September 30, 2025

SARS released updated tax interest rate tables effective from September and November, 2025. The South African Revenue Service (SARS) has...

September 29, 2025

The agreement encourages investment, ensures protection and transparency, provides mechanisms for resolving disputes, and supports a strong investment climate to...

September 29, 2025

Austrian Council of Ministers authorised the signing of an income and capital tax treaty with Oman The Austrian Council of...

September 29, 2025

The agreement aims to prevent double taxation on income and capital between the two countries while addressing tax avoidance and...

September 29, 2025

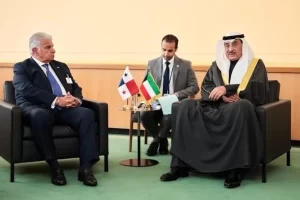

The discussions focused on strengthening bilateral relations and enhancing cooperation in areas of mutual interest, including investment opportunities. Panama’s Ministry...

September 29, 2025

Bhutan and Bangladesh held talks on the sidelines of the 80th UN General Assembly. Bhutanese Prime Minister Tshering Tobgay and...

September 29, 2025

The export customs duty on sunflower seeds will remain at 50%, but not less than RUB 32,000 per tonne. For...

September 29, 2025

Under the Act for the Development of Biotech and Pharmaceutical Industry, profit-seeking enterprises that invest in qualifying companies may claim...

September 29, 2025

Singapore’s tax authority has clarified the income tax treatment of business transfer transactions in Advance Ruling Summary No. 19/2025, confirming...

September 29, 2025

The Taxation Administration stated that the tax payment notice will be sent to taxpayers by mail by the tax collection...

September 29, 2025

FBR removed the “estimated market value” column from the 2025 tax return form The Federal Board of Revenue (FBR) has...

September 29, 2025

Companies are encouraged to actively engage in R&D, and the principle should be the establishment of in-house R&D capacity. However,...

September 26, 2025

IRD updated rules on global minimum and top-up taxes, introducing the Pillar 2 Portal and new group registration requirements. Hong...

September 26, 2025

IRAS rules revaluation gains on overseas shares in liquidation are not taxable. The Inland Revenue Authority of Singapore (IRAS) has...

September 26, 2025

The move aims to protect Europe’s steel industry, which faces pressure from global overcapacity and limits on existing safeguards set...

September 26, 2025

Tax authority warned of frequent errors in 2065-INT-SD filings, urging corrections to avoid penalties. The French tax administration has reported...

September 26, 2025

Signed on 7 February 2023, the agreement aims to eliminate double taxation on income and prevent tax evasion and avoidance. ...

September 26, 2025

Starting 1 July 2025, taxpayers can receive a full 100% penalty waiver, contingent on their cooperation and compliance, replacing the...