Vietnam considers revising tax treaty and IPA with Switzerland

Vietnam seeks to revise its 1996 tax treaty and investment pact with Switzerland to reflect recent changes and boost bilateral economic ties. Vietnam expressed interest in revising the Switzerland–Vietnam Income and Capital Tax Treaty (1996)

See MoreHong Kong, Cameroon to start first round of tax treaty negotiations

Hong Kong and Cameroon will hold their first tax agreement negotiations from 11 to 15 August 2025. As per the Hong Kong Inland Revenue Department’s update on 4 August 2025, the initial negotiations for a tax agreement between Hong Kong and

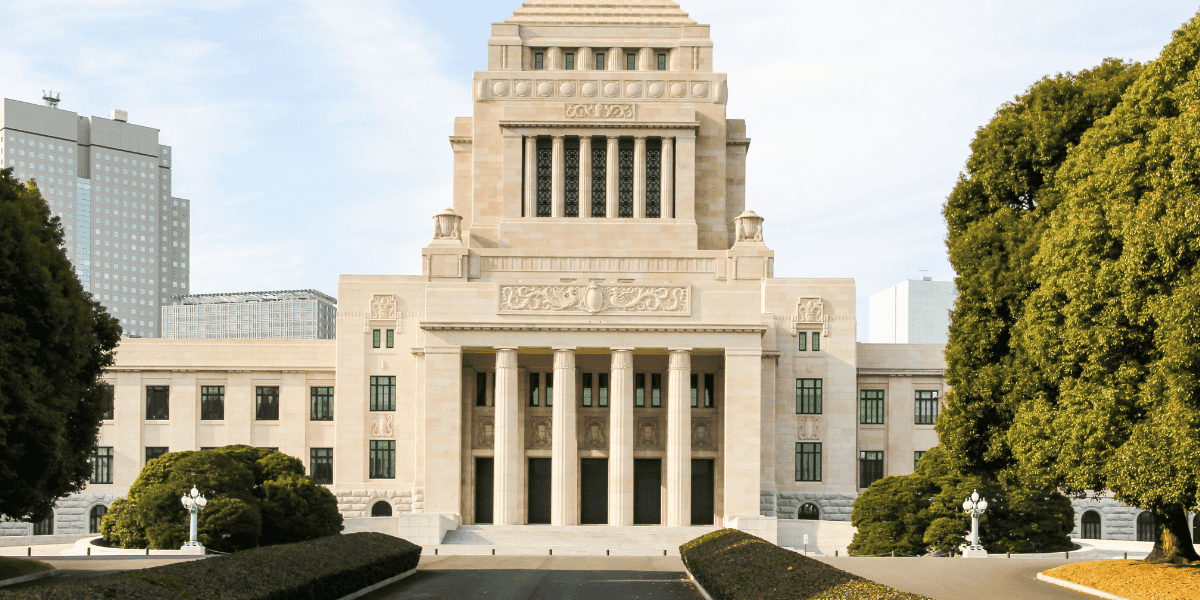

See MoreJapan, Ukraine tax treaty enters into force

The new tax treaty replaces the 1986 tax treaty between Japan and Ukraine. Japan’s Ministry of Finance announced on 2 July 2025 that the new income tax treaty between Japan and Ukraine entered into force on 1 August 2025. The new treaty,

See MoreAmending protocol France, Switzerland tax treaty enters into force

The amending protocol to the 1966 France–Switzerland tax treaty, has entered into force on 24 July 2025. The agreement is designed to prevent double taxation and prevent tax evasion between the two nations. Earlier, France published Law No.

See MoreAlbania: Council of Ministers approve income tax treaty with Denmark

The agreement aims to enhance economic cooperation and combat tax evasion. The Albanian Council of Ministers approved an income tax treaty with Denmark on 23 July 2025. This announcement was made by the Albanian Telegraphic Agency (ATA) on the

See MoreAmending protocol to Serbia, Switzerland tax treaty enters into force

The protocol, signed on 19 September 2023, will generally take effect from 1 January 2026 and relates to withholding and other taxes. The amending protocol to the 2005 income and capital tax treaty with the former Serbia-Montenegro and

See MoreBelgium, Switzerland sign amending protocol to tax treaty

The tax treaty between the two jurisdictions was last amended in 2014. Belgium and Switzerland signed a protocol in Brussels to update their 1978 income and capital tax treaty on 16 July 2025. The protocol aligns the agreement with current

See MoreRussia, UAE tax treaty enters into force

The 2025 income and capital tax treaty between Russia and the UAE took effect on 18 July 2025, which replaces the 2011 limited tax treaty. The 2025 Russia–UAE income and capital tax treaty entered into force on 18 July 2025. The new

See MoreCroatia, Liechtenstein tax treaty enters into force

The treaty takes effect from 1 January 2026. Liechtenstein has published the income and capital tax treaty with Croatia in the Official Gazette on 18 July 2025, which includes the notice that the treaty entered into force on 26 July

See MoreSlovenia ratifies 2024 tax treaty with New Zealand

Slovenia finalises ratification of its 2024 income tax treaty with New Zealand. The President of Slovenia signed legislation ratifying the 2024 income tax treaty between Slovenia and New Zealand on 16 July 2025. The ratified law was published

See MoreOman, Philippines move forward to finalise tax treaty

Oman and the Philippines advanced tax treaty talks and signed a visa waiver on 14 July 2025. Officials from Oman and the Philippines met in Manila to advance negotiations on a tax treaty and an investment protection agreement (IPA) between the

See MoreBrazil: National Congress approves tax treaty with Poland

The treaty will take effect three months after the exchange of ratification instruments and will apply starting 1 January of the following year. Brazil's National Congress has issued Legislative Decree No. 186 of 2025, approving the income tax

See MoreLuxembourg, Moldova amending protocol to tax treaty enters into force

The protocol aligns the agreement with OECD and BEPS standards. Moldova's State Tax Service announced that the amending protocol to the 2007 income and capital tax treaty with Luxembourg has entered into force on 14 July 2025. The protocol

See MoreMontenegro: Government authorises signing of tax treaty with Iceland

The treaty will enter into force after the exchange of ratification instruments. The government of Montegnero has authorised the Ministry of Foreign Affairs to sign the tax treaty with Iceland. The decision was announced in a report on the

See MoreRwanda: Government approves tax treaty with Nigeria

The agreement will enter into force after the exchange of ratification instruments. The government of Rwanda approved the ratification of the income tax treaty with Nigeria on 16 July 2025. Earlier, on 27 June 2025, Nigeria’s Federal

See MoreCroatia, Switzerland sign amending protocol to tax treaty

Croatia and Switzerland signed a protocol on July 18, 2025, amending their 1999 tax treaty to align with international and BEPS standards. Croatia and Switzerland signed an amending protocol to their 1999 income and capital tax treaty on 18

See MoreCzech Republic, Iraq to negotiate for tax treaty

The first round of negotiations will be held from 21 - 24 July 2025. Officials from the Czech Republic and Iraq will hold the first round of negotiations for a new income tax treaty from 21 - 24 July 2025. The treaty aims to prevent double

See MoreAndorra: General Council ratifies income tax treaty with UK

Andorra’s parliament has approved the ratification of a new income and capital tax treaty with the UK, set to take effect after ratification is exchanged. The Andorran General Council approved the ratification of the income and capital tax

See More