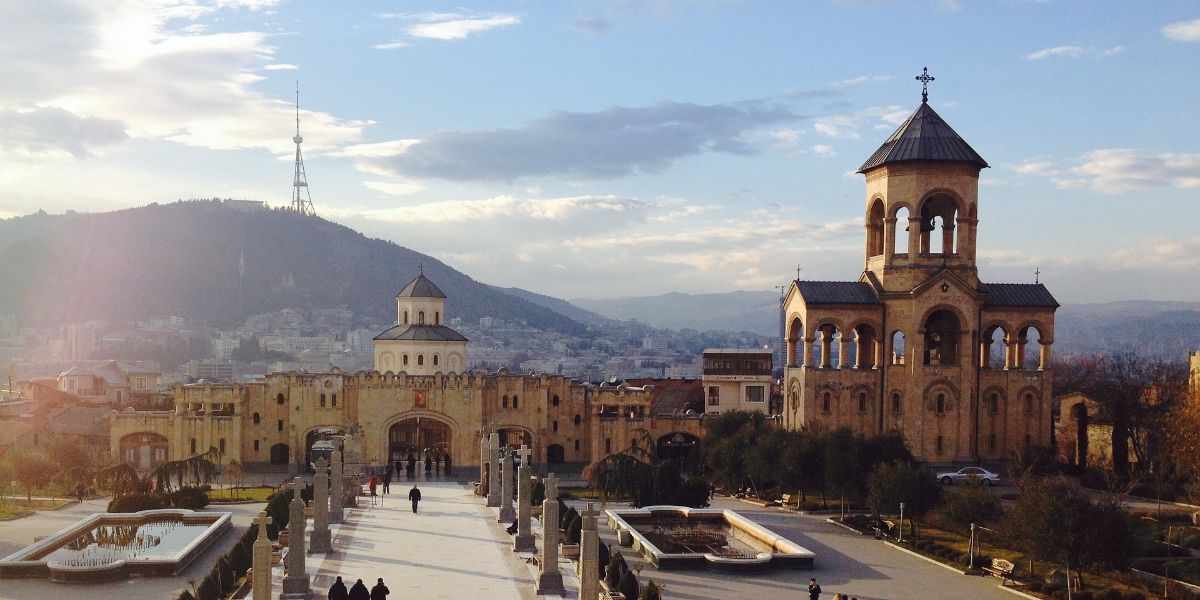

Luxembourg: Council of State approves amending protocol to tax treaty with Georgia

Luxembourg's Council of State approved the amending protocol to the 2007 income and capital tax treaty with Georgia on 20 January 2026. The protocol was signed on 3 July 2025 and it updates provisions related to exchange of information. It

See MoreLuxembourg: Council of State approves amending protocol to tax treaty with San Marino

Luxembourg’s Council of State has approved the ratification of the amending protocol to the 2006 income and capital tax treaty with San Marino on 20 January 2026. The two countries signed an amending protocol to their 2006 tax treaty on 14 May

See MoreJordan ratifies protocol amending 2001 income tax treaty with Kuwait

Jordan issued a royal decree ratifying the protocol amending the 2001 income tax treaty with Kuwait on 22 January 2026. Originally signed on 13 November 2025, the protocol updates taxes covered, adds rules for technical services with 20%

See MoreMalta, Morocco sign protocol updating 2018 income tax treaty

Malta and Morocco signed a protocol on 2 January 2026, amending their 2018 income tax treaty. Deputy Prime Minister Borg and Minister Chiappori signed the update to the Bilateral Agreement on the Avoidance of Double Taxation and the Prevention of

See MoreIndonesia deposits MLI entry-into-force notification for tax treaty with Mongolia

According to an update from the OECD, Indonesia deposited, on 12 January 2026, an updated notification confirming the completion of its internal procedures for the entry into effect of the Multilateral Convention to Implement Tax Treaty Related

See MoreAlbania: Council of Ministers approves protocol to amend 2010 income tax treaty with Germany

The Albanian Council of Ministers has approved a protocol to amend the 2010 income and capital tax treaty with Germany on 30 December 2025. The agreement seeks to prevent double taxation and fiscal evasion between the two nations The

See MoreAmending protocol to tax treaty between Norway, Qatar enters into force

In an update, Norway's government clarified that the protocol amending the 2009 income tax treaty between Norway and Qatar entered into force on 4 September 2025. The amendments modernise the treaty in line with OECD BEPS standards and strengthen

See MoreGermany, Netherlands tax treaty protocol enters into force

The amending protocol to the 2012 tax treaty between Germany and the Netherlands will enter into force on 31 December 2025. The Netherlands and Germany signed the protocol on 14 April 2025. It will take effect starting 1 January 2026. The

See MoreLuxembourg ratifies amending protocol to treaty with Vietnam

Luxembourg has issued the Law of 17 December 2025 in the Official Gazette on 18 December 2025, approving the ratification of protocol to its 1996 income and capital tax treaty with Vietnam. The protocol, signed on 4 May 2023, updates provisions

See MoreCambodia: Senate approves protocol amending tax treaty with Singapore

Cambodia's upper house of Parliament (Senate) approved the protocol to the 2016 income tax treaty with Singapore on 5 December 2025. Signed on 2 November 2023, the protocol will take effect after the exchange of ratification instruments. It

See MoreLuxembourg: Parliament approves tax treaty protocol with Vietnam

The Luxembourg parliament ratified a protocol updating the 1996 income and capital tax treaty with Vietnam on 2 December 2025. The Chamber of Deputies approved the protocol on 20 November 2025, following earlier approval by the Council of State

See MoreCambodia approves tax treaty protocol with Singapore

Cambodia’s National Assembly approved the protocol amending the 2016 income tax treaty with Singapore on 28 November 2025. Originally signed on 2 November 2023, this is the first amendment to the treaty and will take effect after the

See MoreSwitzerland: Federal Council approves amending protocol to tax treaty with Croatia

The Swiss Federal Council confirmed on 26 November 2025 the adoption of the dispatch for the protocol amending the 1999 income and capital tax treaty with Croatia. Signed on 18 July 2025, the protocol makes updates to the OECD Model Double

See MoreSwitzerland: Federal Council adopts protocol to income tax treaty with Belgium

The Swiss Federal Council adopted the dispatch on 26 November 2025 for a protocol to the income tax treaty with Belgium. The protocol implements minimum standards for such treaties, including an abuse clause to prevent arrangements or

See MoreSri Lanka: Cabinet approves signing of amending protocol to tax treaty with Luxembourg

The Sri Lankan Cabinet approved the signing of an amending protocol to the 2013 income and capital tax treaty with Luxembourg on 24 November 2025. The new agreement aims to align with the latest international standards and implement

See MorePeru ratifies 2025 income tax treaty with UK

Peru approved the 2025 Income Tax Treaty with the UK through Supreme Decree No. 051-2025-RE on 20 November 2025, with the ratification published in the Official Gazette on 21 November 2025. The agreement aims to mitigate tax base erosion and

See MoreMauritius revises tax treaty protocols with Oman, Rwanda

The Mauritius Revenue Authority has announced that discussions are in progress to revise the protocols for the 1998 tax treaty with Oman and the 2013 tax treaty with Rwanda. So far Mauritius has concluded 46 tax treaties and is party to a series of

See MoreGeorgia: Parliament ratifies amending protocol to tax treaty with Luxembourg

The Parliament of Georgia approved the ratification of the amending protocol to the 2007 income and capital tax treaty with Luxembourg on 11 November 2025. The protocol was signed on 3 July 2025 and it updates provisions related to exchange of

See More