Brazil: MDIC sets new tax waivers to boost investment in manufacturing, infrastructure

Brazil’s MDIC has set new tax waiver limits and accelerated depreciation rules to incentivise investment in machinery, equipment, and fixed assets across key industries. Regfollower Desk Brazil’s Ministry of Development, Industry, Trade,

See MoreKazakhstan 2026 tax code: A full reset of the country’s approach to corporate taxation

Kazakhstan’s new Tax Code, coming into force on 1 January 2026, is more than a technical rewrite. It’s a full reset of the country’s approach to corporate taxation, profit allocation, and cross-border oversight. Behind the headlines of

See MoreHungary: Parliament reviews Autumn Tax Package measures

Hungary’s draft autumn tax package, presented on 14 October 2025, proposes adjustments across corporate, VAT, insurance, retail, and advertisement taxes—including R&D incentives, global minimum tax compliance, reduced VAT on beef,

See MoreItaly: Council of Ministers approves 2026 draft state budget, multi-year budget for 2026-28

Italy's 2026 draft budget introduces a new three-year tax credit for businesses in SEZs, extends plastic and sugar tax exemptions until 2026, allocates EUR 100 million for SLZs, and refinances the Nuova Sabatini incentive. Italy’s Council of

See MoreTunisia: Government presents 2026 draft finance law, includes measures to support small and medium enterprises

The draft finance law proposes an amount of TND 10 million dedicated to financing the needs of small and medium enterprises. Tunisia’s government has presented the draft Finance Law for 2026 in the Parliament on 14 October 2025. The bill

See MoreGreece: IAPR clarifies tax incentives for corporate reorganisations

IAPR issued Circular E.2088/2025 on 10 October 2025, detailing rules for the new corporate reorganisation tax incentives. Greece’s Independent Authority for Public Revenue (IAPR) has released a Circular E.2088/2025 on 10 October 2025, outlining

See MoreItaly: MoF presents draft budget plan for 2026-28

Italy’s 2026 budget introduces a new three-year tax credit for businesses in SEZs, extends plastic, sugar, and tourist tax exemptions until 2026, allocates EUR 100 million for SLZs, and refinances the Nuova Sabatini incentive. Italy’s

See MoreMalaysia presents 2026 Budget, extends R&D incentives

The 2026 income tax measures introduce new taxes, extended exemptions, and expanded incentives across sectors covering LLP profit distributions, foreign-sourced income, MSME listings, social enterprises, sustainable finance, carbon emissions,

See MoreLuxembourg: MoF presents 2026 state budget to Chamber of Deputies, proposes fiscal measures to bolster innovation-driven investments

The 2026 budget focuses on strengthening its financial centre through tax reforms and tech investments, while expanding incentives and support measures for SMEs and start-ups to boost innovation and entrepreneurship. Luxembourg's Minister of

See MoreUK: HMRC introduces tool to determine qualifying R&D activities for tax relief

The tool is designed to check R&D tax relief for eligible projects. The UK’s HM Revenue and Customs (HMRC) issued guidance on 30 September 2025 introducing an online tool designed to help taxpayers assess whether a project contains

See MoreUS: Treasury, IRS issue guidance on rural opportunity zone investments under the One, Big, Beautiful Bill

The guidance provides clarification on rural Qualified Opportunity Zone investments, which offer tax incentives to encourage economic growth and job creation in underserved areas. The US Department of the Treasury and the Internal Revenue Service

See MoreBrazil: Government introduces tax incentives framework for data centres

The REDATA regime is aimed at encouraging the growth of data centres in Brazil by fostering digital infrastructure development and attracting investments. Brazil’s government published Provisional Measure 1.318/2025 in the Official Gazette on

See MoreTaiwan: MOF issues guidance on R&D investment tax credits eligibility

Companies are encouraged to actively engage in R&D, and the principle should be the establishment of in-house R&D capacity. However, certain outsourced R&D expenses, if necessary and compliant with the regulations, may also qualify for

