Belarus: President authorises tax treaty negotiations with Myanmar

The President of Belarus signed a decree approving a draft income tax treaty with Myanmar on 25 November 2025. The draft agreement provides a framework for Belarus to negotiate with Myanmar and includes provisions to eliminate double taxation on

See MoreUAE, Benin income tax treaty enters into force

The UAE Ministry of Finance has announced that the income tax treaty with Benin entered into force on 23 January 2025. Originally signed on 4 March 2013, the agreement applies to personal, corporate, and single trade taxes in Benin, as well as

See MoreSri Lanka: Cabinet approves signing of amending protocol to tax treaty with Luxembourg

The Sri Lankan Cabinet approved the signing of an amending protocol to the 2013 income and capital tax treaty with Luxembourg on 24 November 2025. The new agreement aims to align with the latest international standards and implement

See MoreFrance issues guidance on 2022 tax treaty with Moldova

The French General Directorate of Public Finance issued new guidance on 19 November 2025 regarding the application of the 2022 income tax treaty with Moldova. The guidance provides detailed explanations on several aspects of the treaty, including

See MoreArmenia, Japan tax treaty enters into force

Japan’s Ministry of Foreign Affairs announced on 21 November 2025 that the Armenia–Japan Income Tax Treaty (2024) will enter into force on 20 December 2025, with most of its provisions coming into effect on 1 January 2026. However, the

See MoreCroatia: Parliament approves amending protocol to tax treaty with Switzerland

Croatia’s parliament approved the ratification of the amending protocol to the 1999 income and capital tax treaty with Switzerland on 21 November 2025. Signed on 18 July 2025, the protocol makes updates to the OECD Model Double Taxation

See MoreAustralia, Croatia sign income tax treaty

Australia and Croatia signed a new income tax treaty on 24 November 2025. This agreement aims to eliminate double taxation on income and prevent tax evasion and avoidance between the two countries. The treaty sets dividend withholding tax at

See MoreUAE, China sign MoU on tax cooperation

The UAE’s Federal Tax Authority (FTA) has signed a Memorandum of Understanding (MoU) with the State Taxation Administration of China (STA) to strengthen bilateral cooperation in tax-related matters on 20 November 2025. The MoU was signed by HE

See MoreNetherlands, Thailand sign new income tax treaty

The Netherlands and Thailand signed a new income tax treaty on 21 November 2025 during the 4th EU Indo-Pacific Ministerial Forum (IPMF) in Brussels. The new agreement aims to align with the latest international standards and implement

See MoreEstonia: Government approves draft law to ratify 2025 tax treaty with Andorra

The Estonian government approved a draft law on the ratification of the Income and capital tax treaty 2025 on 20 November 2025. Andorra and Estonia signed an income and capital tax treaty on 23 September 2025. This treaty aims to prevent

See MorePeru ratifies 2025 income tax treaty with UK

Peru approved the 2025 Income Tax Treaty with the UK through Supreme Decree No. 051-2025-RE on 20 November 2025, with the ratification published in the Official Gazette on 21 November 2025. The agreement aims to mitigate tax base erosion and

See MoreMauritius revises tax treaty protocols with Oman, Rwanda

The Mauritius Revenue Authority has announced that discussions are in progress to revise the protocols for the 1998 tax treaty with Oman and the 2013 tax treaty with Rwanda. So far Mauritius has concluded 46 tax treaties and is party to a series of

See MoreCroatia, New Zealand sign income tax treaty

Croatia’s Ministry of Finance announced that Croatia and New Zealand have signed a new income tax treaty on 20 November 2025. The agreement aims to eliminate double taxation and prevent tax evasion between the two countries. The treaty is

See MoreFrance, Moldova tax treaty enters into force

The tax treaty between France and Moldova signed on 15 June 2022, officially entered into force on 23 April 2024. The convention, which includes an annex forming an integral part of the agreement, is designed to eliminate double taxation on

See MoreEstonia ratifies tax treaty with Liechtenstein

Estonia gazetted the law ratifying the income and capital tax treaty with Liechtenstein on 19 November 2025. Signed on 10 July 2025, the agreement seeks to eliminate double taxation and prevent tax evasion. The treaty covers Estonian income tax,

See MoreLiechtenstein: Parliament approves income tax treaty with Montenegro

Liechtenstein’s Parliament (Landtag) confirmed the approval of the income tax treaty with Montenegro on 7 November. Liechtenstein and Montenegro signed an income and capital tax treaty on the sidelines of the 80th session of the UN General

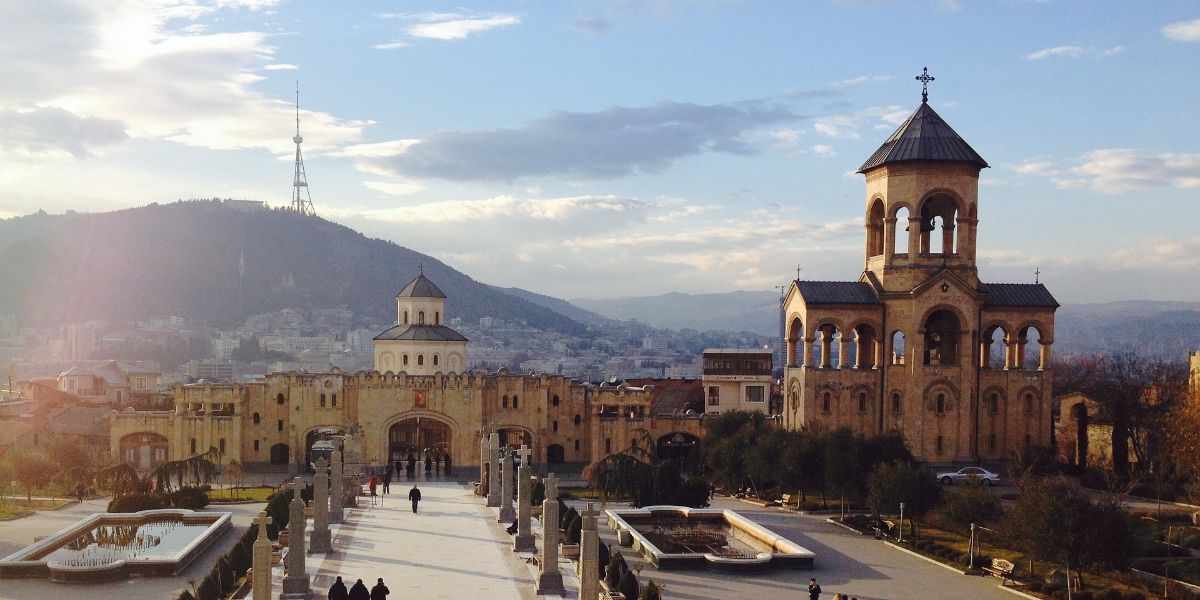

See MoreGeorgia: Parliament ratifies amending protocol to tax treaty with Luxembourg

The Parliament of Georgia approved the ratification of the amending protocol to the 2007 income and capital tax treaty with Luxembourg on 11 November 2025. The protocol was signed on 3 July 2025 and it updates provisions related to exchange of

See MoreHungary, Switzerland: Amending protocol to tax treaty enters into force

The amending protocol the 2012 income and capital tax treaty between Hungary and Switzerland entered into effect on 16 November 2025. The protocol will generally take effect from 1 January 2026 for withholding and other taxes. Changes under

See More