Belgium mandates electronic filing for affected intermediary, recognised representative legal entities

Belgium’s tax authority announced, in the Official Gazette no. 2026001356 of 23 February 2026, that Belgian intermediary legal entities and Belgian recognised representative legal entities are required to file annual tax returns on securities

See MoreMalta exempts certain entities from Pillar Two filing requirements

Malta’s government has issued amendments to the European Union Global Minimum Level of Taxation for Multinational Enterprise Groups and Large-Scale Domestic Groups, Subsidiary Legislation 123.212, under Legal Notice 48 of 2026, published on 20

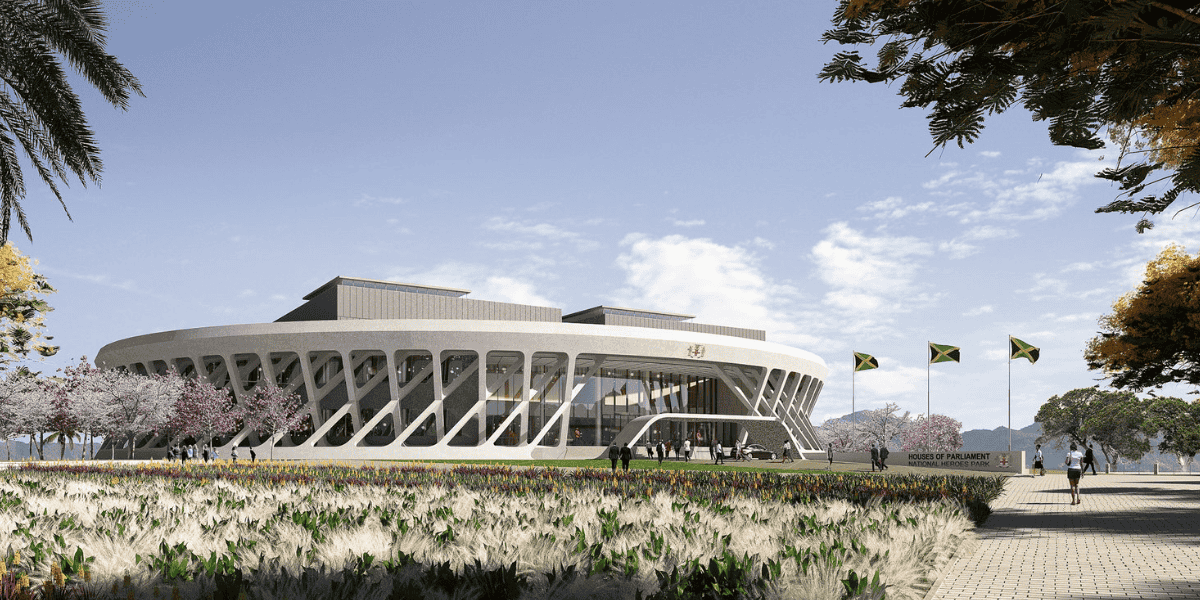

See MoreJamaica: TAJ extends corporate income tax filing deadline

Jamaica’s tax administration (TAJ) announced, on 19 February 2026, that it will introduce separate due dates for the filing of Final Income Tax and Assets Tax Returns, beginning with the Year of Assessment 2025. Under a proposed amendment to

See MoreIMF Working Paper: Benefits of Setting Up a Large Taxpayer Office

On 20 February 2026 an IMF working paper was published with the title Who Pays When Tax Administration Improves? Revenue, Compliance, and Behavioural Responses to Georgia’s Large Taxpayer Office. The authors, J. Atsebi, M. Chikviladze, M. Das, E.

See MoreRomania: ANAF to revise withholding tax reporting requirements

Romania’s tax authority, the National Agency for Fiscal Administration (ANAF), has issued an Order No. 179/2022 on 16 February 2026 to modify the reporting requirements for Form 205, the "Informative Declaration on Withholding Tax and Investment

See MoreFrance enacts 2026 Finance Law, introduces exceptional contributions for large corporations

France has enacted Finance Law for 2026 (Law No. 2026-103) and published it in the Official Journal of the French Republic on 20 February 2026. Before promulgation, the Constitutional Court reviewed the legislation and validated most of its

See MoreTurkey outlines taxation of capital gains from sale of real estate

Turkey’s Revenue Administration has issued Guidance No. 583, outlining the taxation of capital gains from the sale of real estate. The guidance details the rules, calculation methods, and declaration procedures for income tax on gains realised

See MorePoland: Senate considers DAC8 crypto-asset reporting, DAC9 centralised top-up tax filing rules

Poland's Senate is examining draft legislation to implement two EU directives on administrative cooperation in taxation — DAC8 and DAC9 — following its approval by the Committee on Budget and Public Finance on 18 February 2026. Poland, along

See MoreBrazil: RFB extends deadline for cooperative tax compliance programme

Brazil's Federal Revenue Service (RFB) announced yesterday, 19 February 2026, that it has extended the application deadline for the inaugural edition of its Cooperative Fiscal Compliance Programme — known as Confia — to 20 March 2026, following

