Turkey hikes petroleum consumption tax by 19.49%

Turkey’s Revenue Administration (GIB) announced, on 3 July 2024, that it raised the fixed special consumption tax (SCT) on petroleum products by 19.49%. The petroleum products, listed in Schedule I of the SCT Law that are subject to increased

See MoreSaudi Arabia unveils criteria for 13th phase of e-Invoicing integration

The Saudi Zakat, Tax, and Customs Authority (ZATCA) has announced its criteria for the 13th wave of integrating the country's new e-Invoicing requirement into its Fatoora system. The 13th wave includes all taxpayers whose revenues subject to VAT

See MoreNigeria passes new withholding tax regime

Nigeria’s federal government passed a new withholding tax regime on Tuesday, 2 July 2024, following the country’s ongoing efforts to reform its fiscal and taxation system. These changes include reduced rates for businesses with low margins and

See MoreLebanon extends deadline for 2023 tax filings

Lebanon’s Ministry of Finance has extended the deadline for filing various annual tax forms and making tax payments for the fiscal year 2023. The new deadline is set for 25 July, 2024. This extension applies to sole proprietorships,

See MoreSaudi Arabia extends cancellation of fines and exemption of financial penalties initiative

The Saudi Zakat, Tax and Customs Authority (ZATCA) announced the extension of the Cancellation of Fines and Exemption of Financial Penalties Initiative for taxpayers subject to all tax laws for six months until 31 December, 2024. ZATCA stated

See MoreNigeria exempts taxes on imported pharmaceutical inputs

Nigeria’s President Bola Tinubu has signed an executive order that removes excise duties, VAT, and other tariffs on imported pharmaceutical inputs which include specified equipment, machinery, components, and other forms of raw materials used in

See MoreSaudi Arabia extends cancellation of fines and exemption of financial penalties initiative

The Saudi Zakat, Tax and Customs Authority (ZATCA) announced the extension of the Cancellation of Fines and Exemption of Financial Penalties Initiative for taxpayers subject to all tax laws for six months until 31 December, 2024. ZATCA stated

See MoreAngola extends transfer pricing submission deadline

The Angolan General Tax Administration, on 27 June 2024, announced that it is extending the deadline for the submission of the transfer pricing information. The deadline has been extended from 30 June, 2024, to 31 July, 2024. The announcement

See MoreSaudi Arabia, Slovak Republic: Tax treaty comes into effect

The Saudi Arabia - Slovak Republic Income Tax Treaty (2023) will become effective starting 1 August, 2024, with provisions generally applying from 1 January, 2025, concerning withholding and other taxes. The treaty was initially signed on 13

See MoreKazakhstan approves tax treaty with Oman

In a move set to boost international economic relations, Kazakh Prime Minister Oljas Bektenov signed Decree No. 404, empowering Finance Minister Madi Takiev to finalise an income and capital tax treaty with Oman. Earlier, Kazakhstan's government

See MoreUAE: Companies licensed in March-April must register for corporate tax by June 2024

The UAE Federal Tax Authority (FTA) issued a release on 23 June, 2024, reminding juridical persons licensed in March and April to register for corporate tax by 30 June, 2024. Previously, the FTA, in a release on 23 May 2024, called for juridical

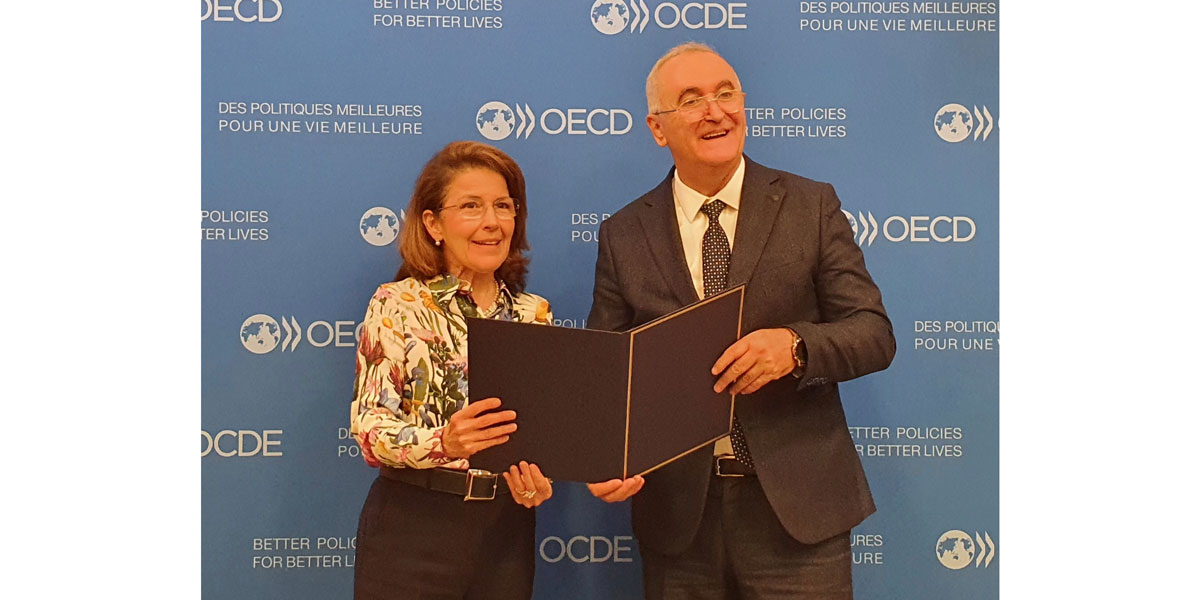

See MoreAlgeria joins BEPS MLI

The OECD, in an announcement, confirmed that Algeria signed the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (BEPS Convention) on 27 June, 2024. Algeria has become the 103rd

See MoreKenya withdraws controversial Finance Bill 2024 amid deadly protests

The Kenyan President William Ruto has announced yesterday, 26 June 2024, that he would not sign the Finance Bill 2024 into law and plans to withdraw the legislation. This decision followed after Kenyans protested against the controversial

See MoreEthiopia revises VAT exemptions

Ethiopia's Ministry of Finance has released Directive No. 1006/2024, which alters VAT exemptions across the country. Effective from 20 June, 2024, all goods and services previously exempt through various ministry directives or decisions will now

See MoreUganda unveils new tax measures in 2024-25 budget

On 13 June, 2024, Uganda's Minister of Finance, Planning and Economic Development, Matia Kasaija, presented the Budget Speech for the Financial Year 2024/2025 in the Parliament. The speech, among other things, outlined certain tax measures for

See MoreSwitzerland approves pending tax treaty with Angola

On 14 June, 2024, the Swiss Federal Council announced the dispatch of the approval of a double taxation agreement (DTA) with Angola. The agreement will create legal certainty for the further development of bilateral economic relations and tax

See MoreEgypt reportedly finalising tax 2024-30 policy strategy, drafts new corporate tax law

The Egyptian Ministry of Finance’s tax policy strategy for 2024-30 is said to be in its final stages of completion, which possibly includes a draft of a new corporate tax law. It is rumoured that it will introduce a 15% minimum tax for

See MoreMalaysia publishes synthesised text of tax treaty with Qatar under BEPS MLI

The Inland Revenue Board of Malaysia (IRBM) has released the synthesised text of the tax treaty with Qatar, providing clarifications regarding the impact of the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion

See More