Cyprus, Vietnam sign income tax treaty

Cyprus and Vietnam signed an income tax treaty on 15 September 2025. The Agreement aims to strengthen and further develop trade and economic relations between the two countries, ensuring fair treatment while preventing opportunities for tax

See MoreUK issues order to ratify Andorra tax treaty

The UK issued the Double Taxation Relief and International Tax Enforcement (Andorra) Order 2025 on 10 December 2025. This enabled ratification of the income and capital tax treaty with Andorra. Signed on 20 February 2025, the treaty is the first

See MoreAustria: National Council approves tax treaty amendment with Kuwait

Austria’s National Council (Nationalrat) approved the amending protocol to the tax treaty with Kuwait on 10 December 2025. It will take effect on the first day of the third month after the ratification instruments are exchanged and will apply

See MoreItaly, Libya income tax treaty enters into force

The Italy–Libya income tax treaty of 2009 entered into force on 10 December 2025, following the exchange of ratification instruments, as confirmed by a memorandum of understanding signed in Tripoli on the same day. Signed on 10 June 2009, this

See MoreCambodia: Senate approves income tax treaty with Philippines

Cambodia's upper house of Parliament (Senate) approved the income tax treaty with the Philippines on 5 December 2025. The treaty was initially signed on 11 February 2025, during the Cambodian Prime Minister’s visit to the Philippines. The

See MoreBulgaria ratifies new income and capital tax treaty with Malta

Bulgaria issued the decree ratifying its new income and capital tax treaty with Malta on 9 December 2025. The agreement, signed on 10 December 2024, aims to prevent double taxation and curb fiscal evasion in income and capital taxes between

See MoreCambodia: Senate approves protocol amending tax treaty with Singapore

Cambodia's upper house of Parliament (Senate) approved the protocol to the 2016 income tax treaty with Singapore on 5 December 2025. Signed on 2 November 2023, the protocol will take effect after the exchange of ratification instruments. It

See MoreChile: SII publishes circular on MFN clause activation in tax treaties with five countries

Chile’s tax authority (SII) issued Circular No. 65 on 3 December 2025, addressing the activation of Most-Favoured-Nation (MFN) clauses in Chile’s tax treaties with Belgium, New Zealand, Norway, Switzerland, and Uruguay. These clauses are

See MoreQatar, Uruguay sign income tax treaty

Qatar's General Tax Authority (GTA) announced, on 7 December 2025, that Qatar and Uruguay signed an income tax treaty. The agreement was signed by HE Ali bin Ahmed Al Kuwari, Minister of Finance of the State of Qatar, and HE Mario Lopetegui,

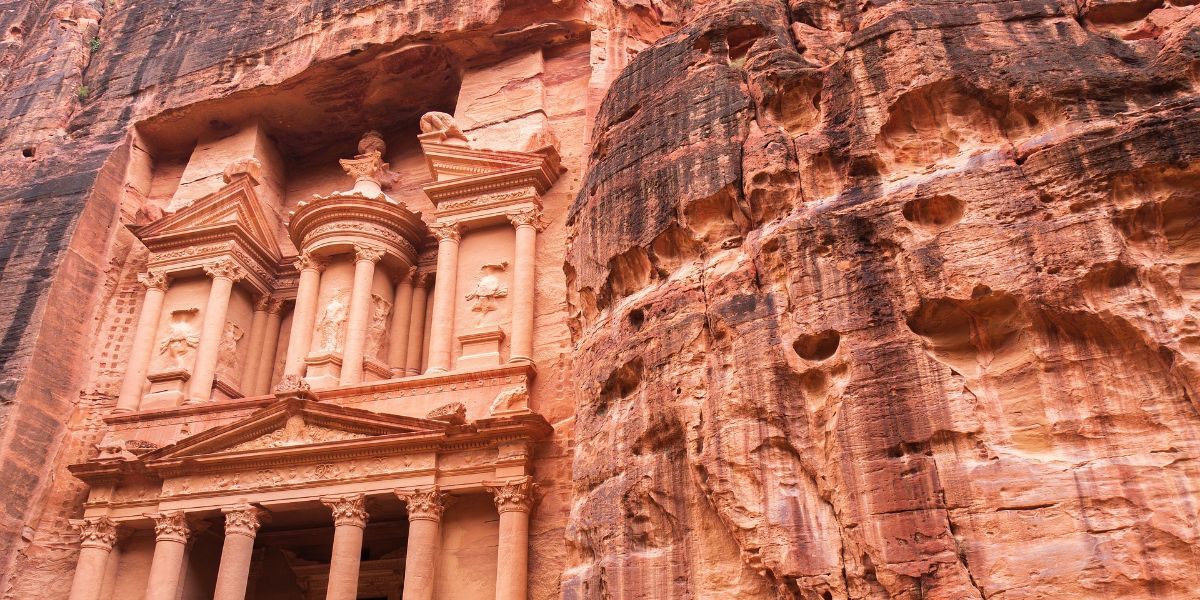

See MoreJordan, Switzerland income tax treaty enters into force

The income tax treaty between Jordan, Switzerland entered into force on 4 December 2025. Signed on 13 December 2023, the agreement aims to prevent double taxation on income and curb tax evasion between Jordan and Switzerland. It applies to

See MoreKenya: National Assembly ratifies income tax treaty with Singapore

Kenya’s National Assembly approved the ratification of a new income tax treaty with Singapore on 3 December 2025. This agreement, signed on 23 September 2024, replaces the 2018 treaty, which never came into effect. The tax treaty aims to

See MoreMalaysia, Russia income tax treaty enters into force

The new income tax treaty between Malaysia and Russia entered into force on 3 September 2025. The agreement covers Malaysian income tax and petroleum income tax, as well as Russian corporate profit and individual income taxes. Withholding tax

See MoreMontenegro: Government approves tax treaty with Liechtenstein

Montenegro’s government approved the draft law to ratify the income and capital tax treaty with Liechtenstein on 4 December 2025. Liechtenstein and Montenegro signed an income and capital tax treaty on the sidelines of the 80th session of the

See MoreBahrain, Saudi Arabia sign income tax treaty

Bahrain and Saudi Arabia signed a tax treaty on 3 December 2025. The agreement aims to address double taxation and promote investment. The treaty is the first of its kind between the two countries and will enter into force upon the exchange of

See MoreLuxembourg: Parliament approves tax treaty protocol with Vietnam

The Luxembourg parliament ratified a protocol updating the 1996 income and capital tax treaty with Vietnam on 2 December 2025. The Chamber of Deputies approved the protocol on 20 November 2025, following earlier approval by the Council of State

See MoreCambodia: National Assembly approve income tax treaty with Laos

Cambodia's National Assembly approved the income tax treaty with Laos on 28 November 2025. The two countries had signed the agreement on 4 December 2024, during the visit of the Laotian Prime Minister to Cambodia. According to the National

See MoreCambodia approves tax treaty protocol with Singapore

Cambodia’s National Assembly approved the protocol amending the 2016 income tax treaty with Singapore on 28 November 2025. Originally signed on 2 November 2023, this is the first amendment to the treaty and will take effect after the

See MoreVietnam, South Africa move toward income tax treaty

Vietnam’s Ministry of Foreign Affairs has reported that representatives from Vietnam and South Africa met on 21 November 2025, during which both sides agreed to deepen bilateral cooperation and to pursue negotiations on an income tax

See More