November 17, 2025

Russia’s Ministry of Finance has proposed removing the UAE from its Special List of jurisdictions considered offshore zones for the...

November 17, 2025

Taiwan’s National Taxation Bureau of the Southern Area outlined rules for claiming losses on damaged assets. Southern Taiwan recently faced...

November 17, 2025

India’s Ministry of Finance (MoF) has issued a notification on 6 November 2025, setting tolerance limits for arm’s length pricing...

November 17, 2025

Belgium’s Chamber of Representatives approved a law extending the country’s tax-neutral treatment to simplified sister mergers on 23 October 2025....

November 17, 2025

Indian agricultural exporters will benefit after US President Donald Trump exempted dozens of food items from tariffs. Products such as...

November 17, 2025

Thailand will continue trade talks with the US independently of its border dispute with Cambodia, the government said after Prime...

November 17, 2025

Estonia announced a call for flexibility in implementing the Pillar 2 global minimum tax during a recent EU finance ministers’...

November 17, 2025

Germany’s lower house of parliament (Bundestag) approved the second revised draft of a law amending domestic Pillar 2 rules and...

November 17, 2025

Cambodia’s General Department of Taxation issued Notification No. 34236 on 30 October 2025, confirming that a 20% capital gains tax...

November 17, 2025

Taiwan’s Southern District National Taxation Bureau of the Ministry of Finance (MoF) clarified that the annual gift tax exemption is...

November 17, 2025

Lebanon’s Ministry of Finance (MoF) issued Decision No. 899/1 and related measures on 29 October 2025, extending key filing and...

November 14, 2025

Taiwan’s Ministry of Finance’s Taipei National Taxation Bureau has announced, on 13 November 2025, the implementation of new tax regulations...

November 14, 2025

The Inland Revenue Authority of Singapore (IRAS) announced that the Protocol amending the income tax treaty between Singapore and Brazil,...

November 14, 2025

The Ministry of Finance and Dubai Finance (DOF) have announced the execution of the UAE’s first government financial transaction using...

November 14, 2025

The Taipei National Taxation Bureau of the Ministry of Finance in Taiwan stated, on 13 November 2025, that when taxpayers...

November 14, 2025

Taiwan’s Taipei National Taxation Bureau of the Ministry of Finance stated, on 13 November 2025, that if a business operator...

November 14, 2025

Taiwan’s National Taxation Bureau of the Central Area (NTBCA) has announced, on 13 November 2025, that taxpayers whose taxes have...

November 14, 2025

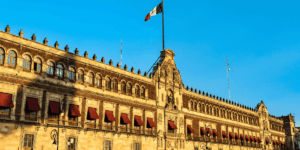

Mexico’s Tax Administration Service (SAT) has reminded taxpayers that they can claim personal deductions in their annual tax return for...