New Zealand consults tax framework for off-market share cancellations

New Zealand's Inland Revenue has released a draft Operational Statement for public consultation addressing the bright line tests used to classify off-market share cancellations as either taxable dividends or non-taxable capital returns. This

See MoreGermany publishes draft permanent establishment guidelines

The German Federal Ministry of Finance has released a draft of its revised guidelines on permanent establishments (PEs) in domestic and international tax law. These guidelines are intended to replace the previous version issued in December

See MoreSouth Africa: SARS outlines qualifying requirements for Domestic Constituent Entity GloBE Information Return

The South African Revenue Service (SARS) released the Business Requirement Specification (BRS) for the Global Anti-Base Erosion (GloBE) programme on its Global Minimum Tax webpage on 13 February 2026. This Business Requirement Specification

See MoreSlovenia gazettes Pillar 2 top-up tax return regulations

Slovenia published regulations governing the top-up tax return and the domestic top-up tax return in its Official Gazette on 13 February 2026. The measures form the country’s implementation of the global minimum tax under Pillar 2. The top-up

See MoreUN: Intergovernmental Negotiating Committee Discusses Cross-Border Services Protocol

In February 2026 the intergovernmental negotiating committee (INC) continued discussions on the UN Framework Convention on International Tax Cooperation, looking at the early Protocol on taxation of cross-border services. With increasing

See MoreEcuador: SRI updates income tax self-withholding rates for large taxpayers

Ecuador’s Internal Revenue Service (SRI) has issued Resolution No. NAC-DGERCGC26-00000003 of 27 January 2026, updating the income tax self-withholding rates that apply to companies classified as “Large Taxpayers”. The revised rates form

See MoreSlovenia specifies minimum tax directive reporting obligations

Slovenia’s Ministry of Finance has published a notice on 6 February 2026 outlining the principal reporting obligations under the Minimum Taxation Directive (2022/2523). A person liable for minimum tax under the Minimum Tax Act (Official Gazette

See MoreUAE exempts non-commercial sports entities from corporate tax

The UAE’s Ministry of Finance (MoF) has announced the issuance of Cabinet Decision No. (1) of 2026 on Exempting Certain Sports Entities from Corporate Tax for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and

See MoreFinland: Government proposes side-by-side package implementation under Pillar 2 amendments

Finland’s government submitted a new law proposal (HE 6/2026) to parliament on 12 February 2026, which supplements the earlier proposal HE 196/2025, introducing further amendments to the Law on Minimum Tax by Large Groups, which implements the

See MoreUN: Meeting of Committee to Discuss Framework Convention on International Tax Cooperation

The intergovernmental negotiating committee (INC) met in February 2026 to continue discussions on the UN Framework Convention on International Tax Cooperation and the two early Protocols on taxation of cross-border services and tax dispute

See MoreArgentina: ARCA introduces monthly electronic settlement to streamline VAT, income tax compliance

Argentina's tax authority (ARCA) introduced new electronic invoicing requirements and a monthly settlement system through General Resolution 5824/26 to simplify tax compliance for businesses and individuals on 13 February 2026. Financial

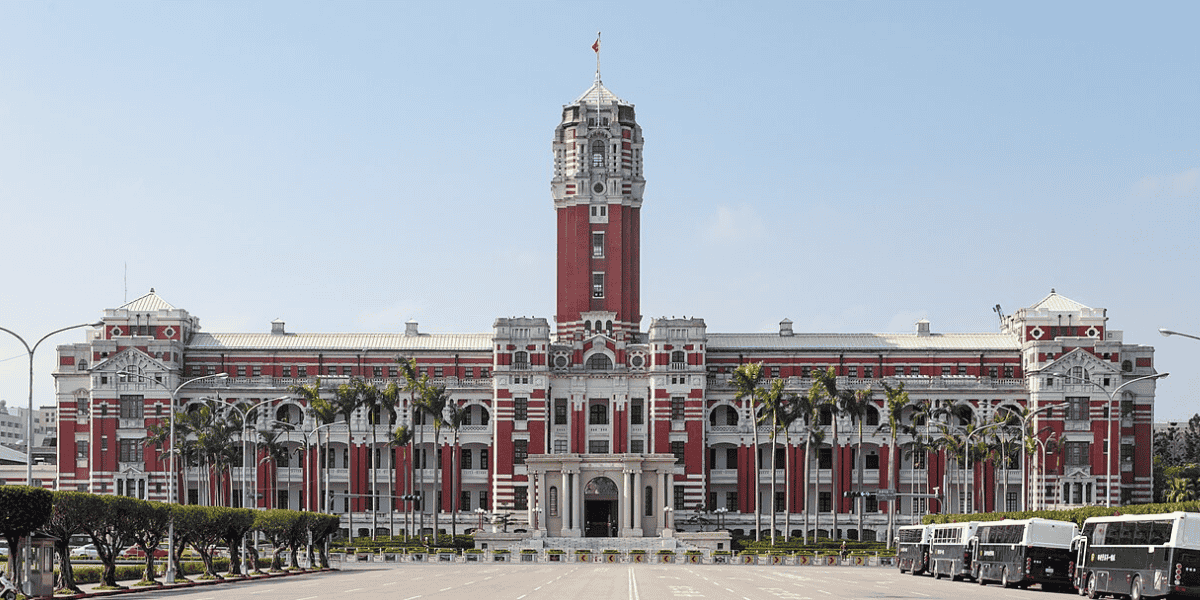

See MoreTaiwan: Tax bureau clarifies input tax credit rules for mixed business operations

Taiwan’s Northern Region National Taxation Bureau announced on 13 February 2025 that businesses selling both taxable and tax-exempt goods must follow specific regulations when claiming input tax credits on fixed assets like factory buildings and

See MoreTaiwan: Tax bureau clarifies contract penalties taxation, late interest exemption

The Central Taiwan National Taxation Bureau has clarified, on 13 February 2026, that breach of contract penalties and late payment interest receive different tax treatments. Penalties collected for contract breaches are subject to business tax

See MoreCanada consults domestic content requirements for clean technology, electricity investment tax credits

Canada’s Department of Finance, in a news release on 13 February 2026 ,announced that it launched consultations on the possibility of introducing a domestic content requirement under the Clean Technology and Clean Electricity investment tax

See MoreBrazil: Tax authority announces deadline for property declaration under lower rates

Brazil's Federal Revenue Service (RFB) issued an alert on 13 February 2026, reminding taxpayers of the approaching deadline to enrol in the Special Regime for Updating and Regularising Assets under the Update modality (Rearp Update). The

See MoreUS issues new tax rules to limit Chinese clean energy components

The US Treasury Department released interim guidelines on 12 February 2026 addressing how companies can qualify for clean energy tax credits while restricting reliance on Chinese-made equipment under President Donald Trump's tax legislation. The

See MoreTaiwan: Tax bureau clarifies sole proprietors on invoice rules during change of responsible person

The Northern Taiwan National Taxation Bureau of the Ministry of Finance has clarified on 13 February 2026 that sole proprietorships that change in the responsible person may trigger business tax obligations if inventory and fixed assets are

See MoreUS: IRS new clarification on energy tax credits linked to prohibited foreign assistance under federal law under OBBB

The Department of the Treasury and the Internal Revenue Service (IRS) announced on 12 February 2026 that it is providing guidance for determining whether electricity-producing qualified facilities, energy storage technologies, or eligible components

See More