Netherlands: Council of Ministers approves tax treaty between Curacao and Suriname

The treaty will be submitted to the Dutch parliament (Staten-Generaal) and the parliament of Curacao for approval. The Netherlands Council of Ministers has approved the 2024 Curacao-Suriname Income and Capital Tax Treaty on 29 August

See MoreNetherlands: Council of Ministers approves tax treaty between Curacao and Cyprus

The treaty seeks to eliminate double taxation and prevent tax evasion in cross-border transactions involving taxpayers from the Netherlands, Curacao, and Cyprus. The Netherlands Council of Ministers approved the first-ever income tax treaty

See MoreLiechtenstein: Government approves tax treaty with Estonia

The agreement will take effect 15 days after the exchange of ratification instruments and will be applicable from 1 January of the following year. The Liechtenstein government approved the ratification of the income and capital tax treaty with

See MoreNigeria, Singapore IPA enters into force

Nigeria and Singapore first signed the IPA in November 2016. The 2016 Nigeria-Singapore Investment Protection Agreement (IPA) entered into force on 22 August 2025. Signed in November 2016, the agreement will remain valid for 10 years and can

See MoreIndia, Belgium amending protocol to tax treaty enters into force

The Protocol expands the existing framework for exchanging tax information, aiming to reduce tax evasion and avoidance between the two countries while also facilitating mutual assistance in tax collection. The amending protocol to the 1993

See MoreJapan, Serbia hold second investment agreement talks

Japan and Serbia held their second round of investment agreement talks via video conference on 27 August 2025 and agreed to continue negotiations toward an early conclusion. The second round of negotiations on the Japan–Serbia investment

See MoreFrance, Peru finalise tax treaty negotiations

Peru’s Ministry of Foreign Affairs announced that France and Peru have completed negotiations on a tax agreement. Peru’s Ministry of Foreign Affairs announced that France and Peru have finalised negotiations on a bilateral tax agreement on

See MoreTanzania, Qatar conclude negotiations for DTA

The talks, hosted by the Tanzanian Embassy and Qatar’s General Tax Authority, aimed to prevent double taxation and strengthen measures against tax avoidance and evasion between the two nations. Tanzania and Qatar completed the third round of

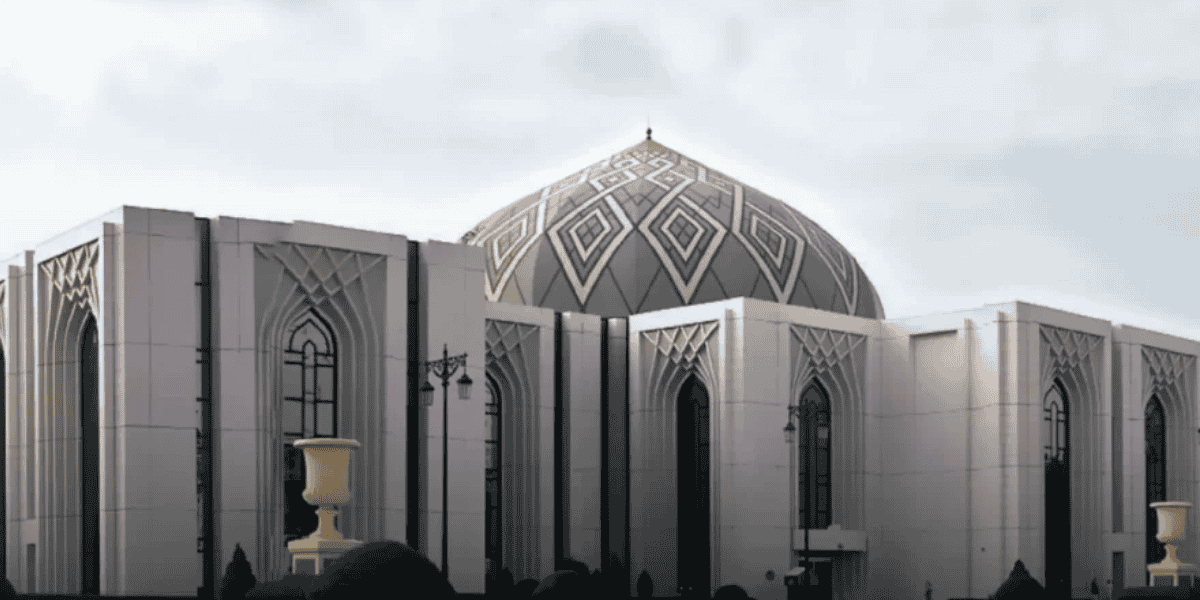

See MoreCyprus, Oman tax treaty enters into force

Cyprus and Oman’s first income tax treaty enters into force, effective 1 January 2026. The income tax treaty between Cyprus and Oman entered into force on 5 March 2025. Signed on 8 December 2024, the agreement is a first between the two

See MoreGreece: Parliament considers ratification of bill to renew tax treaty with UAE

The Greek Parliament is reviewing a draft bill, submitted on 26 August 2025, to ratify the exchange of notes with the UAE concerning the renewed application of the countries’ bilateral tax treaty. The agreement, formalised through an exchange

See MoreBrazil: Senate approves tax treaty with Colombia

The tax treaty will take effect once the ratification instruments are exchanged and will apply from 1 January of the following year. Brazil’s Senate approved the ratification of the income tax treaty with Colombia on 26 August 2025. Signed

See MoreBhutan, Vietnam to negotiate for tax treaty

Bhutan and Vietnam held talks from 18–22 August 2025, expressing interest in negotiating an income tax treaty to boost economic cooperation. Officials from Bhutan and Vietnam met during a state visit from 18-22 August 2025, according to a joint

See MoreBarbados seeks tax and investment deals with India

Barbados plans its first income tax treaty and investment protection agreement with India. Barbados has expressed its interest in negotiating an income tax treaty and an investment protection agreement (IPA) with India. The announcement came

See MoreEstonia: Government approves income tax treaty with Oman

The tax treaty will take effect after ratification instruments are exchanged and apply from 1 January of the following year. Estonia’s government has approved the income tax treaty with Oman on 21 August 2025. Signed on 27 October 2024, the

See MoreTaiwan, Singapore negotiate to update tax treaty

Taiwan and Singapore first signed an income tax treaty in 1981. Taiwan’s Ministry of Foreign Affairs has announced, on 19 August 2025, that negotiations to update the 1982 tax treaty with Singapore are ongoing. Although specific updates

See MoreSaudi Arabia, Syria sign IPA

The agreement seeks to strengthen bilateral cooperation by promoting quality investments and fostering a supportive business environment for the private sector in both countries. Saudi Arabia and Syria signed an investment protection agreement

See MoreMorocco, Kenya continue tax treaty negotiations

Any resulting treaty will be the first of its kind between the two nations, and must be finalised, signed, and ratified before it can take effect. Officials from Morocco and Kenya are continuing negotiations to enhance economic collaboration and

See MoreEcuador, Panama sign TIEA

The agreement takes effect upon the exchange of ratification instruments. Ecuador’s Internal Revenue Service (SRI) announced the signing of a tax information exchange agreement (TIEA) with Panama on 14 August 2025. This is the first

See More