See MoreGermany updates Global Minimum tax FAQs with new ‘Side-by-Side’ guidance

Germany’s Federal Ministry of Finance revised its Global Minimum Tax FAQs on 16 February 2026. The update primarily adds guidance on the “side-by-side” arrangement endorsed by the BEPS Inclusive Framework in January 2026, which is intended,

See MoreAustralia consults amendments to minimum tax regime in line with OECD administrative updates

Australia's Treasury has initiated a public consultation on proposed amendments to the Taxation (Multinational—Global and Domestic Minimum Tax) Rules 2024 from 16 February - 13 March 2026. The draft amending rules, titled the Taxation

See MoreUN: Discussion of Protocol on Dispute Prevention and Resolution

In February 2026 the intergovernmental negotiating committee (INC) continued discussions on the UN Framework Convention on International Tax Cooperation, looking at the early Protocol on tax dispute resolution. Dispute resolution

See MoreNigeria: NRS clarification refutes 25% tax on building materials, funds

The Nigeria Revenue Service has clarified, on 17 February 2026, that the Nigeria Tax Act 2025 is already in effect and does not impose a 25% tax on building materials, construction funds, or related transactions, contrary to false claims circulating

See MoreEU Commission consults to simplify corporate tax rules

The European Commission has opened a call for evidence to gather stakeholder input on a new initiative aimed at simplifying the EU’s legal framework for direct taxation on 16 February 2026 . The consultation seeks to reduce administrative burdens

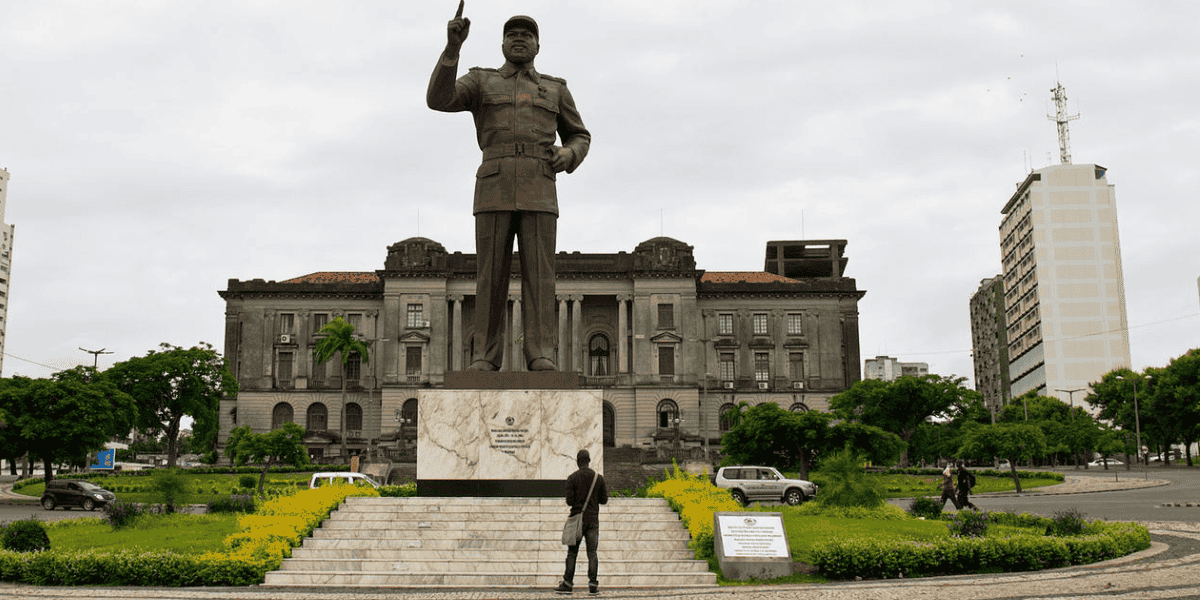

See MoreMozambique enacts 2026 tax reforms, introduces VAT on digital services

Mozambique's President signed into law and ordered the official publication of the Economic and Social Plan and State Budget (PESOE) for 2026, along with a package of tax reform legislation on 29 December 2025. Effective from 1 January 2026, the

See MoreUS releases further interim guidance on corporate alternative minimum tax implementation

The Internal Revenue Service (IRS) released Notice 2026-7 on 18 February 2026, setting out further interim guidance on the application of the Corporate Alternative Minimum Tax. The notice is scheduled for publication in the Internal Revenue Bulletin

See MoreBotswana: 2026-27 FY budget proposes increased corporate tax rates, VAT reforms

Botswana’s Ministry of Finance presented its budget proposals for the 2026-2027 Financial Year (FY) to the National Assembly on 9 February 2026 . Amendments include changes to corporate taxation, VAT and personal taxation. The key tax-related

See MoreChile: SII clarifies tax credit claim for foreign taxes paid

Chile's tax authority (SII) issued Letter Ruling No. 286 on 4 February 2026, clarifying the conditions under which taxpayers may claim a credit for foreign taxes paid. The ruling responds to a taxpayer request seeking both a foreign tax credit where

See More