UK: Finance minister plans tax changes to aid small businesses

UK plans tax reforms to boost small business growth. The UK’s finance minister, Rachel Reeves, announced plans to explore reforms to business property taxation on 11 September 2025, aiming to ease expansion for small enterprises and stimulate

See MoreGermany: Federal Cabinet approves bill to encourage private investments

The draft promotes private investment in infrastructure and renewable energies as well as in smaller enterprises and start-ups (venture capital). The German Federal Cabinet approved a draft law on 10 September 2025 to encourage private

See MoreCzech Republic: Chamber of Deputies passes law amending employer reporting and tax regulations, introduces 150% R&D allowance

The bill is now awaiting the president’s signature. The Czech Republic’s Chamber of Deputies (Lower House of Parliament) passed a new law on 10 September 2025, introducing significant changes to employer reporting and tax regulations,

See MoreAustralia: Treasury consults proposed tax concessions for alcohol producers

The deadline for submitting feedback is 22 September 2025. Australia’s Treasury has released draft legislation for consultation on proposed tax relief measures for alcohol producers as part of its 2025–26 Budget commitments. Higher rebate

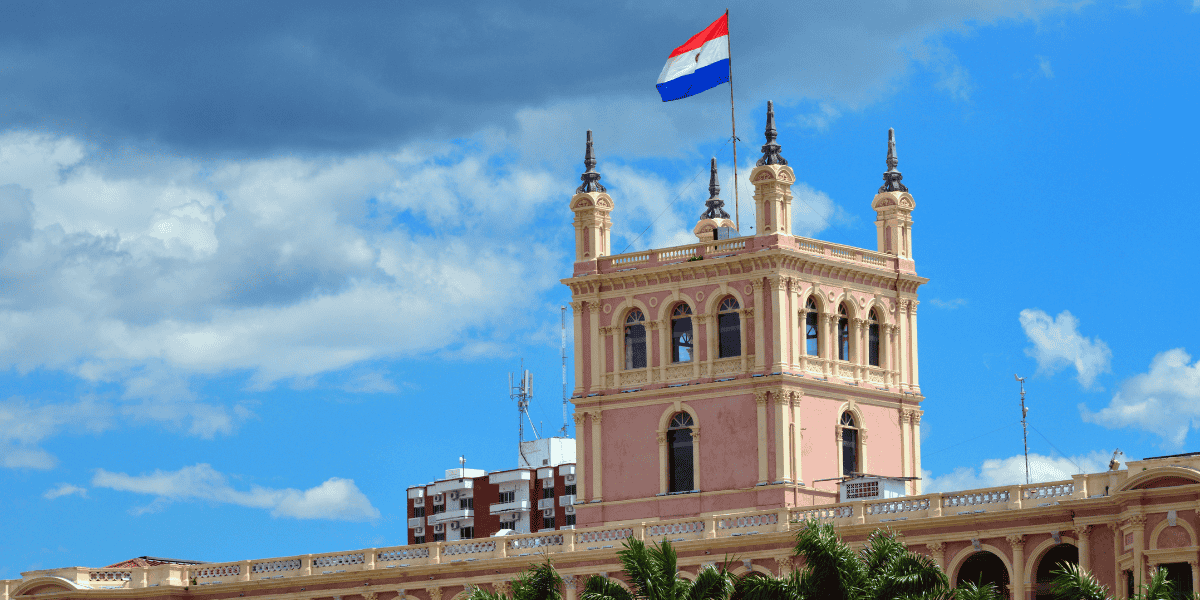

See MoreParaguay unveils new tax incentives for local, foreign investors

Key incentives include exemptions on customs duties, VAT, nonresident income tax, and dividend/profit tax for substantial investments in capital goods, industrial or agricultural production, and large-scale tourism or entertainment projects, subject

See MoreUAE: MoF issues new rules on qualifying and excluded activities in free zones

UAE issues Ministerial Decision No. 229 of 2025 on Free Zone corporate tax activities, effective from 1 June 2023. The UAE Ministry of Finance ( MOF) issued Ministerial Decision No. 229 of 2025 on 28 August 2025, which repeals Ministerial

See MoreUzbekistan: President announces tax incentives for legal firms

From 1 January 2026, legal entities switching from turnover tax to VAT for the first time will receive a 1-year corporate tax exemption, a 1-year waiver of VAT registration penalties, and a six-month deduction on accounting

See MoreUAE: FTA emphasises the need to retain records and documentation to ensure accuracy of tax return information for taxable persons subject to corporate tax

FTA urges all taxable and exempt persons to retain records for seven years and submit corporate tax returns and payments within nine months via the EmaraTax platform. The UAE Federal Tax Authority (FTA) emphasises that all Taxable Persons subject

See MoreNew Zealand introduces 2025–26 tax changes on foreign income, GST, electricity sales

New Zealand introduces 2025–26 tax updates, including foreign investment income, GST, employee share schemes, and new exemptions. New Zealand Inland Revenue announced the introduction of the bill Taxation (Annual Rates for 2025–26, Compliance

See MoreUruguay launches new investment incentives, prioritises R&D+i amongst others projects

Uruguay unveils investment promotion package with tax incentives, streamlined procedures, and support for SMEs, large projects, tech, and housing. The Ministry of Economy and Finance announced on Monday, 18 August 2025 a package of measures aimed

See MoreTurkey issues draft on R&D tax exemptions

Turkey has clarified the new rules for income tax on R&D wage exemptions and related incentives. Turkey released a draft Communiqué on Income Tax on 20 August 2025, clarifying amendments under Law No. 7555 to the Technology Development

See MoreColombia invites applications for R&D&I projects with tax incentives

Colombia’s MinCiencias launches Call 970 for R&D&I projects eligible for 50% tax credits or 30% deductions, with applications open until 10 September 2025. The Colombian Ministry of Science, Technology and Innovation (MinCiencias)

See MoreSouth Africa extends energy efficiency tax incentive to 2030

South Africa extends Section 12L Energy-Efficiency Tax Incentive to 2030, supporting business energy savings and carbon reduction. The South African government announced it has extended the Section 12L Energy-Efficiency Tax Incentive by five

See MoreBrazil unveils Sovereign Plan to shield exports from US tariffs

Brazil’s Sovereign Brazil Plan introduces measures including BRL 30 billion in affordable credit, extended export compliance deadlines, and increased REINTEGRA refund rates to protect exporters, preserve jobs, attract investment, and support

See MoreColombia: Bogota Mayor’s Office proposes major tax reform for 2025

The tax reforms are aimed at modernising the system, boosting investment, and creating jobs. Bogota’s Mayor’s Office, Colombia, submitted Project of Agreement 767 of 2025 to the District Council, proposing a major tax reform designed to

See MoreTaiwan: MoF clarifies recovery of retained earnings tax break for assets disposed of within three years

Taiwan's finance ministry announced that tax incentives on retained earnings invested in qualifying assets will be revoked with interest if the assets are transferred, repurposed, or sold within three years. Taiwan’s Ministry of Finance (MOF)

See MoreIndia: Lower house approves higher standard deductions, pension exemptions, incentives for Saudi investment funds

Lok Sabha approves Taxation Laws (Amendment) Bill 2025, proposing higher standard deductions, pension exemptions, and incentives for Saudi investment funds. The Lok Sabha, India’s Lower House of Parliament approved the Taxation Laws (Amendment)

See MoreItaly introduces conditional IRES rate cut to reward responsible corporate growth

The incentive is available to Italian-resident joint-stock companies, commercial entities, and permanent establishments of non-resident companies, and non-commercial entities on income from commercial activities. Italy’s Ministry of Economy

See More