Some modifications have been occurred to the Value Added Tax (VAT) Code by using Law No. 13/2016 and those changes are approved by the Parliament of Mozambique. These changes are applied to facilitate implementation of net VAT system. The new system is proposed to make VAT revenue management more efficient. The amendments are about inclusion the tax electronic services, exemption in aviculture and beekeeping services, deadline reduction for delivery of the periodic VAT return (from the end of the following month to the 15th day of the following month when there are credits under paragraph 2, article 32), relief in public passenger transport services, deadline extension for the VAT exemption in case of sugar and oil and soaps industries until 31st of December 2019, no longer exemption applies for acquisition of services regarding drilling, research and construction of infrastructures in the scope of mining and oil activity and inclusion in article 27 of the obligation of invoices to be issued in a national language and currency, irrespective to the recipient’s residence. These amendments come into force from 1st of January 2017.

Singapore, UK TIEA enters into force

Related Posts

Mozambique: Government adopts amendments to VAT law

Mozambique’s government adopted a draft Value Added Tax (VAT) law during the 41st Session of the Council of Ministers on 2 December 2025. The VAT law is designed to modernise and streamline the electronic submission of invoices and similar

Read More

Mozambique restores VAT exemption on soap, sugar, and oil

The VAT exemption will be effective from 30 May 2025 to 31 December 2025. Mozambique has published Law No. 3/2025 in the Official Gazette on 21 May 2025, amending the VAT Code to reintroduce a VAT exemption for soap, sugar, and cooking

Read More

Mozambique updates procedures for monthly VAT invoice reporting

Mozambique’s tax authority (MTA) announced on 27 March 2025 that VAT taxpayers must submit a certified monthly invoice data file via its electronic declaration website, starting May 2025. The VAT invoice file must include party details,

Read More

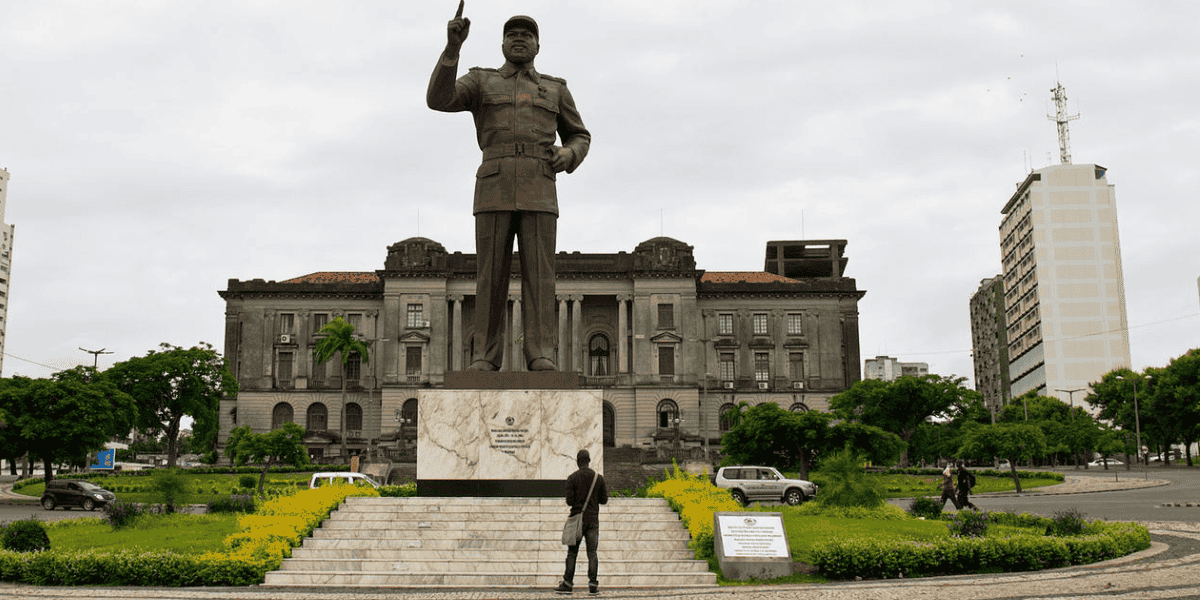

Mozambique: President announces new tax proposals in inauguration speech

Mozambique's new president, Daniel Chapo, announced new tax measures, including renegotiating deals with foreign investors, in his inauguration speech on 15 January 2025. The measures aim to eliminate poverty and improve the country's business

Read More

IMF Working Paper: Is Tax Policy Supporting a Costly Industrial Policy in Mozambique

An IMF working paper written by Santos Bila, Utkarsh Kumar and Alexis Meyer-Cirkel with the title Is Tax Policy Costly Industrial Policy in Mozambique? Finds that tax advantages do not compensate for shortcomings in economic conditions. The

Read More

IMF Issues Report under Extended Credit Facility Arrangement for Mozambique

On 8 January 2024 the IMF issued a report after completing the Third Review under the Extended Credit Facility (ECF) Arrangement with Mozambique. The ECF arrangement aims to support structural reforms to promote Mozambique’s economic recovery and

Read More