Mexico: Federal Executive Branch presents 2026 Economic Package to Congress, includes indirect tax reforms

Mexico’s Federal Executive Branch submitted the 2026 Economic Package to Congress, proposing major changes to VAT, excise, and income taxes, as well as the federal tax code, which are under review until 31 October 2025. Mexico’s Federal

See MoreDenmark gazettes consolidated minimum taxation Act in line with OECD guidelines

Denmark gazettes consolidated Minimum Taxation Act under Executive Order No. 1089/2025, aligning with OECD guidance and EU Directive 2022/2523 Denmark has published the consolidated Minimum Taxation Act through Executive Order No. 1089/2025 on 10

See MoreBahrain: NBR updates guidance on Domestic Minimum Top-Up Tax

The guidance clarifies scope, exclusions, and safe harbors. Bahrain’s National Bureau for Revenue (NBR) published an updated guidance on 12 August 2025 concerning the 15% Domestic Minimum Top-Up Tax (DMTT), effective from 1 January 2025. The

See MoreSaudi Arabia: MoF consults multinational regional headquarters rules

MoF has initiated a consultation on Regional Headquarters (RHQ) rules set to run from 9 September-9 October, 2025. The Saudi Ministry of Finance (MoF) launched a public consultation on 9 September 2025 regarding draft rules for licensing and

See MoreChile: SII clarifies eligibility timing for special capital gains on listed shares

Ruling 1750 clarifies that capital gains from selling shares in public companies or mutual funds qualify for the Article 107 special regime only if the shares meet the stock market presence requirement at the time of sale. Chile’s tax

See MoreGermany: Federal Cabinet approves bill to encourage private investments

The draft promotes private investment in infrastructure and renewable energies as well as in smaller enterprises and start-ups (venture capital). The German Federal Cabinet approved a draft law on 10 September 2025 to encourage private

See MoreCzech Republic: Chamber of Deputies passes law amending employer reporting and tax regulations, introduces 150% R&D allowance

The bill is now awaiting the president’s signature. The Czech Republic’s Chamber of Deputies (Lower House of Parliament) passed a new law on 10 September 2025, introducing significant changes to employer reporting and tax regulations,

See MoreGreece publishes 2023 preferential tax jurisdictions

Under Greek law, preferential tax regimes are those with a corporate tax rate equal to or less than 60% of Greece’s rate for legal persons or permanent establishments. The Greek Public Revenue Authority (AADE) issued Decision No. A.1125 on 9

See MoreTurkey restricts simple method in business taxation

Certain businesses in metropolitan areas must use the real tax method from 2026. The Turkish government issued Presidential Decision No. 10380, published in the Official Gazette on 9 September 2025, introducing changes to business taxation under

See MoreAustralia: ATO announces GIC, SIC rates for Q2 2025-26

From 1 October 2025, the GIC annual rate will be 10.61%, and the SIC annual rate will be 6.61%. The Australian Taxation Office (ATO) announced the general interest charge (GIC) rates and shortfall interest charge (SIC) rates for the second

See MoreAustralia: Treasury consults on amendments to PPRT

The deadline for submitting feedback is 3 October 2025. Australia’s Treasury has issued a draft legislation for consultation under the Treasury Laws Amendment Bill 2025 to implement one of the key recommendations from the government’s 2017

See MoreAustralia: Treasury consults proposed tax concessions for alcohol producers

The deadline for submitting feedback is 22 September 2025. Australia’s Treasury has released draft legislation for consultation on proposed tax relief measures for alcohol producers as part of its 2025–26 Budget commitments. Higher rebate

See MoreSlovak Republic: MoF unveils 2026 public finance, tax reform measures

The key tax changes are in the corporate and investment sectors, which face higher taxes: the top corporate license fee rises to EUR 11,520, and the special levy jumps to 15%. Consumption taxes increase, with VAT on sugary/salty foods at 23% and

