August 27, 2025

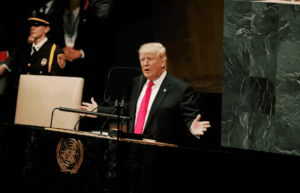

US to impose extra 25% tariffs on Indian imports from 27 August 2025, raising total duties to 50%. The US’ ...

August 27, 2025

The new rules are scheduled to take effect on 1 January 2026. Under the New Tax Code of Kazakhstan, foreign...

August 27, 2025

The new Resolution modifies the reporting requirements for the Mining Annex (“Anexo Minero”) established by Resolution No. NAC-DGERCGC25-00000004 of 20...

August 27, 2025

This extension applies to the filing of affidavits for refunds of advance payments of the Impuesto Para una Argentina Inclusiva...

August 26, 2025

Bhutan and Vietnam held talks from 18–22 August 2025, expressing interest in negotiating an income tax treaty to boost economic...

August 26, 2025

Ecuador’s SRI updates tax haven list, removing Panama effective 18 August 2025. The Ecuadorian Internal Revenue Service (SRI) has issued...

August 26, 2025

Botswana introduces VAT amendment bill to tax digital services, apply reverse charge, and modernise compliance. The Government of Botswana has...

August 26, 2025

The government invites all interested Canadians and stakeholders to provide feedback on these draft legislative proposals by emailing their comments...

August 26, 2025

Danish companies must submit comprehensive transfer pricing documentation, including master and local files and intercompany agreements, within 60 days of...

August 26, 2025

Germany has issued the official XML data set and schema for filing minimum tax reports under Pillar Two from fiscal...

August 25, 2025

Turkey has set standard construction costs to calculate real estate tax for 2026. Turkey has published General Communiqué No. 87...

August 25, 2025

Turkey has clarified the new rules for income tax on R&D wage exemptions and related incentives. Turkey released a draft...

August 25, 2025

India’s Foreign Minister says trade talks with the US are continuing, but New Delhi will defend key “redlines” as additional...

August 25, 2025

The proposed tax incentives and special rules aim to boost Chile’s green hydrogen industry and strengthen its global leadership in...

August 25, 2025

FBR issues electronic income tax return forms for the 2025 tax year with filing deadlines set for individuals and companies....

August 25, 2025

This month, companies will receive a notification with the tax information proposed for publication. The communication will also outline steps...

August 25, 2025

Turkey has initiated a public consultation on the scope and application of the reduced corporate income tax regime for investments...

August 22, 2025

Barbados plans its first income tax treaty and investment protection agreement with India. Barbados has expressed its interest in negotiating...