February 11, 2025

Turkey has released a new guide outlining the requirement for taxpayers and non-taxpayers, including end consumers, to document collections and...

February 11, 2025

Irish Revenue has published eBrief No. 014/25 20 January 2024, providing updated guidance on the surcharge for certain undistributed income...

February 11, 2025

Irish Revenue has released eBrief No. 015/25 on 21 January 2025, providing updated guidance on the Section 481A Digital Games...

February 11, 2025

The Dominican Republic Directorate General of Internal Taxes informs taxpayers and the public that a public forum has been opened...

February 11, 2025

The Swiss State Secretariat for International Finance has revised its list of jurisdictions participating in the automatic exchange of financial...

February 11, 2025

Lithuania’s State Tax Inspectorate (STI) has introduced new guidelines on the increase of the dividend tax rate from 15% to...

February 11, 2025

Switzerland has established a referendum deadline of 19 April 2025 for the protocol to the 2005 tax treaty with Serbia....

February 11, 2025

Luxembourg’s Chamber of Deputies ratified the protocol to the 2007 income and capital tax treaty with Moldova on 22 January...

February 11, 2025

The State Tax Inspectorate of Lithuania has issued a new order (VA-5) outlining updated procedures for registering and deregistering VAT...

February 11, 2025

Colombia’s tax authority issued Official Tax Opinion No. 100208192-69 on 17 January 2025, providing clarification on the treatment of tax...

February 11, 2025

Russia’s Ministry of Finance has issued guidance Letter No. 03-07-11/121626 on the corporate income tax and VAT implications of dividends...

February 11, 2025

The Egyptian House of Representatives approved a draft law to amend provisions of the Unified Tax Procedures Law (Law No....

February 11, 2025

Egypt’s Ministry of Finance launched a tax reform initiative aimed at simplifying administrative procedures, expanding the taxpayer base, and creating...

February 11, 2025

Sweden is set to revise its research and development (R&D) tax incentives and expert tax relief rules to simplify administration...

February 11, 2025

Vietnam and Togo have agreed to negotiate an income tax treaty as part of efforts to deepen economic and diplomatic...

February 11, 2025

Germany published the Third Ordinance amending the Tax Haven Defense Ordinance in the Official Gazette on 30 December 2024. The...

February 11, 2025

The United Arab Emirates (UAE), represented by the Ministry of Finance, has successfully concluded the final round of negotiations for...

February 10, 2025

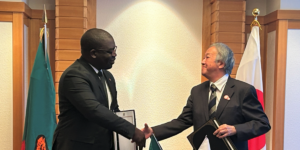

The “Agreement between Japan and the Republic of Zambia for the Promotion and Protection of Investment” (Japan-Zambia Investment Agreement) was...