See MoreDenmark proposes higher tax-exempt payments for neighbours of solar farms

The Ministry of Climate, Energy and Utilities has suggested increasing the tax-exempt compensation for residents living near solar farms. Denmark’s Ministry of Climate, Energy and Utilities has suggested increasing the tax-exempt compensation

See MoreFinland: Government presents 2026 budget to parliament, proposes reduced corporate taxes

The 2026 budget proposal lowers corporate and CO2 fuel taxes while tightening crypto reporting, adjusting VAT, and raising taxes on vehicles, tobacco, alcohol, and soft drinks. Finland’s government has presented the 2026 budget proposal (HE

See MoreHong Kong: Chief Executive delivers 2025 policy address, includes tax incentives for strategic industries, and digital investments

The Hong Kong government plans to introduce legislative changes in early 2026 to enhance preferential tax regimes and attract more funds, family offices, and carried interest, reinforcing its role as a global financial hub. Hong Kong’s Chief

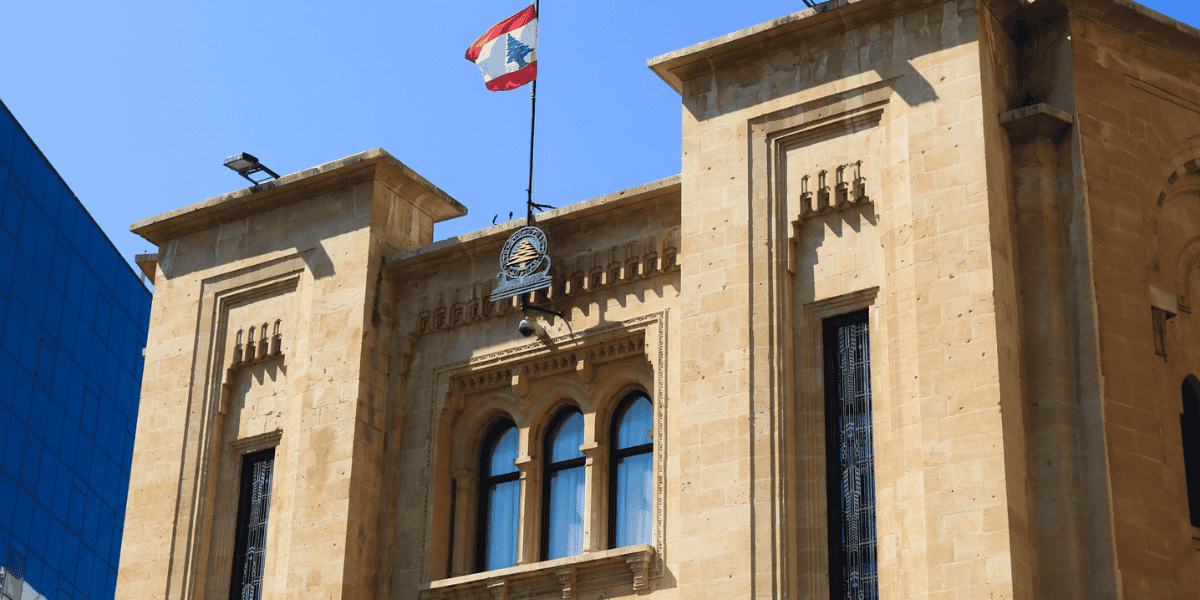

See MoreLebanon: Government tables 2026 budget law draft, introduces amendments to corporate income tax

Lebanon submitted its 2026 Draft Budget Law to the Council of Ministers, proposing wide-ranging reforms across corporate tax, VAT, customs, excise duties, digitalisation, and tax incentives, including stricter deduction rules, and targeted

See MoreAustralia: Treasury consults draft rules for critical minerals production tax incentive

The consultation ends on 10 October 2025. Australia’s Treasury has initiated a public consultation on draft regulations aimed at clarifying elements of the Critical Minerals Production Tax Incentive (CMPTI). The Income Tax Assessment (1997

See More