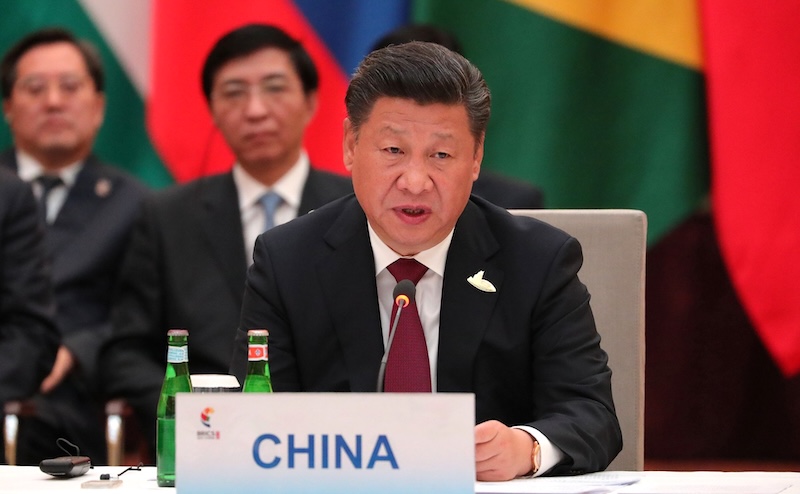

Trade war escalades: China imposes 125% tariffs on US imports

Beijing announced it has increased its tariffs on US imports to 125% earlier today, 11 April 2025. "The US side's imposition of excessively high tariffs on China seriously violates international economic and trade rules, runs counter to basic

See MoreSaudi Arabia: GAZT extends tax penalty relief measures up to December 2023

On 25 July 2023, Saudi Arabia’s Zakat, Tax and Customs Authority (ZATCA) announced the extension of tax penalty relief measures in response to the COVID-19 pandemic. Accordingly, the taxpayers can be exempted from fines and financial penalties for

See MoreSaudi Arabia: GAZT extends tax penalty relief measures up to 31 May 2023

On 30 November 2022, Saudi Arabia’s Zakat, Tax and Customs Authority (ZATCA) announced the extension of tax penalty relief measures in response to the COVID-19 pandemic. Accordingly, the taxpayers can be exempted from fines and financial penalties

See MoreCOVID-19: Tax relief measures around the world

The global outbreak of COVID-19 is significantly affecting businesses, government revenues, and individuals with long-term impacts on domestic and global economies. As a result, many governments around the world have announced fiscal and monetary

See MoreIreland: Revenue updates guidelines for phased payment arrangements (PPA)

On 21 September 2022, the Irish Revenue published an eBrief No. 174/22 on Instalment Arrangements. Accordingly, the Tax and Duty Manual - Guidelines for Phased Payment Arrangements (PPA) - has been updated. This Guideline outlines Revenue’s

See MoreTaiwan: MOF exempts provisional income tax payments from January to June 2022

Recently, the Ministry of Finance of Taiwan provides an exemption on provisional income tax payments for the period January to June 2022. The exemption is provided for provisional income tax returns in September 2022 for companies affected by the

See MoreUS: IRS provides broad-based penalty relief for certain 2019 and 2020 returns

To help struggling taxpayers affected by the COVID-19 pandemic, on 24 August 2022, the Internal Revenue Service issued Notice 2022-36, which provides penalty relief to most people and businesses who file certain 2019 or 2020 returns late. The relief

See MoreNew Zealand extends R&D tax incentive due dates

On 26 Aug 2022, New Zealand’s Inland Revenue (IR) issued research and development (R&D) tax incentive updates due to the ongoing COVID-19 pandemic. The IR provides details on R&D tax incentive extensions, changes to claiming supporting

See MoreOECD: Tax Administration 2022

On 23 June 2022 the OECD’s Forum on Tax Administration (FTA) issued Tax Administration 2022, which is the tenth edition of the report. The report sets out internationally comparative data on various features of tax systems and tax

See MoreTaiwan announces net profit rate reduction for companies affected by COVID-19

On 9 May 2022, the Ministry of Finance of Taiwan has announced that net profit rate is reduced for companies affected by the COVID-19 pandemic. The rate is reduced by 20% for companies which net operating income was reduced of at least 30% in 2021

See MoreTaiwan extends filing deadline for 2021 income tax return to 30 June 2022

On 4 May 2022, Taiwan’s Ministry of Finance (MOF) has extended the deadline for filing income tax return for the tax year 2021 from 31 May 2022 to 30 June 2022 due to the COVID-19 pandemic. The extension is applicable for both personal income tax

See MoreThailand extends transfer pricing disclosure deadline

On 25 March 2022, in response to the COVID-19 pandemic, the Thai Minister of Finance has announced an extension the deadline for filing the transfer pricing disclosure form to 30 May 2022 for the fiscal years starting on or after 1 January 2020 to

See MoreNetherlands: Covid-19 support measures will end in the second quarter of 2022

The Dutch government has published a notice declaring the key support measures implemented and subsequently extended in response to the Covid-19 pandemic will end with effect from 1 April 2022. The measures contain the fixed costs grant scheme

See MoreFrance: Government Officially publishes Finance Act 2022

On 31 December 2021, Government Officially published Finance Law for the year 2022. On 22 September 2021, the Minister of Economy, Finance and Recovery, Bruno Le Maire and the Minister Delegate in charge of Public Accounts, Olivier Dussopt,

See MoreThailand extends certain tax incentives

The government of Thailand has declared that it will extend the period of certain tax incentives for business located in the special economic development zones (SEZs) in Narathiwat province, Pattani province, Yala province, Songkhla province (only

See MoreNigeria: President submits Finance Bill 2022 to Senate

On 7 December 2021, the President, Muhammadu Buhari, transmitted the Finance Bill 2021 through a letter to the Senate for consideration. In the letter, the President explained that the Finance Bill seeks to support the implementation of the 2022

See MoreNetherlands declares tax payment extension and repayments

The Dutch Tax and Customs Administration grants temporary special payment extensions to entrepreneurs, to help them cope with the corona crisis. Taxpayers can apply for a special tax payment extension for most taxes. The extension will be valid

See MoreAustralia extends CbC reporting deadline

On 18 November 2021, the Australian Taxation Office (ATO) announced that country-by-country (CbC) reporting entities that have a CbC reporting obligation due by 31 December 2021 will now have until 4 February 2022 to file (lodge) such CbC reporting

See More