November 11, 2025

Denmark’s Ministry of Taxation (MoT) published a consultation bill on 10 November 2025 proposing a one-year delay in the higher...

November 11, 2025

The South African Reserve Bank (SARB) issued Exchange Control Circular 15/2025 on 22 October 2025, revising provisions in the Currency...

November 11, 2025

Germany’s lower house of parliament (Bundestag) approved the draft law (KStTG) on 5 November 2025, aimed at implementing the EU’s...

November 11, 2025

The Argentine Tax Authority (ARCA) has revised the conditions of the payment facility for outstanding tax and customs obligations, established...

November 10, 2025

Peru’s Congress approved the tax treaty with the UK on 6 November 2025. The agreement aims to mitigate tax base...

November 10, 2025

The Estonian parliament approved the Act ( 718 SE) for the ratification of the income and capital tax treaty with...

November 10, 2025

Luxembourg’s Government Council approved protocols updating the tax treaty with San Marino on 31 October 2025. The two countries had...

November 10, 2025

Luxembourg’s Government Council met on 31 October 2025 under Prime Minister Luc Frieden, approving a series of measures to modernise...

November 10, 2025

Luxembourg’s Government Council approved protocols amending the tax treaty with Georgia on 31 October 2025. The two countries had signed...

November 10, 2025

China’s Ministry of Commerce (MOFCOM) announced on Sunday, 9 November 2025, that it will temporarily suspend part of its 2024...

November 10, 2025

Portugal’s parliament has gazetted Law No. 64/2025 on 7 November 2025, reducing corporate income tax rates. Under the new law,...

November 10, 2025

Greece’s Independent Authority for Public Revenue (AADE) unveiled a new Multi-Annual Plan (MAP) for EU tax administrations on 6 November...

November 10, 2025

Poland’s Ministry of Finance (MoF) has initiated a public consultation on 5 November 2025 regarding the draft of the GloBE...

November 7, 2025

The Turkish Revenue Administration has published a comprehensive guide on 5 November 2025, explaining the tax obligations, exemptions, and reporting...

November 7, 2025

The Taipei National Taxation Bureau of Taiwan’s Ministry of Finance stated that it often receives inquiries regarding situations where a...

November 7, 2025

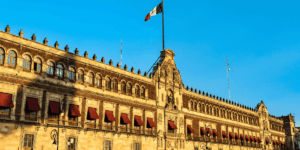

Mexico’s central bank, Bank of Mexico, has cut its benchmark interest rate by 25 basis points to 7.25%, continuing its...

November 7, 2025

Slovenia’s tax authorities launched a dedicated website to guide crypto asset service providers on DAC8 and CARF reporting on 3...

November 7, 2025

Taiwan’s Northern Region National Taxation Bureau (NTB) has reminded businesses selling pure gold jewellery to issue separate invoices for gold...