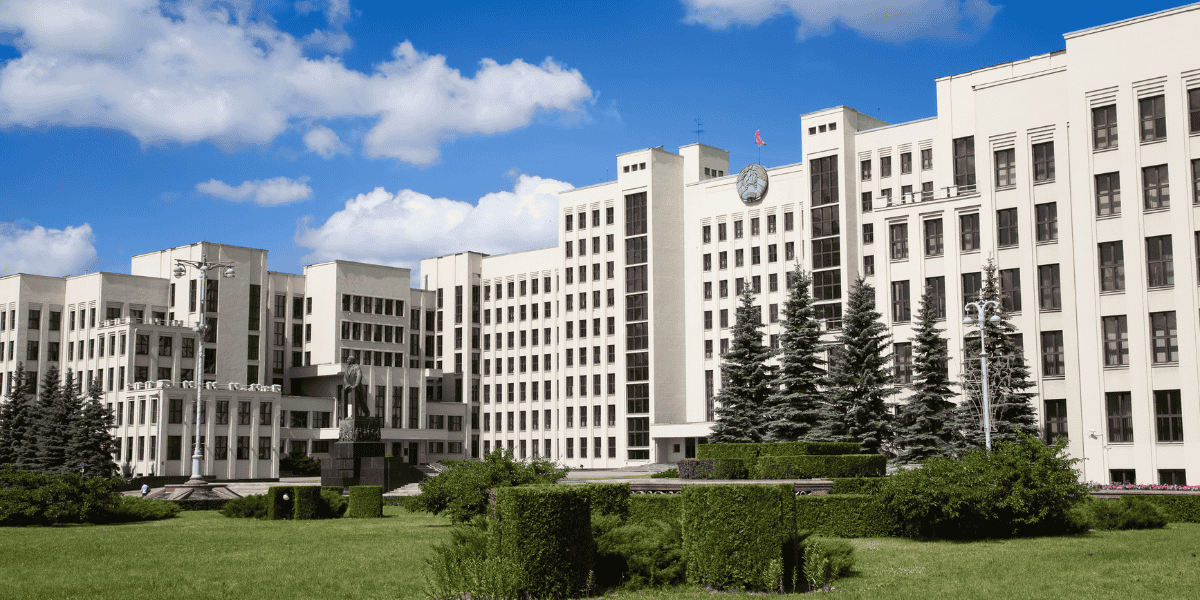

Belarus: Tax ministry sets FATCA filing deadline for 2024

The Belarus Ministry of Taxes announced the 12 August 2025 deadline for 2024 FATCA filings under the Belarus-US Model 1B Agreement. The Belarus Ministry of Taxes and Duties announced on 7 July 2025 that the deadline for FATCA filing under the

See MoreSwitzerland opens consultation on new FATCA agreement to exchange tax data with US

The Swish Federal Council opened a consultation on 7 March 2025 regarding a new FATCA agreement. In the future, Switzerland will no longer only provide financial account information to the US but will also receive information from the US as part of

See MoreUS, Thailand FATCA enters into force

The US Department of the Treasury announced on 6 September 2024 that the Intergovernmental Agreement (IGA) between the US and Thailand for implementing FATCA came into effect on 28 April 2024. However, Thailand is considered to have had the IGA in

See MoreThailand, US sign competent authority arrangement to FATCA agreement

The US Internal Revenue Service (IRS) released the official text of the competent authority arrangement (CAA) that the US government signed with Thailand under the Thailand—United States FATCA Model 1A Agreement (2016) (IGA) to implement the

See MoreArgentina sets reporting deadline for CRS and FATCA

Argentina's tax authority issued General Resolution 5517/2024 on 26 June, 2024, in which it announced the exceptional extension deadline for the 2023 CRS and FATCA reporting. The new deadline is now set for 31 July, 2024. Submissions made

See MoreSwitzerland, US sign new FATCA agreement

The Swiss Federal Council has announced that it signed a new FATCA agreement with the United States at Bern on 27 June, 2024. Switzerland currently provides financial account data to the United States on a unilateral basis. In the future, it will

See MoreUS schedules FATCA IDES testing for July

The FATCA (Foreign Account Tax Compliance Act) International Data Exchange Service (IDES) will undergo its next testing phase, as announced by the IRS yesterday, 13 June 2024. FATCA IDES will be migrating to an updated system and vendor on

See MoreCanada releases revised FATCA and CRS guidance

The Canada Revenue Agency (CRA) revised the guidance under the FATCA and Common Reporting Standard (CRS) regimes on 5 April, 2024. The updated guidance specifies that Canadian financial institutions must obtain the Global Intermediary Identification

See MoreArgentina set to initiate automatic financial data exchange under FATCA with the US

Argentina set to initiate the inaugural automatic exchange of financial information under the Intergovernmental Agreement (IGA) between Argentina and the US for FATCA implementation. The Argentine tax authority (AFIP) in a release announced that

See MoreFinland amends FATCA and CRS annual information returns for 2023

The Finnish Tax Administration issued a newsletter on 15 May, 2024, announcing that financial institutions can submit corrected FATCA and Common Reporting Standard (CRS) annual information returns for 2023. These amendments can be made by

See MoreOECD: AEOI report for 2019

On 24 November 2019 the OECD’s Global Forum released its third annual AEOI implementation report. The Standard on Automatic Exchange of Information (AEOI) outlines the procedure for the automatic exchange of pre-defined financial information

See MoreSingapore changes to FATCA reporting requirements with effect from 1 April 2020

On 10 July 2019, the Inland Revenue Authority of Singapore (IRAS) issued an announcement that, with effect from 1 April 2020, the IRAS will no longer accept FATCA (Foreign Account Tax Compliance Act) notifications submitted via the International

See MoreCyprus: FATCA data submission begins for 2017

The Cyprus Tax Department has notified financial institutions and their representatives that the data submission under the FATCA Intergovernmental Agreement for the year 2016 has started. This process will be performed through the Government Gateway

See MoreSaudi Arabia-Intergovernmental agreement to implement FATCA approved

The cabinet of Saudi Arabia officially approved the Intergovernmental Agreement (IGA) between Saudi Arabia (KSA) and the United States (US) on 6 February 2017. The agreement would improve international tax compliance and implement the Foreign

See MoreUS: FATCA agreement signed with Ukraine

An intergovernmental agreement between Ukraine and the United States was signed on 7 February 2017 to improve international tax compliance with respect to the US Foreign Account Tax Compliance Act (FATCA). The agreement helps to reduce the

See MoreAlgeria ratifies FATCA agreement with United States

Algeria has ratified an intergovernmental agreement signed on October 2015 with the United States by way of Presidential Decree No. 16-328, as published in Official Gazette No. 74 of 18 December 2016. The US-Algeria IGA is based on the

See MoreUS: FATCA agreement signed with Greece

An intergovernmental agreement between Greece and the United States was signed on 19th January 2017 to improve international tax compliance with respect to the US Foreign Account Tax Compliance Act

See MoreUS-Croatia FATCA agreement enters into force

The Foreign Account Tax Compliance Act (FATCA) Agreement between the United States and Croatia entered into force on 27 December 2016. The agreement was signed on 20 March 2015 for implementation of the Foreign Account Tax Compliance Act

See More