January 28, 2026

Vietnam passed Law No. 149/2025/QH15 on 11 December 2026, amending the Value-Added Tax Law No. 48/2024/QH15. The law was approved...

January 28, 2026

Venezuela has extended a temporary exemption from VAT, customs duty, and other taxes on hydrocarbon fuels under Decree No. 5.207,...

January 27, 2026

The Chilean Tax Administration (Servicio de Impuestos Internos, SII) has announced an automatic remission of interest and fines for taxpayers...

January 27, 2026

Luxembourg’s Council of State approved the amending protocol to the 2007 income and capital tax treaty with Georgia on 20...

January 27, 2026

The Japanese Ministry of Foreign Affairs announced, on 26 January 2026, that the first round of negotiations to update the...

January 27, 2026

Irish Revenue issued eBrief No. 016/26 on 22 January 2026, updating the guidance for reduced tax rate on income and...

January 27, 2026

New Zealand’s Inland Revenue has issued updated guidance on the Crypto-Asset Reporting Framework (CARF) on 16 January 2026. The Framework,...

January 27, 2026

Korea (Rep.)’s Ministry of Strategy and Finance has released Legislative Notice No. 2026-15 on 19 January 2026, initiating a public...

January 27, 2026

Taiwan’s Central District National Taxation Bureau of the Ministry of Finance has announced that the filing period for 2025 income...

January 26, 2026

Jordan issued a royal decree ratifying the protocol amending the 2001 income tax treaty with Kuwait on 22 January 2026. Originally...

January 26, 2026

Malta and Morocco signed a protocol on 2 January 2026, amending their 2018 income tax treaty. Deputy Prime Minister Borg...

January 26, 2026

Vietnam has enacted Law No. 108/2025/QH15 on 10 December 2025, establishing a comprehensive legal framework for managing taxes and other...

January 26, 2026

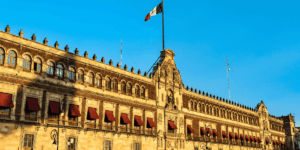

Mexico signed the Addendum to the Multilateral Competent Authority Agreement on Automatic Exchange of Financial Account Information (CRS MCAA) on...

January 26, 2026

The South African Revenue Service (SARS) has released updated interest rate tables on 22 January 2026. Interest rates charged in...

January 26, 2026

The UAE Federal Tax Authority (FTA) published the Taxpayer User Manual – Registration of Deactivated Corporate Tax TRN (Version 2.0.0.0)...

January 26, 2026

Bangladesh’s government plans to gradually withdraw its long-standing excise duty, National Board of Revenue (NBR) Chairman Abdur Rahman Khan said...

January 26, 2026

Japan’s Cabinet has adopted a decision of 23 January 2026 to bring the country’s Pillar 2 global minimum tax framework...

January 26, 2026

The French tax authorities have confirmed, on 21 January 2026, the automatic renewal of the special regime for calculating advance...