September 2025, providing comprehensive guidance on the registration

See MoreNetherlands releases Q&As on Minimum Tax Act 2024

The Q&As offer practical guidance for implementing the Minimum Tax Act 2024 in the Netherlands. The Netherlands tax authority has released a Q&A document on the Minimum Tax Act 2024. This document compiles questions submitted to the

See MoreCanada: CRA extends withholding tax relief for nonresident subcontractor reimbursements to June 2026

Taxpayers reimbursing non-residents for services in Canada via subcontracting can defer the 15% withholding tax and related interest or penalties until 30 June 2026. The Canada Revenue Agency (CRA) has extended its administrative relief policy

See More