January 23, 2026

The South African Revenue Service (SARS) has released updated guidance on turnover tax for micro businesses, aimed at helping small...

January 23, 2026

Japan and the UAE concluded the seventh round of negotiations for their Economic Partnership Agreement (EPA) in Tokyo, held from...

January 23, 2026

Estonia’s parliament approved the Act to ratify the income and capital tax treaty with Andorra on 21 January 2026. Andorra...

January 23, 2026

Slovenia has signed the Multilateral Competent Authority Agreement on the Exchange of GloBE Information (GIR MCAA) on 22 December 2025,...

January 23, 2026

The Inland Revenue Authority of Singapore (IRAS) has issued Advance Ruling Summary No. 1/2026 on 2 January 2026, clarifying how...

January 23, 2026

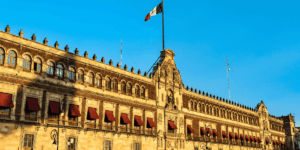

The Tax Administration Service (SAT) of Mexico has announced on 22 January 2026 the implementation of the Fiscal Regularisation Programme...

January 23, 2026

Taiwan’s Datun Office, National Taxation Bureau of the Central Area, Ministry of Finance, stated, on 23 January 2026, that in...

January 23, 2026

Mexico’s Tax Administration Service (SAT) has confirmed, on 20 January 2026, that the Proof of Tax Status (Constancia de Situación...

January 22, 2026

Turkey’s Ministry of Treasury and Finance has increased the limits for cash refund claims related to withholding tax (WHT). For...

January 22, 2026

Turkey’s Revenue Administration has set the asset revaluation rate for the fourth interim tax period of 2025 at 25.49%. The...

January 22, 2026

Luxembourg has gazetted the municipal rate multipliers for commercial and property taxes for the 2026 tax year. The published tables...

January 22, 2026

Switzerland has updated its list of jurisdictions for the automatic exchange of Country-by-Country (CbC) reports under the Multilateral Competent Authority...

January 22, 2026

Taiwan’s Northern National Taxation Bureau of the Ministry of Finance has reminded profit-seeking enterprises that when calculating Controlled Foreign Corporation...

January 22, 2026

The UK tax authority, His Majesty’s Revenue and Customs (HMRC) has updated its International Manual, providing revised guidance on key...

January 22, 2026

Mexico’s tax administration, the Servicio de Administración Tributaria (SAT), has announced, on 12 January 2026, that the annual tax filing...

January 21, 2026

The Federal Government of Nigeria has welcomed the decision of the European Commission to remove Nigeria from the European Union’s...

January 21, 2026

Georgia has amended its excise duty framework for tobacco and tobacco products, introducing both reduced and increased rates depending on...

January 21, 2026

The French government has published a list of the first 101 platforms approved for use under the country’s electronic invoicing...