Sri Lanka to sign first income tax treaty with Austria

At a press briefing on Cabinet decisions from 2 September 2024, Sri Lanka's Cabinet announced its approval for signing an income tax treaty with Austria. According to the convention, Sri Lanka will be taxed at a rate not exceeding 10% of the

See MoreCzech Republic approves tax treaty with Tanzania

The Czech government has authorised the signing of an income tax treaty with Tanzania on 21 August 2024. This income tax treaty aims to eliminate double taxation concerning taxes on income or concerning taxes on income and capital in force

See MoreSwitzerland approves tax treaty with Jordan

During a meeting, the Swiss Federal Council approved a double taxation agreement (DTA) with Jordan on 21 August 2024. The agreement will create legal certainty and favourable conditions for the further development of bilateral economic relations

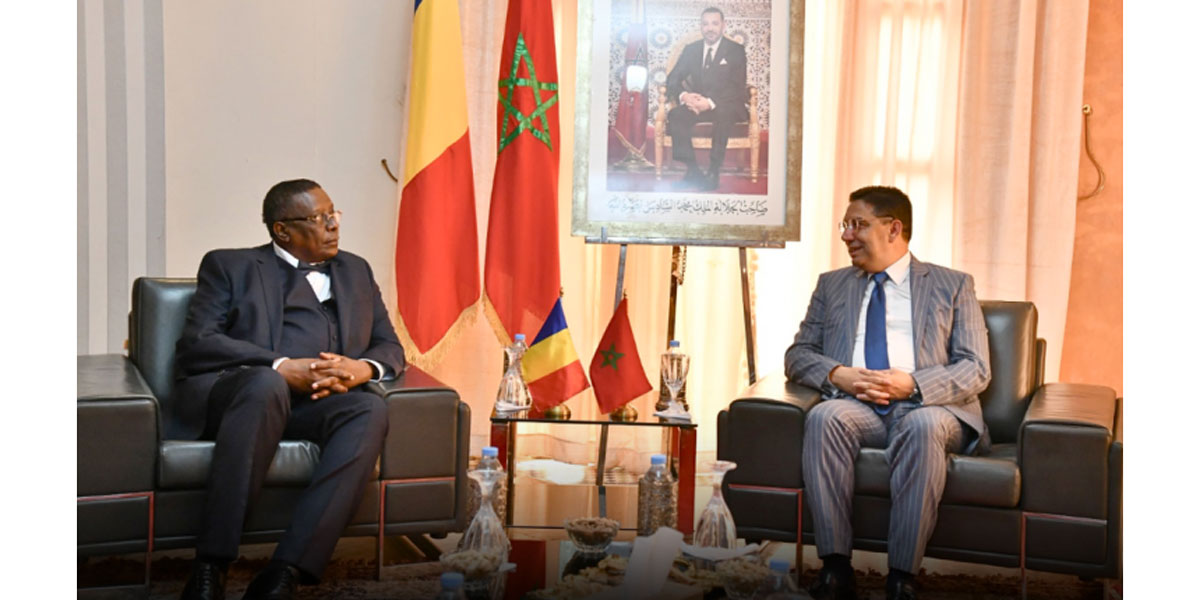

See MoreMorocco, Chad sign income tax treaty

Morocco and Chad have signed an income tax treaty on 14 August, 2024. This agreement is the first between the two nations. The tax treaty was signed by Minister of Foreign Affairs, African Cooperation and Moroccan Expatriates, Nasser Bourita, and

See MoreAndorra, Latvia approve signing of tax treaty

The Executive Council of the Principality of Andorra has approved signing an income tax treaty with Latvia following the conclusion of negotiations in January 2024. The tax treaty, the first between the two nations, aims to establish a convention

See MoreAndorra ratifies tax treaty with South Korea

The Principality of Andorra has announced the ratification of the income tax treaty with South Korea, the notice was published in the Official Gazette on 6 August 2024. The agreement aims to eliminate double taxation involving income taxes and

See MoreNew Zealand ratifies pending tax treaty with Slovak Republic

New Zealand published the Double Tax Agreements (Slovak Republic) Order 2024 on 29 July, 2024. The order, which comes into force on 29 August 2024, gives effect to the agreement between New Zealand and the Slovak Republic for the elimination of

See MoreNetherlands ratifies pending Curacao-Malta tax treaty

The Netherlands published the Law of 27 July 2024 in the official gazette, on 25 July 2024, ratifying the pending income tax treaty between Curaçao and Malta. The treaty aims to prevent double taxation and eliminate fiscal evasion regarding income

See MoreNetherlands: Curaçao, Suriname sign tax treaty

The Netherlands announced in the Official Gazette on 25 July, 2024, that it signed a tax treaty to prevent double taxation between Curaçao and Suriname. As a constituent country of the Kingdom of the Netherlands, Curaçao can negotiate bilateral

See MoreAzerbaijan publishes law on ratification of pending tax treaty with Kyrgyzstan

Azerbaijan published the law – titled, “Law of the Republic of Azerbaijan on approval of the ‘Agreement between the Republic of Azerbaijan and the Kyrgyz Republic on the elimination of double taxation and prevention of tax evasion with respect

See MoreEgypt approves tax treaty with Oman

The Egyptian Cabinet approved the ratification of the income tax treaty with Oman on 9 July 2024. Signed on 22 May 2023, the treaty specifies that dividends, royalties, and fees for technical services are liable to a maximum withholding tax rate

See MorePanama regulates mutual agreement procedures for double tax treaties

Panama’s tax authority (Dirección General de Ingresos, DGI) published Resolution 201-3777 of 7 June 2024 in the Official Gazette on 24 June 2024. This Resolution sets forth procedural guidelines for taxpayers to access the Mutual Agreement

See MoreNetherlands, Kyrgyzstan ratify pending tax treaty

Kyrgyzstan announced that it ratified the pending income tax treaty with the Netherlands on 28 June, 2024. The new tax treaty, which will be the first between the Netherlands and Kyrgyzstan, aims to eliminate double taxation on income and prevent

See MoreFrance approves pending tax treaty protocol with Switzerland

The French Council of Ministers approved the pending protocol with Switzerland, amending the 1966 income and capital tax treaty, on 26 June 2024. Previously, the Swiss Council of States (the upper house of parliament) announced that it ratified

See MoreFinland approves new tax treaty with France

Finland’s President Alexander Stubb ratified the new income tax treaty with France by signing it into law on 28 June, 2024. This treaty, which was signed on 4 April 2023, will replace the existing 1970 tax agreement between the two nations. The

See MoreSwitzerland ratifies tax treaty protocol with Slovenia

Switzerland has announced its decision to ratify the pending protocol to the 1996 income and capital tax treaty with Slovenia, published in the Official Gazette on 25 June, 2024. Signed on 30 May 2023, this protocol marks the second amendment to

See MoreAzerbaijan ratifies tax treaty with Kyrgyzstan

Azerbaijan's National Assembly (Milli Mejlis) ratified the pending income tax treaty with Kyrgyzstan on Friday, 28 June 2024. The income tax agreement is expected to eliminate double taxation on income and prevent tax evasion between the two

See MoreSaudi Arabia, Slovak Republic: Tax treaty comes into effect

The Saudi Arabia - Slovak Republic Income Tax Treaty (2023) will become effective starting 1 August, 2024, with provisions generally applying from 1 January, 2025, concerning withholding and other taxes. The treaty was initially signed on 13

See More