Czech Republic, Iraq to negotiate for tax treaty

The first round of negotiations will be held from 21 - 24 July 2025. Officials from the Czech Republic and Iraq will hold the first round of negotiations for a new income tax treaty from 21 - 24 July 2025. The treaty aims to prevent double

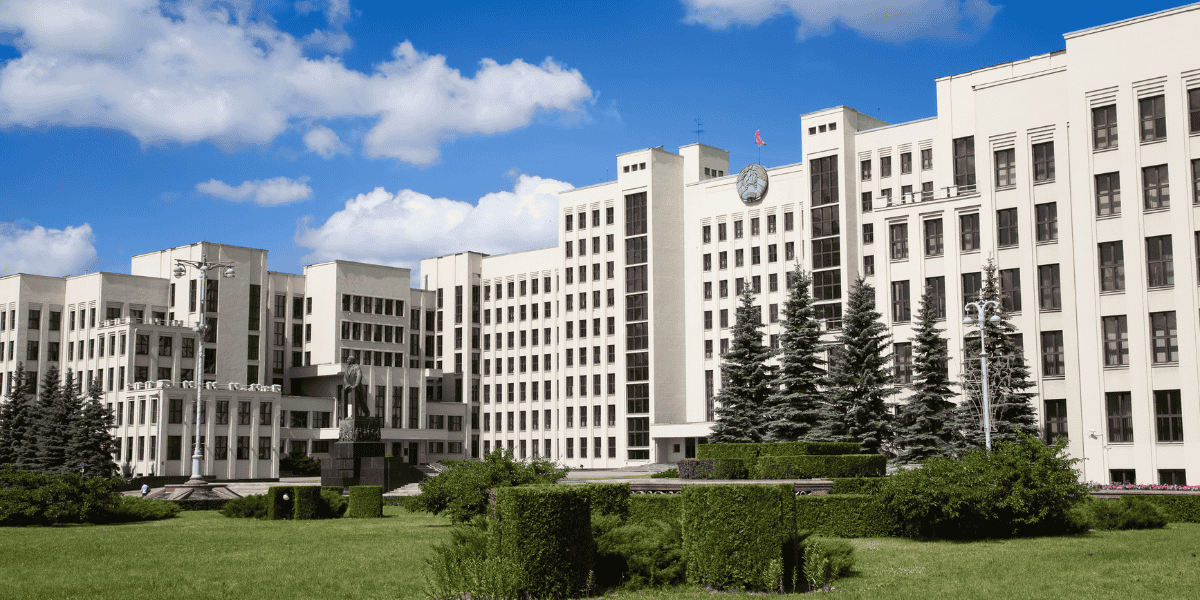

See MoreBelarus, UAE sign free trade in services and investments agreement

The agreement complements the EPA between the Eurasian Economic Union and the UAE, signed on the same day. Belarus and the UAE formalised an agreement in Minsk focusing on free trade in services and investments on 27 June 2025. This agreement

See MoreAndorra: General Council ratifies income tax treaty with UK

Andorra’s parliament has approved the ratification of a new income and capital tax treaty with the UK, set to take effect after ratification is exchanged. The Andorran General Council approved the ratification of the income and capital tax

See MoreFrance: Council of Ministers approves tax treaty protocol with Sweden

The protocol updates the 1990 France–Sweden Income and capital tax treaty with OECD BEPS standards. France’s Council of Ministers approved the amending protocol to the 1990 France–Sweden Income and Capital Tax Treaty on 11 July

See MoreFrance, Uganda begin negotiations on income tax treaty

French and Ugandan officials started negotiations in June 2025 for their first bilateral income tax treaty to prevent double taxation. French and Ugandan officials held the first round of negotiations for an income tax treaty in Kampala, Uganda,

See MoreGermany, Japan formalise tax treaty arbitration rules

The agreement details the procedures for the arbitration of their 2015 tax treaty between the two countries. The German Ministry of Finance released an agreement on 4 June 2025, signed with Japan, detailing the application of arbitration

See MoreKenya, Cyprus negotiating income tax treaty

An income treaty from these negotiations will be the first between Kenya and Cyprus. Kenya’s Ministry of Foreign Affairs announced that officials from Kenya and Cyprus convened on 7 July 2025 to discuss strengthening bilateral relations,

See MoreBrazil: Senate approves tax treaty with Poland

The treaty becomes effective three months after the exchange of ratifications and applies from 1 January of the following year. Brazil's Senate (upper house of the National Congress) approved the ratification of its first income tax treaty with

See MoreFrance: Council of Ministers approves new income tax treaty with Finland

The new treaty will replace the existing 1970 tax agreement between France and Finland. The French Council of Ministers gave approval to the updated income tax agreement with Finland on 11 June 2025. Signed on 4 April 2023, this treaty will

See MoreBelarus, Zimbabwe tax treaty enters into force

The treaty applies from 1 January 2026. The Belarus Ministry of Taxes and Duties announced that the income and capital tax treaty between Belarus and Zimbabwe came into effect on 2 July 2025. Signed on 31 January 2023, this is the first tax

See MoreNetherlands: Tax authority clarifies software distribution payments not royalties under Korea (Rep.) tax treaty

The royalty payments are exempt from withholding tax in Korea (Rep.), granting the Netherlands exclusive taxing rights over the income. The Netherlands tax authority clarified on 10 July 2025 that payments for software distribution licenses by a

See MoreBelarus: Tax ministry sets FATCA filing deadline for 2024

The Belarus Ministry of Taxes announced the 12 August 2025 deadline for 2024 FATCA filings under the Belarus-US Model 1B Agreement. The Belarus Ministry of Taxes and Duties announced on 7 July 2025 that the deadline for FATCA filing under the

See MoreBrazil, Nigeria sign trade and investment framework agreement

The trade and investment framework agreement is aimed to strengthen economic and agricultural cooperation between the two jurisdictions. Brazil and Nigeria signed a Trade and Investment Promotion Framework (TIPF) agreement on 24 June 2025

See MoreChad: Senate approves ratification of income tax treaty with UAE

Chad's upper house of Parliament (Senate) approved the law ratifying the income tax treaty with the UAE on 10 July 2025. Chad and the UAE signed their income tax treaty on 4 September 2018. It will enter into force after the exchange of

See MoreSri Lanka: Cabinet reapproves income tax treaty with Austria

Sri Lanka’s Cabinet has reapproved the signing of its first income tax treaty with Austria, requiring signature and ratification to take effect. Sri Lanka’s Cabinet reapproved the signing of an income tax treaty with Austria on 7 July 2025,

See MoreGeorgia, Luxembourg sign protocol to amend 2007 tax treaty

Georgia and Luxembourg signed their first amending protocol to the 2007 tax treaty on 3 July 2025, with entry into force ratification. Georgia and Luxembourg signed a protocol amending their 2007 income and capital tax treaty on 3 July 2025. This

See MoreNetherlands ratifies tax treaty between Curacao, San Marino

The tax treaty aims to prevent double taxation and curb tax evasion in cross-border transactions between Curacao and San Marino. The Netherlands has published the Law of 2 July 2025 in its Official Gazette on 10 July 2025, ratifying the first

See MoreLiechtenstein, Estonia sign income tax treaty

Liechtenstein and Estonia signed their first income tax treaty on 10 July 2025, exempting withholding tax on dividends, interest, and royalties. Liechtenstein and Estonia signed an income tax treaty on 10 July 2025. The agreement seeks to

See More