Japan, Paraguay sign investment protection agreement

Japan’s Ministry of Foreign Affairs announced, on 6 December 2025, that Japan and Paraguay signed the “Agreement for the Promotion and Protection of Investment” on 5 December 2025. The agreement is designed to strengthen investment

See MoreEthiopia, Germany sign new development cooperation treaty

Ethiopia and Germany concluded high-level development cooperation talks in Berlin, signing a new treaty confirming continued German support for Ethiopia’s reform agenda. Germany committed EUR 106 million in bilateral sectoral funding, plus an

See MoreIsrael, India sign bilateral investment agreement

This is India's first-ever investment agreement with Israel. Israel and India have signed a new bilateral investment agreement aimed at bolstering economic ties and encouraging mutual investments. The agreement, signed in New Delhi by Israel's

See MoreIran, Oman sign IPA

The IPA agreement aims to lower investment risks between the two countries. Iran and Oman signed an Investment Protection Agreement (IPA) on 27 May 2025. IPAs aim to have the participating national governments commit to lowering investment

See MoreKorea (Rep.), Bangladesh begin CEPA negotiations

Korea (Rep.) and Bangladesh began CEPA talks in Seoul to strengthen trade and economic ties. Korea (Rep.) and Bangladesh began official talks in Seoul from 25 to 27 August 2025, to negotiate a Comprehensive Economic Partnership Agreement

See MoreNigeria, Singapore IPA enters into force

Nigeria and Singapore first signed the IPA in November 2016. The 2016 Nigeria-Singapore Investment Protection Agreement (IPA) entered into force on 22 August 2025. Signed in November 2016, the agreement will remain valid for 10 years and can

See MoreJapan, Serbia hold second investment agreement talks

Japan and Serbia held their second round of investment agreement talks via video conference on 27 August 2025 and agreed to continue negotiations toward an early conclusion. The second round of negotiations on the Japan–Serbia investment

See MoreBarbados seeks tax and investment deals with India

Barbados plans its first income tax treaty and investment protection agreement with India. Barbados has expressed its interest in negotiating an income tax treaty and an investment protection agreement (IPA) with India. The announcement came

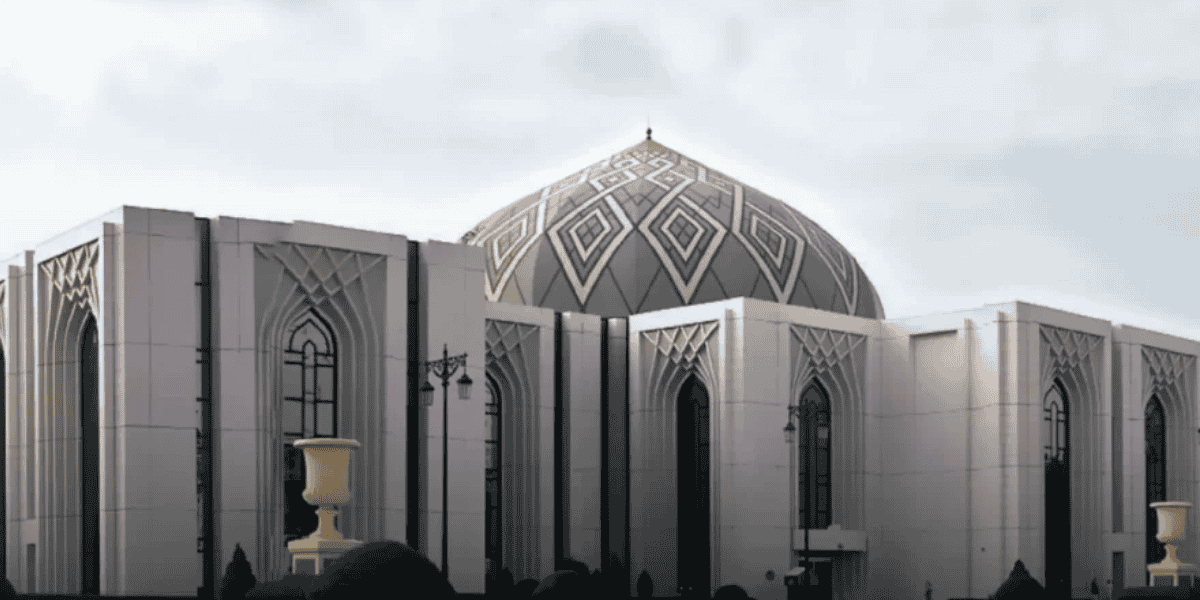

See MoreSaudi Arabia, Syria sign IPA

The agreement seeks to strengthen bilateral cooperation by promoting quality investments and fostering a supportive business environment for the private sector in both countries. Saudi Arabia and Syria signed an investment protection agreement

See MoreBrazil, Nigeria sign trade and investment framework agreement

The trade and investment framework agreement is aimed to strengthen economic and agricultural cooperation between the two jurisdictions. Brazil and Nigeria signed a Trade and Investment Promotion Framework (TIPF) agreement on 24 June 2025

See MoreItaly, Uzbekistan sign investment protection agreement

Italy and Uzbekistan signed an investment protection agreement (IPA) on 29 May 2025. Italy and Uzbekistan signed an investment protection agreement (IPA) on 29 May 2025. The agreement aims to support Uzbekistan in improving its legal

See MoreItaly, Kyrgyzstan sign investment protection agreement

Italy and Kyrgyzstan signed an investment protection agreement (IPA) on 30 May 2025. Italy and Kyrgyzstan signed an investment protection agreement (IPA) on 30 May 2025. The IPA between Italy and Kyrgyzstan aims to promote and protect

See MoreSwitzerland, Sweden sign a mutual agreement on arbitration

Switzerland and Sweden have agreed on procedures for resolving tax disputes through arbitration if unresolved after four years. The Swiss Federal Tax Administration (FTA) announced on 22 May 2025 that it had signed a mutual agreement with Sweden

See MoreEU: European Council adopts UN convention on transparency for dispute settlement

The decision will increase public access to documents and hearings and include civil society in investor-state disputes under investment treaties. The Council of the European Union adopted a decision on the conclusion of the United Nations

See MoreEU, Singapore sign landmark digital trade agreement

The European Union ( EU) and Singapore have taken a significant step forward in their bilateral trade relations with the signing of a landmark Digital Trade Agreement (DTA). Signed by Commissioner for Trade and Economic Security Maroš Šefčovič

See MoreBahrain, UAE investment agreement now in effect

The Investment Promotion and Protection Agreement ( IPA) between the UAE and Bahrain became effective on 8 May 2025, after completing the required legal procedures. The agreement establishes a legal framework that protects investments, boosts

See MoreChina and Russia sign IPA

China and Russia signed an investment protection agreement (IPA) in Moscow on 8 May 2025. Investment Promotion Agreements (IPAs) are designed to protect investors by requiring national governments to minimize risks such as currency controls,

See MoreBahrain ratifies IPA with Hungary

Bahrain has completed the ratification of the Bahrain-Hungary Investment Protection Agreement (2024) through Law No. 19 of 2025, effective as of 23 April 2025. Investment Promotion Agreements (IPAs) commit national governments to reduce

See More