Luxembourg publishes Law ratifying first amendment to tax treaty with Moldova

Luxembourg released the Law of 25 March 2025 in the Official Gazette on 7 April 2025, which facilitates the ratification of the protocol to the 2007 income and capital tax treaty with Moldova. The protocol, signed on 25 June 2024, represents the

See MoreCongo (Rep.), UAE sign CEPA agreement

The United Arab Emirates (UAE) and the Republic of the Congo signed a Comprehensive Economic Partnership Agreement (CEPA) aimed at boosting economic cooperation between the two nations on 8 April 2025. The agreement was signed during an official

See MoreDenmark updates list of jurisdictions for automatic exchange of financial information

Denmark issued Executive Order No. 366 on 7 April 2025 , published in Official Gazette A on 9 April 2025. This order updates the list of jurisdictions that participate in the automatic exchange of financial account information, in line with

See MoreEuropean Commission adopts updated regulation to enforce DAC7

The European Commission (EC) has adopted Implementing Regulation 2025/648 of 2 April 2025, introducing changes to Implementing Regulation 2015/2378, as regards the standard forms and computerised formats to be used for the mandatory automatic

See MoreParaguay announces extension for 2024 financial statement submissions

Paraguay's National Directorate of Tax Revenues (DNIT) has issued General Resolution DNIT No. 29/25, which extends the deadline for corporate taxpayers (IRE) to submit financial statements for the fiscal year ending 31 December 2024. The new

See MoreNorway: Parliament approves new reporting rules for digital platforms

Norway’s parliament has approved the government proposal to introduce new reporting requirements for digital platforms on 4 April 2025. These proposals align with the OECD Model Rules for Reporting by Platform Operators and the Multilateral

See MoreUruguay extends tax incentives for large construction projects to 2025

Uruguay has issued Decree No. 85/025 on 2 April 2025, extending the tax benefits for large investment projects in construction and urban development. These incentives were first introduced in 2020 under Decree No. 138/020 as part of measures to

See MoreChile sets tax rates for SMEs in the copper mining industry

Chile's Internal Revenue Service (SII) has issued Circular No. 24 of 28 March 2025, setting new tax rates for small artisan miners and SMEs involved in copper mining and sales. Small artisan miners tax rates For small artisan miners using the

See MoreSingapore: IRAS issues updated guidance on globe rules and domestic top-up tax

The Inland Revenue Authority of Singapore (IRAS) has published new presentations offering guidance on the Global Anti-Base Erosion (GloBE) Rules and the Domestic Top-up Tax (DTT) on 8 April 2025. . The first module focuses on the scope and charging

See MoreMalta extends deadlines for electronic filing of corporate tax returns in 2025

Malta's Commissioner for Revenue has revealed the extended deadlines for submitting corporate income tax returns electronically in 2025. This announcement was made by the Government of Malta on 25 March 2025. The Commissioner for Tax and

See MoreBrazil: Senate approves tax treaty protocol with China

Brazil’s Senate has approved the protocol amending the Brazil-China Income Tax Treaty (1991) through Draft Legislative Decree No. 343/2024 on 8 April 2025. Signed on 23 May 2022, this protocol is the first amendment to the treaty. It will come

See MoreCanada: Newfoundland and Labrador announces 2025 budget, introduces no changes to tax rates

Canada province Newfoundland and Labrador finance minister Siobhan Coady has presented the province’s 2025 budget on 9 April 2025. The minister mentioned the province’s deficit has decreased from CAD 1.5 billion in 2020-21 to CAD 372 million

See MoreCameroon: Senate approves tax treaty with Czech Republic

The Cameroon Senate has approved the law to ratify the income tax treaty with the Czech Republic on 8 April 2025. The agreement was signed by Cameroon by the Minister of Finance, MINFI, Louis Paul Motaze and Czech Republic Ambassador to Cameroon

See MorePanama updates CRS participating jurisdictions list

Panama published Resolution No. 201-3013 of 26 March 2025 in the Official Gazette on 1 April 2025 updating the list of participating jurisdictions for the automatic exchange of financial account information under the Common Reporting Standard

See MoreAustralia: ATO updates guidance on 2024–25 monthly foreign exchange rates

The Australian Taxation Office (ATO) has updated its guidance on Monthly exchange rates for 1 July 2024 to 30 June 2025, including rates for January, February, and March 2025 on 2 April 2025. According to the main Foreign exchange rates guidance,

See MoreEU pauses counter trade measures against US

The European Commission announced on 9 April 2025 that its proposal to implement trade countermeasures against the US had received approval from EU Member States. The Commission's proposal was made in response to the US decision in March to

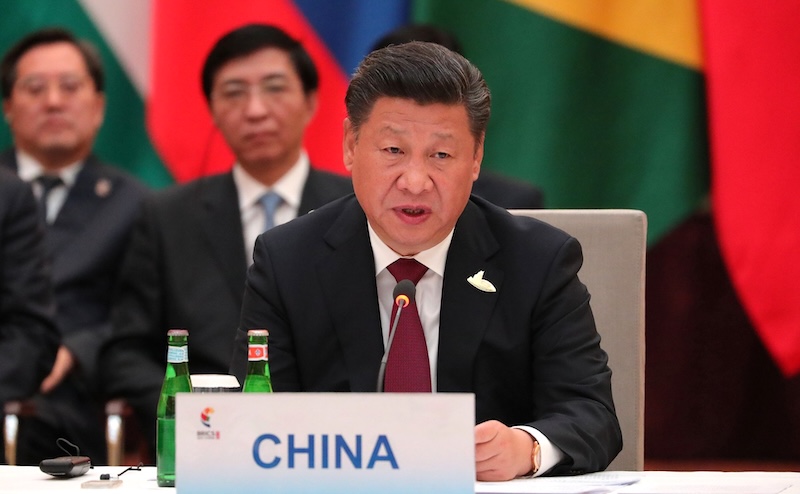

See MoreTrade war escalades: China imposes 125% tariffs on US imports

Beijing announced it has increased its tariffs on US imports to 125% earlier today, 11 April 2025. "The US side's imposition of excessively high tariffs on China seriously violates international economic and trade rules, runs counter to basic

See MoreGermany: Coalition government to lower corporate tax rate amongst other policy changes

Germany’s new coalition government, formed by the conservative alliance led by Friedrich Merz and the centre-left Social Democrats (SPD), announced a set of tax measures on 9 April 2025 as part of their policy agreement. The measures include a

See More