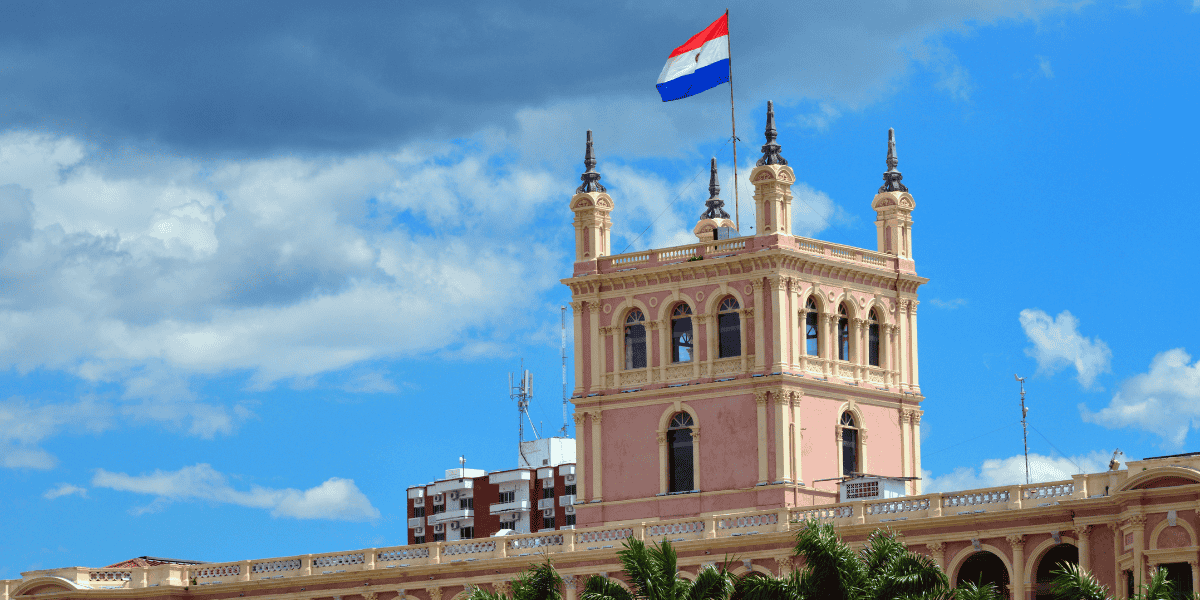

See MoreParaguay unveils new tax incentives for local, foreign investors

Key incentives include exemptions on customs duties, VAT, nonresident income tax, and dividend/profit tax for substantial investments in capital goods, industrial or agricultural production, and large-scale tourism or entertainment projects, subject

See MorePhilippines introduces tax reforms targeting large-scale metallic mining activities

Republic Act No. 12253 takes effect on 20 September 2025, affecting large-scale metallic mining contractors 150 days later, with implementing rules to be issued within 90 days. The Philippines has published Republic Act No. 12253, an Act

See MoreNigeria gazettes tax reform acts, updates corporate and minimum effective tax rates

The Nigeria Tax Act 2025 and the Nigeria Tax Administration Act 2025, which will take effect on 1 January 2026, as well as the Nigeria Revenue Service (Establishment) Act 2025 and the Joint Revenue Board (Establishment) Act, which came into force on

See MorePortugal updates blacklist of favourable tax jurisdictions

Portugal delists Hong Kong, Liechtenstein, and Uruguay from its tax blacklist. Portugal has issued Ordinance No. 292/2025/1 on 5 September 2025, introducing changes to the list of jurisdictions considered to have privileged tax regimes under

See MoreVietnam: Government issues decree on Pillar 2 global minimum tax implementation, includes compliance

The Decree outlines Vietnam’s Pillar 2 global minimum tax rules for MNEs, including IIR and QDMTT, specifying notification, registration, and reporting deadlines. Vietnam’s government announced that it has issued Decree No. 236/2025/ND-CP,

See More